August 7, 2020

Preface

The rebound that was expected to come as the economy re-opened from pandemic-caused shutdowns kicked in over the last couple of months, but as might have been expected, so did a surge in infection across a wide swath of states. While this has caused some curtailment in activity -- new restrictions in states and regions most affected by the fresh outbreak -- for the most part the overall economy remains fairly open relative to where it was in March, April and even into early-mid May.

The considerable burst of activity has seen the economy begin to climb out of a record-size hole, where Gross Domestic Product for the second quarter of 2020 posted an annualized decline of 32.90%. This "advance" figure is subject to two revisions, and given some data collection issues during the period, larger-than-usual updates should be expected. Still, even big moves in one direction or the other won't change that picture much, and the road ahead to full recovery is certain to be a long and difficult one, especially for certain sectors of the economy, and including those connected with education at all levels.

What's worse is the sense that the easiest portion of the recovery is now behind us. Certainly, there has been measurable improvement in key metrics; unemployment has been trending in the right direction, and something on the order of 40% of the jobs lost in the March-April period have now been recovered. Even as there is still likely some yet-unrealized improvement to be seen, it's getting the other 60% back into the game which will prove more challenging as we close out the summer and turn to fall. Without the businesses that support these workers surviving -- let alone getting fully back up to speed -- returning to a real pattern of fuller growth with broad participation will be impossible. Even though the COVID recession may officially end up being only a quarter long, the lingering economic malaise in its wake will be persistent, and won't feel much like a recovery for a lot of folks for a long while.

Headwinds to a better or more durable recovery certainly exist. In fact, these may actually be creating more permanent damage, ranging from a distortion of the traditional education structure to the accelerated loss of millions of good jobs in retail, transportation, entertainment, government and more. With each passing day getting these back up to full speed becomes more difficult, and even if a breakthrough vaccine should prove 100% effective tomorrow, it will be at least a year or longer before creation and distribution of it gets to a point where enough people are inoculated to impart herd immunity, stopping the spread of the disease, and allowing for full resumption of normal indoor and larger-crowd activities.

Still, we have to try to focus on what positives there are, knowing full well that difficulty and disappointment likely lie ahead. Grinding forward is what we have to look forward to, so we might as well get used to it.

Recap

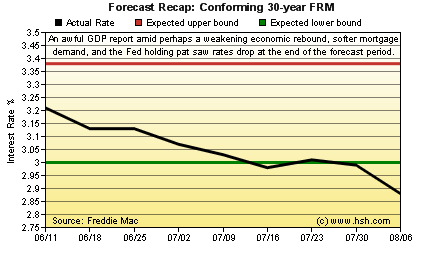

Our expectations for mortgage rates in the early-mid summer period were mostly on target until the very last week of the forecast period. When we wrote the forecast in June, we expected to see the average offered rate for a conforming 30-year fixed rate mortgage as reported by Freddie Mac to hold a range of 3.00% to 3.38%, and while the highest rate the occurred during the period was 3.13%, we mostly held to the low end of our expected range until the week of August 7, when a sharp drop put the rate on the most popular mortgage at 2.88%, a new record low.

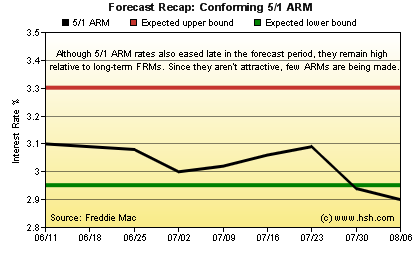

For hybrid 5/1 ARMs, we thought the initial fixed interest rate would wander in between 2.95% and 3.30%, but also saw mostly flat-to-downward movement over the nine-week period, where this interest rate peaked at 3.09% and bottomed in the week ending August 7 at 2.90%.

Since 8 of 9 weeks met our expectations, we'll call it an 88% correct forecast -- not too bad, but not as correct as we would have liked.

Forecast Discussion

It's not a stretch to say "As goes the virus, so goes the economy." Presently, the economy is about as open as it can be, given curtailments and restrictions on large-crowd and much indoor activities. Certainly, most of us have learned to rely more heavily on things like outdoor dining, pop-up drive-in movies and other partial replacements for bars, restaurants, movie theaters and sporting events. These have certainly been a boon for the collective psyche, as outdoor activities have allowed a greater bit of movement and freedoms, expanding our personal isolation spaces greatly. But spring is gone, summer is wending its way to a close and before long, cooler weather and shorter days will begin to close in again, some of those outdoor activities and diversions will diminish or disappear. In turn, business activity enhanced by them will slow again.

These outdoor opportunities have meant everything to millions of businesses struggling to survive and to millions more workers who are striving for normalcy. But how crowded will outdoor restaurants and open-air gathering spots be in October or November? It's hard to know, but any diminishment of such activities will take at least some economic toll.

Many schools are reopening or planning to reopen in some form or another, but distance learning creates all manner of distortions in the daily lives of students, parents and educators, and that ranges all the way from pre-K to university level. Billions of dollars won't be spent on day care for children, or for after-school activities; more billions of dollars won't be spent in college towns this year for rent, books, social activities and more. College sports such as football seem less likely to occur in a meaningful way as each day passes, and while professional sports leagues of all stripes are trying to capture at least some television revenue, the tens of thousands of jobs that are supported by sports by fans in the stands simply aren't going to be back anytime soon.

Although we have seen about 40% of the jobs lost in the March-April period be recovered there is little forward momentum that would suggest robust hiring is coming anytime soon. In fact, the labor components of the most recent Institute for Supply Management reports were both still weak; employment in the manufacturing sector has been contracting for a year, and the larger and more economically important service sector rebounded only weakly off its pandemic bottom and has already faded a bit from that bounce. The unemployment rate is over 10% and the labor force participation rate (although improved in July) is at about 45-year lows. Without a sustained upturn in hiring, true recovery cannot occur, and both current and expected headwinds make a sustained upturn unlikely.

We know from experience with this virus that indoor gatherings pose a greater risk of spread, and social isolation can mean real isolation in a lot of cases. It's not clear if "test and trace" will be effective or not in the U.S., and so "mask and distance" will likely continue to be our best practice for limiting the spread of the disease to others. As it did earlier in the year, more distancing and fewer outdoor activities can mean less consumer spending, trimming or subduing growth.

Because of these current and expected conditions, we expect the surge in economic activity that happened in June and July to show signs of fatigue and start to fade somewhat in August and September, and overall growth will likely settle at a pace that is still sub-par. While all measures will look much improved compared against the hard economic stop of the spring, and some will continue to look good relative to even re-opening figures, most will continue to remain well below year-ago or even pre-pandemic levels, and that's the measure that really matters.

Some additional fiscal support from the federal government will come, but in what form isn't known, and political opportunism seems to be holding up any progress on that front. Even so, no matter what comes, or when, such supports are a poor replacement for actual growth and job creation and will only allow economic activity to limp along at best.

As it often does, uncertainty clouds the future. Unfortunately, an economy that is running at perhaps 50% of what it was pre-pandemic and one that seems to be facing new or additional headwinds doesn't inspire much by way of confidence, and a lack of confidence, growth and inflation will likely mean lower interest rates ahead.

As far as mortgages go in the coming couple of months, there are some crosscurrents to consider. On the one hand, yesterday's risks of making or managing mortgages is flat to falling, as mortgages in active forbearance plans have been gently trending downward. It's also true that after a 4-month requirement for servicers to pay loan owners has passed that the financial obligation for these GSE-backed loans will be passed from servicers to Fannie Mae or Freddie Mac, so there is a lessening burden on servicers for a fair chunk of mortgages. However, risks in making mortgages yet persist, and future risks may again be growing, what with millions still out of work or working with reduced incomes. Some of yesterday's forbearance plans may turn into full-blown loan modifications, while persistent and perhaps intensifying economic weakness could push some unknown number of new homeowners to seek assistance in the coming months.

This matters for mortgages, for even if the yields on instruments that influence mortgage rates are declining due to a difficult economic climate and a lack of inflation, that same climate is serving to increase risks of lending. When risks of lending and owning mortgages are elevated, spreads over mortgage-related benchmarks increase, keeping rates from declining (or even pushing them higher) even if underlying instruments are seeing their yields declining. It is the key reason why mortgage rates have remained stubbornly "high"; although already at record nominal lows, they would likely be even lower if mortgage risks were waning. Any decreases in risks of making and managing mortgages is what would help rates to decline, but given the climate, it doesn't seem likely that we'll see much of that in the next nine weeks.

Forecast

For the next nine weeks, it does seem likely to us that we'll see a repeat of the pattern of the last forecast, where rates are largely stable but retain a downward bias. It wouldn't surprise us at all if a couple of weeks of little movement was interrupted by a more measurable leg downward or two, much as the preceding nine-week period played out. With this in mind, over the coming nine-week stanza, we think that the average offered interest rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac will range between 3.06% and 2.72%, with odds again favoring the bottom of the range. For the initial fixed rate on a hybrid 5/1 ARM (not that many care), a 3.03% and 2.80% pair of fences should contain the most popular adjustable-rate mortgage.

New record lows during the coming period should help to continue to support refinance activity, but can do little to enhance sales of homes, which are being tempered by limited inventory of houses to buy and prices that have begun firming again.

This forecast expires on October 9, 2020. We'll be well into a weird fall sports season at that point, with maybe some football or not, baseball playoffs starting or not and the typical starts of NHL and NBA seasons still months off. As shorter days push you inside more and more, why not take a break from surfing channels looking for entertainment and stop back and see how this forecast turned out?

For interim forecast updates and market commentary, see our weekly MarketTrends newsletter.