April 25, 2025

Preface

Between the last Two-Month Forecast and this one, an earthquake rumbled through the financial markets. While the initial reports suggest there may be considerable damage, it's best not to make such assessments until after the inevitable aftershocks come. The problem is, where the initial quake had a fairly known date that it could be expected to occur, aftershocks may come at any time, and there's even a chance that another strong tremor will come in less than 90 days. Conversely, maybe few or even none will come. There's simply no way to know.

What didn't change much (at least not for now) is what's happening with interest rates. Certainly, the expected trend for them has changed from a scenario where they were likely to have a long downward run and gently fade over time to one where they may be higher for longer still, and even another where long-term rates may remain relatively elevated even if short-term rates are declining.

As an earthquake is wont to do, the ground has shifted beneath the feet of investors and among U.S. trading partners and allies. At least the environment for homeowners and potential homebuyers hasn't changed -- that is to say, housing market conditions continue to be challenging, with any improvements purely on the margins, leaving the overall picture largely the same as it has been. For now.

New earth-moving rumbles may yet come, such as the administration's recent badgering of the Federal Reserve and Chair Powell to cut rates, and do so quickly. While the Fed may or may not make such a move anytime soon (and probably won't), any change they do make will be to respond to economic and inflation conditions. It's fair to say that recent financial market turmoil, downturns in sentiment and sharp increase in inflation expectations haven't been caused by the current stance of monetary policy.

At the same time, it's worth considering the value of a cut in rates. As we wrote in our April 18 MarketTrends, "To be sure, a quarter-point (or even half-point) cut in the federal funds rate doesn't change the picture very greatly from either a business or consumer standpoint, and lower interest rates are only useful to those who need (and have the confidence to) borrow money. As well, if cutting rates should in turn help keep inflation firm at a high level, long-term interest rates would not only not fall, they would likely remain high or even increase."

Recap

As it turned out, our last forecasts were pretty solid, in that we generally got the result in trends we expected to see. However, what turned out to be fairly level lines on a graph belied the tremendous turmoil that overswept the financial markets this spring. Progress in lowering inflation stalled at the close of last year and the start of this one; as such, the Federal Reserve wouldn't likely be in a hurry to cut rates anytime very soon, even though economic growth has been showing signs of flagging a bit.

The imposition of new tariffs on a wide range of trading partners threatens to slow growth further, and perhaps while creating new inflation pressures of both unknown size and duration. Uncertainty had already been creeping into the financial markets, then rushed in a burst, and there is little reason to think that the situation has improved much as yet.

Due to the way increases in levies were announced and implemented, investors simply don't know where to turn for shelter from the tariff maelstrom, and even Treasurys failed to provide a place to hide. Stock prices slumped and rallied; bond yields dropped then spiked, and all in all, there's still no calm or reliable place to hide right now, so volatility continues to be the order of the day. Even periods of relative calm still seem to impart a sense of foreboding rather than hope.

Where things are headed certainly isn't clear, and it may be that some kind of stasis is about the best we can hope for right now.

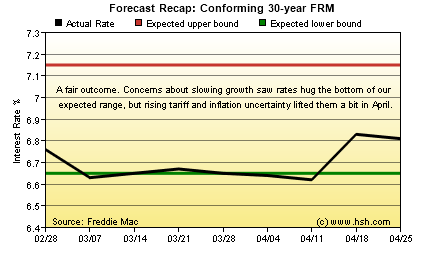

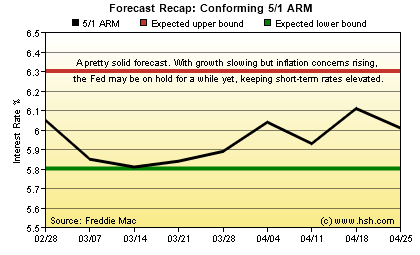

For our part, we expected to see 30-year FRM rates as reported by Freddie Mac range between 6.65% and 7.15%; the markets provided 6.26% and 6.83% stops. For 5-year Hybrid ARMs, our expectation was a pair of 5.80% and 6.30% bookends, and the nine-week period featured a 5.81% loan and 6.11% top. All in all, pretty fairly within our forecast ranges.

Forecast Discussion

Since the early April announcements of the imposition of wide-ranging tariffs, things feel unsettled at best. Consumer and business sentiment have plummeted in recent months, price levels remain high and inflation is expected to kick higher again. Despite this, expectations that the Federal Reserve will be looking to cut rates as the year progresses have grown, and as forecast by futures investors, at least three and perhaps as many as five trims in the federal funds rate will be seen before 2025 comes to a close.

Given the nature of what the Fed is hoping to accomplish, that seems unlikely to us. It seems certain that increased tariffs will be in place, pressuring inflation higher again, but by how much? Will those changes in the price level be "transient" or prove more durable? What will be the effects of changes and disruptions in supply chains, and how does this impact labor market conditions, and how quickly?

Draining billions out of consumer pocketbooks and business coffers may help improve the government's finances, but what will it do to consumer spending? What's the impact on business profits, and in turn, on the investments that consumers hold? The earthquake in the stock market that saw record-level plummets and increases in share prices in just a matter of days will likely have some lasting impact, but how much isn't clear... and the next such bout may be only an Executive Order or Tweet away.

It's true that no one has any right to certainty, and that's true of nearly everything in life. But even in times of turmoil -- and we've certainly seen our share of these in just the last couple of decades alone -- there are things on which you can generally rely, or that there may be at least some kind of backstop to help provide support when things go poorly. We saw such actions during and after the financial crisis and again when the pandemic upended everything; governments sprang into action (to the extent that they can) and communities came together to support one another. Not that things have gone all that south (at least not so far) but the current unsettled environment somehow feels as though no one will be coming to the rescue if things do turn down, and this feels very isolating, somehow.

It's not yet bleak, though, at least not by the actual hard data that tracks what's happening in the economy. Things may feel bad or discomfiting, but overall aren't poor, even though it at times may feel this way. Yes, major stock indices are down, and that's not good -- but even so, are only back to where they were about a year ago. Borrowing rates for many items remain high, but are lower than peak levels of a couple of years ago, and even mortgage rates continue to tread ground they've covered multiple times over the last year or two. Labor market conditions remain very solid, with low unemployment, above-inflation (for now) wage increase and a moderate pace of hiring. Fuel costs are lower, too.

But how things feel as opposed to how they are can go a long way toward influencing future behavior, and expectations of a worsening economic climate with higher inflation can become self-fulfilling. As such, how things feel rather than how things are will likely be the driving force for the coming forecast period. Unsettled financial market conditions seem highly likely to continue and may even re-intensify at times, so perhaps the best course of action is to watch and wait to see how things play out -- all while trying to keep some focus on things that remain fairly solid.

Forecast

We had hoped to be writing this forecast in a climate where inflation was again edging toward the Fed's target and the economy was cooling enough to allow long-term rates to ease a bit more. Such a backdrop would increase the chances that the Fed would resume gradually trimming short-term rates in the coming months. Unfortunately, that's not the case.

By its nature, "hard" economic data only becomes available with a lag, and so is backward looking. With the future so cloudy, waiting for hard evidence of the impact of financial market upheaval and tariff imposition does raise the prospect that the Fed may not be able to time very well any move it may decide to make. It's difficult enough for the central bank to try to act preemptively when adverse conditions seem likely, but in the present climate, it's nearly impossible. Any choice to address one emergent issue risks worsening another, and there's really no way to know or even model the impact of the trade, immigration, fiscal policy and regulation changes the administration is implementing, as their size and scope is by no means certain and seems to change without warning on a nearly-regular basis.

It's in this climate that we offer a forecast, but admittedly one with less conviction than usual. From a "hard data" perspective, it would appear that the most likely range for mortgage rates would be roughly the same as the last forecast period. The "soft data", though would suggest darker times ahead, and those would normally call for rather lower interest rates, with ranges perhaps closer to the levels seen at the end of last summer and into the early fall.

That said, there's at least an fair chance that inflation starts to show over the next month or two, and comes on fast, lifting interest rates back up toward January highs, if not beyond them. All this in mind, you'll have to forgive us a little additional leeway for this forecast, and we've set wider ranges accordingly.

Over the next none weeks, we think that the average offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac will likely hold in a range between 6.55% and 7.25%. As far as the initial offered rate for 5-year hybrid ARMs reported by the Mortgage Bankers Association, we think that a pair of 5.80% and 6.30% fences (same as last time) should contain the most popular alternative to a long-term fixed rate mortgage. We wish we could be more certain than this, but the current environment doesn't permit it.

This forecast expires on June 27, 2025. As you head to the beach, stop back in and see if this forecast was met with favorable tides and winds, or whether it got swept under in the market's rip currents.

Between now and then, interim forecast updates and market commentary can be seen in our weekly MarketTrends newsletter. You can sign up to get MarketTrends by email, too.