Is this the right time to consider an adjustable-rate mortgage (ARM)? Currently, higher interest rates are forcing potential homebuyers to make more considered choices of the kind of mortgage that will work best for them.

There's no question that an ARM can be cheaper than a 30-year fixed-rate mortgage for at least a period of time. Interest rates on ARMs are typically lower than those seen on fixed-rate mortgages, and mortgage lenders tend to price their ARMs more aggressively to attract borrowers. Unlike a fixed-rate mortgage, though, there's a lot more to understand and think about if you're contemplating taking an ARM.

Why should you consider an ARM?

In a word: Savings. The lower monthly payments that ARM may provide in the early years of owning your home can add up to a fair bit of savings, helping you to be able to better manage your household budget.

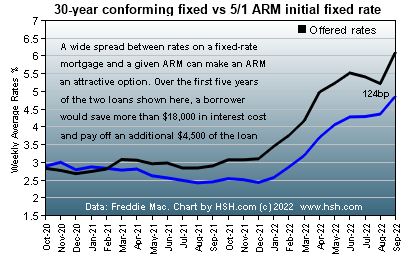

How much savings will be depends on the difference in the interest rate available to you for a 30-year fixed-rate home loan compared to an ARM you might select. A wider gap can make a more compelling argument to consider an ARM, while a narrower one might not bring enough value.

Most ARMs today are so-called "Hybrid ARMs", where the interest rate on the loan is fixed for a period of time before regular changes start to occur. While there can be other terms seen in the market from time to time, the initial fixed-rate period for hybrid ARMs is usually three, five, seven or 10 years, after which rate on the loan will adjust.

Depending on whether or not the loan will be sold by the lender or held on their books, the adjustment period after the fixed-rate period ends may be six months or a year. ARMs with one-year adjustment periods are usually known as 3/1, 5/1, 7/1 and 10/1 ("slash-one") ARMs, while those with six-month adjustment periods may be called "slash six" or "slash-six-m" (e.g. 3/6, 5/6 or 3/6m, 5/6m) ARMs.

The shorter the initial fixed term is, the lower the initial interest rate will be. For instance, the rate for a 3/1 ARM is typically lower than the rate for a 7/1 ARM, all else being equal, while the rate for a 10/1 ARM is usually only slightly lower than the rate for a 30-year fixed-rate loan.

What kind of savings can I expect with an ARM?

As noted above, what matters today is the differential in the interest rate compared to another loan choice. What matters for tomorrow's savings (or not) is what happens to interest rates in the future. While no one knows what the future might bring, the catch with ARMs is that the savings aren't guaranteed beyond the ARM's initial fixed term. After an adjustment (or several) the savings may start to evaporate.

For example, the difference between the monthly payment on a $300,000, 30-year fixed-rate loan at 6.11 percent and the payment for a 5/1 ARM at 4.87 percent would be about $223, explained Keith Gumbinger, vice president of HSH.com. Over a five-year period, the savings would be $18,558 and more than an additional $4,500 of the loan balance would be paid off.

After that, the loan's rate could rise and those savings could disappear over time if interest rates remain high. For example, if the rate on the 5/1 ARM above adjusted to 6.87% for the sixth year (+2 percentage points from 4.87% the initial rate for the first five years), the monthly payment would jump by about $334, which might be difficult to manage.

That said, the loan's new payment would only be about $100 more than if the borrower had originally taken the 30-year fixed, eating up only about $1,200 of the $18,558 in interest cost saved in the first five years of the loan. The borrower who took the ARM would still be ahead, and may be for a long while yet, even if rates and payments should remain high for a several more years. That said, it doesn't make the sizable initial increase in monthly payment any easier to manage, let alone any subsequent increases that may come.

Caps: Limiting Cost Changes

When interest rates do start to change, the ARM's limits on interest rate changes (called "caps") can matter greatly. Most hybrid ARMs have three kinds of caps -- the initial, periodic and lifetime. These are the limits on how high (or low) the rate can go at the loan's first change (at the 61st month, in the case of a 5/1 ARM), how much it can change at each subsequent adjustment and the maximum amount it can even change over the life of the loan.

Lower caps provide more protection against rising rates. Shorter-term hybrid ARMs often feature caps of 2%/2%/5% or 2/2/6, meaning that the rate can't change more than 2 percentage points at the loan's first adjustment, no more than 2 percentage points at any other adjustment and the rate can never be more than six percentage points above the rate at which you started your loan.

Longer-dated hybrid ARMs often have less protection for the initial adjustment, and may offer 5/2/5, 5/2,6 or even 6/2/6 caps. If your initial rate was 4% and the index that governs your ARM is at a very high point, your rate could jump to 9% or 10% at the first adjustment, but it could never go any higher, which is a small consolation.

It's the fear of such a large jump in rate and payment that keeps people away from ARMs. At the same time, rates may remain the same, rise only slightly or even be lower in the future when your ARM comes due to adjust.

Learn ways to ameliorate ARM risks in this section of our Comprehensive Guide to ARMs.

Qualifying for an ARM

Contrary to common belief, an ARM likely won't help you qualify for a significantly larger loan amount, says Neena Vlamis, president of A and N Mortgage Services in Chicago. That's because the lender needs to know you can afford the higher payment.

"When you apply for a five-year ARM, we use the caps to qualify you, so it doesn't help you qualify," Vlamis says. "The seven-year or 10-year ARM could slightly help you qualify because the rate is lower than a 30-year fixed-rate. An ARM helps you save money. It does not help you stretch your budget."

Unlike qualifying conditions seen in the last period of strong ARM originations, lenders today have strict rules on how they qualify you to borrow money. While ARMs with short-term or longer fixed-rate periods have different calculations for qualifying a borrower, 5/6m ARMs (fixed for the first five years with rate adjustments every six months thereafter) eligible for sale to Fannie Mae or Freddie Mac have their own set of calculations a lender must use. For example, a lender can no longer qualify you at a "teaser" or even an "introductory" interest rate; rather, they need to use the higher interest rate produced from two calculations:

The "fully-indexed rate"; or

The initial (aka "introductory", "contract" or "note") interest rate PLUS the initial interest rate cap when the loan is due to adjust for the first time.

Caps for these products are 2% initial, 1% periodic and 5% lifetime, so the calculation would use the "note" rate plus two percentage points.

The "fully-indexed" rate is the sum of the current value of the index to which the loan is tied plus a stated markup ("margin"). ARMs saleable to Fannie Mae or Freddie Mac use a variant of a new index called the Secured Overnight Financing Rate (SOFR) as a benchmark for making rate changes.

If the value of SOFR is 3%, and the lender is using a margin of 3%, the loan's fully-indexed rate would be 6%, and this would be the rate the lender would use to qualify you.

Lenders may offers introductory rates for ARMs as an inducement for borrowers to take them. However, a lender won't qualify you to borrow based on that introductory rate,

For example, if the lender offers an introductory rate for the first five years of 3.5%, he cannot use this rate to qualify you. Instead, the lender will use the sum of the introductory rate (3.5%) PLUS the amount of the loan's first-adjustment cap, commonly 2%, although this may be higher or lower.

In this case, the sum of the introductory rate plus the first adjustment cap is 5.5% and is below the fully-indexed rate. Since the lender must use the greater value produced by the initial rate plus cap method (5.5%) or fully-indexed calculation method (6%), the lender must qualify you at the higher (fully-indexed) rate of 6%.

It's important to remember that the loan's interest rate doesn't determine whether or not you can qualify to borrow the loan. Rather, it serves as a limiter on how much mortgage you can borrow based on your income.

For example (and all other things being equal) a borrower with an $80,000 income might qualify for a principal and interest payment of $1,867 per month. At a 5% interest rate, this would qualify them for a loan amount of $260,606. However, the same borrower presented with a 6% interest rate would be allowed to borrow only $239,271 -- the higher monthly payment produced by the higher interest rate reduces the mortgage amount, keeping the qualifying payment the same at $1,867 per month.

In the example above, even if you had to qualify to borrow at an interest rate of 6%, your contract interest rate (the quoted introductory rate) would still be 3.5%, and it is this rate on which your payments would be based for the first five years of the loan. So your required principal and interest payment for the loan would be $1,074 for the first five years, leaving plenty of budgetary slack should rates rise in the future.

If a borrower was qualified at 3.5%, as was too often the case in the years preceding the housing bust, they would have qualified for a $297,758 loan. When rates increased there would might have been little or no budget space for the borrower to manage higher payments, raising the chances of default.

Are ARMs Risky?

Yes and no. While ARMs do present different risks than do fixed-rate mortgages, many potential borrowers are fearful for no reason. Interest rates in the past have turned in the borrower's favor on a number of occasions, most recently though late 2021. As well, folks who take ARMs may not end up staying in them until the loan reaches even the first adjustment, let alone subsequent ones. People sell homes and move before a fixed-rate period ends and opportunities for refinancing come along from time to time, canceling out any rate-change concerns.

In this regard, what may be most important when considering an ARM is knowing your time horizon and selecting a product that presents the least (or no) opportunity for a rate change during the period you expect to be in your home. You can also learn about other methods for managing or even eliminating risks posed by ARMs.

It's important to remember that an ARM isn't like a fixed-rate mortgage; you'll want to keep in routine touch with what's happening to interest rates, and take advantage of opportunities to refinance to a fixed-rate mortgage if your time horizon has changed. You should also keep in mind that even a "horizontal" refinance to a loan with the same interest rate you are currently paying can still have value, as it offers you a chance at a fixed interest rate for a longer period of time -- or even for the life of the mortgage.

And yes, homeowners do refinance into ARMs, and there are times when it makes good sense to do so.

Who should get an ARM?

ARMs make sense for borrowers who plan to sell their home or refinance their loan within the fixed-rate period since they involve no interest rate risk during that time, said Gumbinger.

First-time homebuyers can bank the savings to be used for other financial goals while near-retirees can use the savings to pay other debts or make catch-up retirement contributions, Gumbinger suggested.

"If the borrower is planning on staying in the property for (only) three-to-five years, I would suggest giving them a five- or seven-year ARM," says Vlamis. The seven-year is a bit safer in case they don't move in the first five years," she says.

Learning More About ARMs

If you're curious about an ARM, you should ask some important questions. Here's a list from Fred Arnold, a loan consultant at American Family Funding in Santa Clarita, Calif.

- How long is the rate fixed?

- What index is the loan tied to?

- How has it changed over a reasonable history of 7-10 years?

- What's the margin being added to the index value?

- What's the maximum that the rate can change the first time it adjusts?

- What's the maximum that the rate can change at each adjustment thereafter?

- What's the lifetime cap?

Once you've collected this information, you can do a little math and use a mortgage calculator to figure out the best-case, worst-case and likeliest-case monthly payments at the first adjustment, Gumbinger said.

"Calculate the payment using the remaining loan balance after the initial term, the new interest rate and the remaining term and see how much -- or how little -- financial pain these potential changes will cause," he said.

There's a lot to know about how ARMs work before you decide. Learn everything you need to know with HSH's Comprehensive Guide to ARMs.

Is an ARM a Smart Choice?

Arnold says borrowers are looking "very seriously" at ARMs today as interest rates tick up. However, ARMs aren't appropriate for every borrower or for every situation, regardless of how low a rate offer today may seem.

With an ARM, "You need to not only be concerned about making payments today, but also being able to make them tomorrow," adds Gumbinger. "If you are considering an ARM, you need to have at least a fair grasp of what you expect your financial life to be in the coming years."

You can't guarantee that five or seven years from now everything you expect to happen will work out. A plan to live in a home for a while and then sell may be thwarted by adverse market conditions, opportunities to refinance may not materialize and a change in your income stream may leave you more vulnerable to the challenges of higher monthly mortgage payments in the future.

ARMs may work best for borrowers whose income can reasonably be expected to rise over time, borrowers who have near-certain time frames of ownership in mind and those who can be opportunistic when it comes to being able to refinance to a new ARM or a longer-term fixed rate. They also work best for borrowers when market interest rates are relatively high and have some space to fall over time.

But ARMs can be a smart choice for borrowers when one or more of these conditions are met or are expected to come to pass. If your situation fits in here, an ARM may be a smart choice for you.

Marcie Geffner contributed to this article.