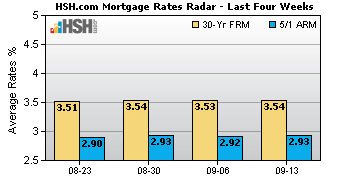

Rates on the most popular types of mortgages settled slightly this week, according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages fell by four basis points (0.04 percent) to 4.00 percent. Conforming 5/1 Hybrid ARM rates decreased by three basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 3.05 percent.

Even small declines can help homebuyers and refinancers

"Fixed mortgage rates have settled slightly above two-month lows this week," said Keith Gumbinger, vice president of HSH.com. "It was early June when we last tested these levels. To be sure, rates only moved up and retreated by about an eighth of a percentage point over that time, but even small declines can help homebuyers and refinancers."

The median home price for an existing home was $229,400 in the second quarter, according to the National Association of Realtors; subtracting a 20 percent down payment leaves a $183,520 mortgage balance. The eighth of a percent drop in rates over the past few weeks trims the monthly payment on this amount by just $14 per month, but saves almost $5,000 in interest costs over a 30-year term.

Small bumps or dips in rates don't change the picture by much

“There’s always uncertainty when it comes to the direction of mortgage rates,” adds Gumbinger. “However, even if you hear that ‘rates are going up’ this doesn’t mean they are rising fast or going very far, and it’s always best to run your own calculations to see if there is much effect on your plans to buy or refinance a home. For most, small bumps or dips in rates don’t change the picture by much, if at all.”

Average mortgage rates and points for conforming residential mortgages for the week ending August 18, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.00 percent

- Average Points: 0.17

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.05 percent

- Average Points: 0.10

Average mortgage rates and points for conforming residential mortgages for the previous week ending August 11 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.04 percent

- Average Points: 0.19

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.08 percent

- Average Points: 0.09

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com’s survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar’s inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.