April 5, 2024

Preface

After the most recent increase in the federal funds rate last July, the question turned from "How many more times will they raise rates?" After several subsequent meetings saw the Fed stand pat, the query changed to "How long will rates be held this high?"

Although the answer to that question had not yet come, once the calendar turned 2024 investors began to ask the next question: "When will rates start to be lowered?" The answer to the "how long?" question will of course come when the "when?" question is answered. Still, there is as yet no answer to either, and "how long?" isn't showing signs of becoming any shorter.

Once the "how long?" and "when?" questions are answered, the next up will be "How many cuts?" and "How quickly will they come?" To these, we'd add a few of our own, most particularly "What does it really mean?"

Even if the federal funds rate is lowered in June, and again in September, and again in December -- as the current expected cadence of change seems to be -- the federal funds rate will have been trimmed to the Fed's median expectation of 4.6%. This would put it on par with about where it ended 2022 and began 2023 (and as high as it was back in 2007); as such, it would only move from perhaps 22 or 23-year highs to perhaps 16 or 17-year highs. Even with these expected reductions, the cost of money will be cheaper, but still by no means cheap.

More importantly, a lower federal funds rate does not guarantee that mortgage rates will fall by a commensurate amount. If they do decline, it will be because inflation has retreated and is expected to remain low or that the economy or labor market has softened to the point where generating sustained upward pressure on prices is no longer likely to occur.

Even then, with record amounts of new debt being issued by the government, there may be limits on how far rates for mortgages can fall. There is only so much demand for longer-term debt and plenty of supply -- and government debt isn't subject to the same kinds of prepayment and default risks as are government bonds, which adds incremental amounts to mortgage rates.

At some point, the perception of what's to come in terms of monetary policy rates must be met with reality, or expectations will again be reset. This seems to be the case as we write this. After last October's Fed meeting, at least some expectations were that perhaps six or seven cuts in rates were coming in 2024, starting as early as January but certainly by March. By the time the March meeting closed, there were no such changes to policy and forecasts have been dialed back to perhaps three cuts in rates this year.

Of late, investors seem to have somewhat less conviction that a rate cut in June is coming, or even if it does, that it will be followed up with more of the same very soon. Since the outlooks for growth, labor markets and inflation remain firm or firmer than previously expected, so too are bond yields and mortgage rates.

Recap

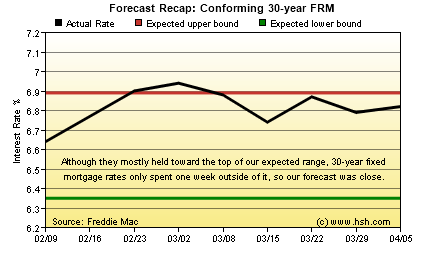

Our expectations for the just-closed forecast period were largely met, the first time that's occurred in a while. Back in early February, we thought that the average offered rate for a conforming 30-year FRM as reported by Freddie Mac would manage to hold between 6.35% and 6.89%, and it outside of a single week it did, with a bottom of 6.64% and a top of 6.94%. The lower half of the range wasn't much tested as rates began firming after we published the forecast.

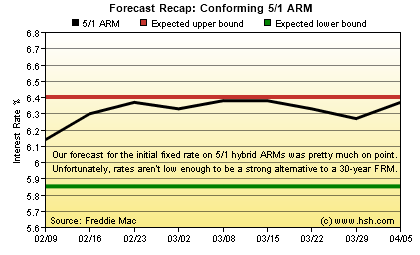

The story was much the same with the initial fixed rate for a hybrid 5/1 as reported by the Mortgage Bankers Association. We peered forward into the late winter and early spring and forecast a 5.85% to 6.40% pair of stops, and the 6.14% low and 6.38% top the markets provided fit within that slot well enough, even if the bottom of the range wasn't used at all.

A forecast that is 89% correct for FRMs and 100% for ARMs is pretty good, so after a string of misses we'll enjoy our moment in the sun for a change.

Forecast Discussion

When the Fed first starting releasing its messaging of "higher rates for longer" we speculated that this meant rates at peak levels for perhaps a year, at least based on prior Fed rate cycles. This of course presupposed that rates would have been pushed high enough as to cause an economic downturn, as has occurred in the past. At least at this point, no signs of a sharp drop in growth is to be seen, and there have now been six consecutive quarters of solid to outsized economic growth.

Labor conditions may be coming into "better balance", per the Fed's description of them, but unemployment below 4%, high job openings, strong wage gains and low layoffs don't suggest much by way of slack starting to form.

Inflation cooled sharply until about last December; since then, not so much. At worst, prices have begun to firm up a little bit again; at best, the downtrend for price pressures has only stalled.

None of these items suggest any imminent likelihood of a rate cut coming. Actually, they collectively suggest that while rates may be high enough to prevent further economic overheating, they aren't high enough to quickly damp activity. In turn, this argues for the Fed holding the present level of rates for a while longer yet, and perhaps past the June meeting, too. At one time a virtual certainty, then a most likely occurrence, futures markets now place about a 53% chance that a cut in June is coming. These odds were considerably higher in early April after Fed Chair Powell said that the outlook for policy hadn't much changed despite a couple of less-that-stellar inflation readings to start 2024, but they dropped back after the strong March employment report.

Mortgage rates are taking their cues from this. The decline of more than a percentage point in 30-year FRMs last November into mid-January was predicated on expectations of as many as six rate cuts for 2024 amid a slumping economy. As the expectation of sustained rate-cutting began to fade, long-term rates stopped falling, and have since reversed course somewhat. If expectations are now that only three cuts are coming, and conviction that the first will come in June is somewhat less strong (and perhaps also suggesting that only two cuts might come this year) mortgage rates simply don't have a whole lot of space to fall.

The Fed wants more confidence that inflation will continue to move toward its goal; investors want more confidence that the Fed will not only get to a place where they will make the first cut in rates but also that a steady path lower can be expected. Neither are with us at the moment.

This isn't to suggest that what the Fed does with monetary policy is the only influence pushing interest rates around. Mortgage rates are also strongly influenced by investor demand for MBS; among other things, MBS prices are influenced by what's happening with the supply of bonds, the supply of bonds is influenced by government and corporate borrowing (mostly government). There are plenty of 100% guaranteed U.S.-backed bonds available to buy at pretty fair yields -- and unlike mortgages, these carry little risk of early repayment as interest rates decline.

At least part of the reason why the spreads between mortgage rates and the influential 10-year Treasury yield has been so wide is that when retail mortgage rates do start to head downward, homeowners will look to refinance. To that end, why would an investor buy an MBS today with only a slight or even normal yield improvement over a longer Treasury note, since that improvement in yield might only last for a very short while?

As well, the Fed is slowly running off its MBS holdings but isn't actually selling them into the market. That's good, since there would likely be little demand for what it would be selling, as much of that accumulation was of mortgages with interest rates far lower than today. It's worth considering that even if mortgage rates do decline meaningfully, the Fed's MBS holdings are likely to be with it for a long time, since the yields on the notes it holds will likely remain below current market rates for the foreseeable future. This means there will be less refinance activity in the bonds it holds, and in turn, that balance-sheet reductions beyond homeowners making routine payments on their loans will only increase if/when homebuying picks up and folks close out existing mortgages.

Having trimmed $1.5 trillion from its balance sheet already, the Fed is planning to slow the pace of portfolio reduction, and a plan will likely be announced this spring. We'll need to see what kind of influence this has on longer-term yields once the plan is in place, as this may (or may not) introduce some volatility into interest rates. Regardless of the change, the Fed still intends to continue to pare its holdings, so investors will still need to absorb the vast amounts of new debt being issued by the Treasury.

All in all, we seem to be at a relative plateau for interest rates at the moment, but one with a bit of upward bias, as the phrase goes. The economy is perking along, labor markets are gently loosening, inflation is firm but still fading overall. Given the state of economic growth, labor markets and inflation, there's little to suggest that mortgage rates have much by way of space to decline. Moreover, the recent leveling in the downward trend for inflation has in turn seen mortgage rates firm up a bit, and we'll likely need to see a couple/few months of improvement here before space for them to meaningfully decline will appear again. As well, near-term expectations for lower policy rates by the Fed continue to wax and wane with improved or worsened outlooks in the inflation trend, and if investors aren't collectively convinced that monetary policy will go in one way or the other, it makes it more difficult for mortgage rates to move strongly higher or lower, too.

Forecast

With all of the above as a backdrop, it doesn't look as though we'll be seeing much by way of mortgage-rate relief for the spring homebuying season. A couple of soothing reports regarding inflation would go a long way to help provide space for mortgage rates to fall, but we've seen the opposite of late. Inflation isn't necessarily becoming more worrisome, but it certainly doesn't appear to be fading in the rearview mirror as quickly as hoped, either.

While inflation isn't getting much better, it also doesn't seem to be getting much worse. However, inflation not continuing to get better means that the prospects for rate cuts from the Fed are diminished, and does call into question how many might actually come this year. Without softer inflation, a flagging economy or a significant reversal in the labor market situation, odds don't favor materially lower mortgage rates just ahead, and suggests that the potential for somewhat higher rates is increased a bit.

Over the next nine weeks, we think that the averaged offered interest rate for a conforming 30-year FRM as reported by Freddie Mac will manage to hold in a range between 6.74% at the bottom and 7.14% at the top. For a hybrid 5/1 ARM, we expect that the rate reported in the Mortgage Bankers Association weekly survey will run between a paid of 6.09% and 6.49% fences during that time.

This forecast technically expires on June 7, 2024, but we may hold it over a week as the next Fed meeting is due June 11-12, and outcome could be consequential for the outlook into deep Summer.

Between now and then, interim forecast updates and market commentary can be seen in our weekly MarketTrends newsletter. You can sign up to get MarketTrends by email, too.