According to a recent survey by HSH.com, nearly 40 percent of respondents said they won’t be buying a house this year because they can’t afford it.

In a time of meager income growth (which we have been in since the recession began), low mortgage rates have played an integral role in enhancing affordability and re-inflating home prices. Why? Low rates increase the ability of a given income to afford a higher-priced home.

It's not clear yet where mortgage rates will eventually land once the Fed does raise rates, but when they do, purchasing power will be crimped.

So instead of another article warning that “mortgage rates are going to rise later this year,” we instead wanted to focus on just how significant and important this low-mortgage-rate environment has been to home buyers and refinancers.

Low rates: Enhancing affordability

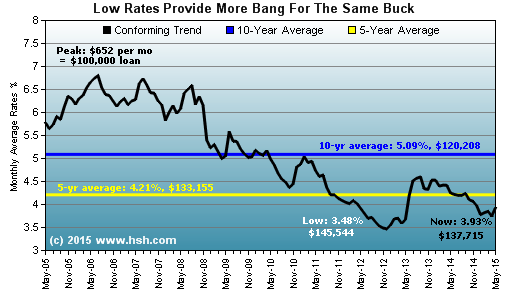

Over the last 10 years, conforming 30-year fixed mortgage rates have been as high a 6.80 percent and as low as 3.28 percent. This decline to rock-bottom levels meant that on a peak-to-trough basis, buying power improved considerably and remains very strong.

At the graph (below) peak in 2006, a monthly payment of $652 was enough to borrow $100,000. When mortgage rates fell to 3.48 percent, that same $652 would have been sufficient to borrow $145,544 -- a 45 percent improvement ($45,544!) in the amount of mortgage debt that a given income could carry.

Low interest rates boost your buying power

As the Fed looks to return interest rates to "normal" over time, it bears noting that the interest rate associated with "normal" continues to shrink. Over the last 10 years, a reasonable time frame, conforming 30-year fixed-rate mortgages have held an average of just 5.09 percent; over the last five years, conforming 30-year fixed-rate mortgages have averaged just 4.21 percent.

In order to demonstrate how lower interest rates have improved buying power, we calculated the monthly payment needed to cover a $100,000 loan in 2006 when the conforming 30-year fixed peaked at 6.80 percent. Using this monthly payment as a constant, we calculated the loan amount this figure would cover at different interest rates over time. In all cases moving forward, there has been a material improvement as these rates have remained below where we began.

|

Time Period |

Mortgage Rate |

Monthly P&I Payment |

Loan Amount This Will Carry |

|

2006 (peak) |

6.80 percent |

$651.93 |

$100,000 |

|

2012 (trough) |

3.48 percent |

$651.93 |

$145,544 |

|

5-year avg. |

4.21 percent |

$651.93 |

$133,155 |

|

Split: 5-10 year avg. |

4.65 percent |

$651.93 |

$126,432 |

|

10-year avg. |

5.09 percent |

$651.93 |

$120,208 |

|

Present |

3.93 percent |

$651.93 |

$137,715 |

It's not clear yet where rates will eventually land once the Fed does raise rates, but when they do, purchasing power will be crimped. So absent stronger income growth, keeping the housing market going may be a challenge.

Income growth will be the savior

The only way to offset the rise in interest rates is stronger income growth. Income growth can outstrip an increase in rates or even home prices. Purchasing power would also increase with income growth and the housing market would strengthen. However, income growth has been fairly weak in the recovery to date, and this is why you’ll often hear experts and pundits expressing concern about the Fed’s eventual campaign to again lift interest rates.

In order just to keep up, or at least to preserve a given level of affordability, incomes will need to keep pace with interest rate increases. Failing that, the other market-based lever to preserve affordability would be declines in home prices, something few would like to see.

The slow growth in incomes as we move forward into the recovery will provide at least some offset for rising mortgage rates, but the impact of rising rates on potential homebuyers is something that will bear watching as we move into the future.

For more about Fed and rate cycles, be sure to read “Federal Reserve policy and mortgage rate cycles.”