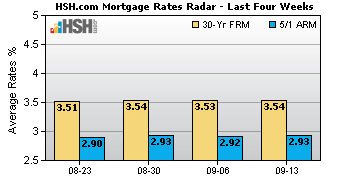

Rates on the most popular types of mortgages edged higher over the last week but stayed near several-month lows, according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages rose by three basis points (0.03 percent) to 3.99 percent. Conforming 5/1 Hybrid ARM rates increased by two basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 3.01 percent.

Slowing growth in China and U.S. monetary policy is giving financial markets the jitters

Stock markets began September still dealing with the same issues that caused turmoil in August," said Keith Gumbinger, vice president of HSH.com. "Slowing growth in China and uncertainty with regards to U.S. monetary policy is giving financial markets the jitters, producing some downward pressure on interest rates."

Low and stable mortgage rates have provided important fuel for the U.S. housing market recovery

Mortgage rates have actually moved very little overall so far in 2015. As measured by HSH's weekly wraparound survey, conforming 30-year fixed rates have only been as high as 4.13 percent in late June and early July, and bottomed at 3.72 percent back in April, when the U.S. economy was coming off a soft patch for growth. Five-one ARMs have held an even tighter range of just 23 basis points from peak to valley this year. Low and stable mortgage rates have provided important fuel for the U.S. housing market recovery, and this looks set to continue.

Mortgage and other interest rates just can't rise or fall by very much

"In this unsettled economic climate, mortgage rates can't get much traction," added Gumbinger. "Even though the economy here is pretty solid, it is of course buffeted by global headwinds and influences, and these kinds of events tend to keep rates down, no matter how strong domestic growth may be. With no inflation to be seen, and with no way to know how much drag on growth we'll see just ahead from these headwinds, mortgage and other interest rates just can't rise or fall by very much. This will likely be the case even if the Fed does choose to make a policy change later this month."

Average mortgage rates and points for conforming residential mortgages for the week ending September 1, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 3.99 percent

- Average Points: 0.15

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.01 percent

- Average Points: 0.09

Average mortgage rates and points for conforming residential mortgages for the previous week ending August 25 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 3.96 percent

- Average Points: 0.14

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 2.98 percent

- Average Points: 0.09

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com’s survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar’s inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.