November 15, 2019

Preface

After a few "mid-cycle adjustments" in policy, the Federal Reserve seems to again have short-term interest rates at a level they deem "appropriate", and unless things unravel greatly from here, the central bank has moved to the sidelines.

Now at their lowest level in more than a year and a half, there is little likelihood that more cuts are coming anytime soon, and there are perhaps the same odds for an increase in rates, too. To be sure, the Fed cut rates to try to counter the effects of both trade "wars" and an otherwise weak global economic climate, and while lower short-term interest rates can only do so much, they have at least provided investors some optimism that brighter days may come. That's also the case with regard to the trade outlook, as the U.S. and China are working on a "phase one" agreement that (while yet unfinished) should help to at least steady wobbly or weak economies in lots of places around the world. As well, movement on the Brexit front has cheered investors, too, and while that process remains rather a mess without a clear outcome at the moment, upcoming elections in December may see a deal get done before much more time passes. As with the trade mess, any deal in place is better than no deal, as a more stable trade climate can help investors plan for future outcomes.

Of course, the consequence of greater optimism and a likely bottoming of interest rates reflects at least one thing: If things aren't getting worse, they are likely getting better (or at least have found a place of likely stability). Things betting better will eventually see interest rates moving higher, but at present -- and for the reasonably foreseeable future -- things are likely to only slog along, much as they did in the early days of the recovery and expansion.

It is here where we find ourselves at the moment, at a place of tenuous stabilization but yet with plenty of risks and headwinds with which to contend. The platform may be wobbly, but it appears at least that most folks now think that there is a platform, and that's a victory in its own right.

Recap

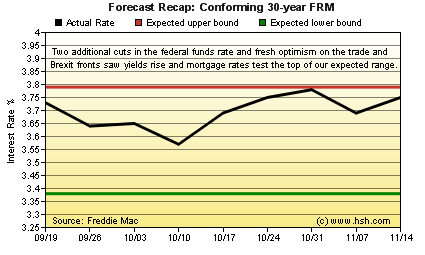

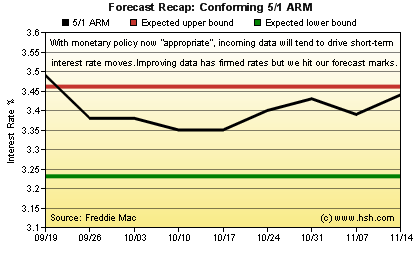

For the first time in a while, we can pat ourselves on the back for our most recent forecast, as our expectations were realized. In our last missive, we said we expected "that a period of greater volatility is ahead with more up-and-down swings than the near-steady 2019 decline which we've enjoyed", and in the 30-year FRM we did see two sizable weekly upward spikes of 17 and 12 basis points and downward drops of nearly a tenth of a percentage point on two occasions, too, so that call was pretty fair. At one point, rates moved to about four-month highs and after settling for a time have moved back toward those levels. Whew.

Back in early September, we thought we would see a range for the conforming 30-year FRM as reported by Freddie Mac each week hold a range between 3.38% and 3.79%, and the market presented us with a 3.57% and 3.78% pair of fences. For the initial fixed rate on a hybrid 5/1 ARM, we expected a 3.23% and 3.46% range and saw a 3.35% bottom and 3.49% top during the period. The 3.49% was an outlier, and likely related to the seizure seen in short-term funding markets during in mid-September. The Fed has since addressed this issue by conducting a regular non-QE purchase of short-term Treasury bills to maintain adequate liquid reserves and help stabilize the federal funds rate and other short-term instruments.

Regardless of that oddball value, the rest of our forecast was fairly spot on.

Forecast Discussion

Where the last forecast was challenging, as the direction of interest rates largely relied on the psyche of investors, it seems to us that this one will be more dictated by the fundamentals of economic growth and prospects for inflation.

Given the situations in many major developed economies, the road just ahead is likely to be a bit of rocky one. Already cooling from earlier this year, the economy here in the U.S. appeared to continue to cool in the early part of the fourth quarter, with GDP growth presently reckoned at a flat one percent rate. It's early in the period in terms of data, though, so we're likely to see a little improvement in that estimate, but will probably struggle to hold the 1.9% clip of the third quarter when all is said and done.

We're faring a bit better here than elsewhere, though. The whole of the Eurozone is estimated to be growing at just a 0.9% clip in the third quarter, with both low-rate policies and open-ended QE-style bond buying in place for support. Growth in Germany (the region's largest economy) is near standstill with growth of just 0.3%. Japan's expansion is even more fragile with just 0.2% growth in the latest period, and China continues to see growth slowing, as it has now for much of the year to date, and the UK is expanding at just a 1 percent rate at the moment. We could go on, but suffice it to say there is considerable room for improvement just about everywhere.

Inflation remains subdued at the moment, but in our estimation is gaining at least a little traction here in the U.S., with core Personal Consumption Expenditures rising from a 1.6% rate in the first two quarters of 2019 to 1.7% in the third. Other price measures, such as the Consumer Price Index, remain at levels somewhat above the Fed's preferred 2% speed limit and have been fairly firm for months. Although not a concern just yet, as core PCE edges closer to the Fed's 2 percent limit discussion will start about the prospects for a coming increase in the funds rate, but we'll need to see prices not only at that 2% level or perhaps slightly above for a time before that becomes a serious conversation.

Since the last forecast, the Fed cut the federal funds rate twice, hoping to take out some insurance against drag of a soft or softening global economic climate. In theory, the Fed's actions will help to eventually lift economic growth, but this comes with a lag of perhaps six months or more before the benefits of lower borrowing costs filter through the economy. With this the typical case, we may only start to see whatever benefits accrue to the June rate cut as we move into December, with the lift from the other two reductions arguably being fully realized by February and April but perhaps beyond. Those improvements, if any, would come beyond the scope of this forecast period, but if the economic train is moving in the right direction more quickly as we come to the end of this forecast period, the additional acceleration from those two cuts may play a role in lifting rates toward the end of the period.

A "phase one" agreement on trade between the U.S. and China has improved the outlook for growth, but not only is the deal not yet signed and executed, key details are still being hammered out, including any rollback on any already-imposed tariffs. Regardless, even if signed tomorrow, re-engaging the trade machine more fully won't happen overnight, and it's a good bet that any improvements on this front will happen very slowly, as businesses will likely be wary for a good while due to President Trump's mercurial nature, where any deal could be called off on a moment's notice by a simple tweet.

Presently, it doesn't seem to us that there is much reason to expect any significant economic acceleration or unexpected deceleration in the coming nine-week period. Most likely, we'll see modest overall growth pushed higher by the consumer but dragged back by soft manufacturing and exports. That said, we might just see more stabilization for manufacturing, albeit at a low level, at least until an actual trade pact is again in place. Price pressures remain mellow, and while we do think they are firming a bit, the trend is a very slow one at best. Without faster growth or rising inflation to drive rates, we feel as though we'll be in a somewhat choppy, data-driven climate for rates for the next while, but probably one that is somewhat less spiky than the period just closed.

Forecast

We may be overly optimistic, but markets feel less jittery to us at the moment than they have for much of this year. It is just quiet before the storm? Hopefully not, and with added central bank stimulus in place, a possible trade pact in play (and the delays on other scheduled tariff impositions, too), a likely outcome plan for Brexit and a U.S. economy that keeps on chugging despite a less-than-favorable climate, we think that odds favor stable to just slightly higher mortgage rates during the period.

With this in mind, over the next nine weeks, we think that the average offered rate for a 30-year fixed-rate mortgage as tracked by Freddie Mac will hold a range between 3.59% and 3.91%, while the initial fixed interest rate for a hybrid ARM should wander in a pair of 3.29% and 3.57% fences over the period.

The next nine week period takes us through the Thanksgiving-Hanukkah-New Years holiday period. We wish you all the best of the season.

This forecast expires on January 17, 2020. Between now and then, holidays will likely quiet markets down a bit before they kick back into high gear in the first full week of January. The dead of winter's a good time for some reading, so stop back and see how we fared with this 2019-closing, 2020-opening forecast.

For interim forecast updates and market commentary, see our weekly MarketTrends newsletter.