June 2, 2017

Preface

Despite two moves by the Federal Reserve in the last six months and the promise of more to come, and mortgage rates continue to remain tethered. To be sure, it's not as though the overnight, intra-bank federal funds rate has much direct impact on long-term fixed mortgage rates; however, if the central bank is slowly raising short-term rates, it is because they are seeing sufficient growth and at least the prospect of higher inflation on the horizon, and are taking steps to keep growth and prices on as even as keel as possible.

In theory, bond investors should be seeing the same things, and adjusting their holdings and demand for yield accordingly, pressing interest rates a bit higher. So far, that has not much been the case; investors continue to show interest in bonds with low yields, as uncertain political waters continue to provide plenty of reason to want to park money in relatively safe locations, even if returns are meager.

Can this continue to be the case, and if so, for how long? As it is, the Fed already expects that the so-called "neutral" rate for the federal funds will likely be lower than it has been in recent times, perhaps topping out at a 3 percent rate (rather than the 4 percent plus which would be suggested by the typical actions of the last few Fed cycles). Could it be that this expectation is serving to keep long term rates lower and more stable than might otherwise be the case? In turn, may the Fed need to begin to ratchet that expectation a little higher if it wants to see longer-term interest rates also tick higher? After all, if investors are being told and don't believe that historically normal levels of interest rates are attainable in this cycle, perhaps long-term rates really aren't able to rise much from these levels.

Can we really ultimately have 2 percent core inflation, a 3 percent federal funds rate and long-term mortgage rates in the low-to-mid 4s? It just doesn't seem likely. Something eventually has to give, even in a world awash with cash from years of central bank stimulus programs. At some point, the yield spectrum must adjust.

To that end, the Fed is starting to coalesce around a plan to gradually reduce its massive portfolio of bonds. At least to start with, the Fed will begin tapering off the reinvestment of inbound proceeds from maturing bonds. Although no plan has been announced, the general idea for example is that if $8 billion in bonds the Fed holds matures this month, the Fed will "recycle" perhaps $5 billion into purchases of replacement bonds and retire $3 billion, shrinking its portfolio. These amounts and the percentage being retired will increase over time until the Fed is eventually no longer recycling any funds and the portfolio will be in standalone runoff mode. Of course, the Fed could decide to sell assets outright, too, but so far there is no public plan to do so. Trimming of the Fed's portfolio is expected to start later this year, perhaps in December, as it is likely that Fed Chair Janet Yellen wants to have this in place before her term expires. Although effects on interest rates are expected to be slight, there's no way of knowing the market's reaction until things are under way.

Recap

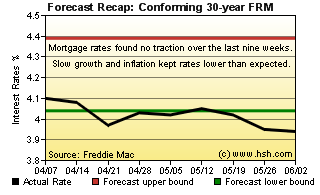

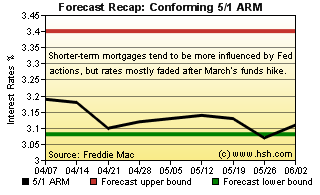

We felt pretty good about the ranges we set for popular mortgage products for our last forecast period, which were largely unchanged from the prior outlook. We expected that another first-quarter slowdown would help keep rates fairly anchored, but that investors would mostly look past this annual aberration and focus on stronger growth to come; that never happened, and rates remained lower than expected. Back at the end of March, we thought that the average conforming 30-year fixed as reported by Freddie Mac would run a range of 4.04 percent to 4.39 percent, but we never even tested the middle of the range, never getting higher than 4.10 percent but managing to fall as low as 3.94 percent. We did fare a little better with our expectation for rates on hybrid 5/1 ARMs, where we called for a 3.08 percent to 3.40 percent pair of stopping points. However, a 3.07 percent bottom and 3.19 percent top also trended lower than expected, but were mostly in range. Although it would be hard to call the forecast a success, lower rates than expected continue to provide some relief for homebuyers who faced sharply higher home prices again this year.

Forecast Discussion

So what might cause mortgage rates to finally begin to move up to a new plateau -- even one that might not be all that far from where we are now? Most likely, it will require a little more aggressive messaging from the Fed, a little higher inflation, and opportunities for investors to make money outside the U.S., which would serve to draw funds out of U.S. financial markets, especially bonds, in turn lifting yields.

However, this would require that the U.S. and other major economies find some way to not only strengthen from current levels but also instill a sense that this higher level of growth will become the norm (or at least reliably appear). This sort of thing has been particularly difficult to come by in this period of expansion in the U.S., where getting even two consecutive quarters of above-trend growth has been a challenge, let along other economies which have mostly lagged behind our recovery. As well, and although deflation or "disinflation" isn't a term much bandied about of late (a good thing), central banks around the globe continue to struggle with creating the kind of reliable price pressures they would prefer to see.

Slow growth and modest inflation will continue to make it difficult for long-term interest rates (and mortgage rates) to rise very much, but if the Fed does continue on a path of slowly increasing interest rates, investors may start to show a preference for shorter-term instruments as their rates rise with the Fed's actions. That would tip demand in favor of shorter over longer term bonds, and this shift in demand might tend to lift longer rates at least a little bit.

From the Fed's standpoint, new economic projections will be released from Federal Reserve members in less than two week's time. If there is even a subtle uptick in the mid-to-long range outlook for the expected path for the federal funds rate, this also could be enough to bump rates up a slight amount. That said, even if the second quarter shows a considerable ramp up in growth over the first (and so far, there's scant evidence of this) it may not be until late in the summer until rates really start to show signs of heading north. This would come after an expected June hike by the Fed, and maybe not even until a September one occurs (if it comes). Another rate hike (or two) in the bag and the impending start of the Fed's portfolio wind down closing in may just be enough to push rates back to or beyond 2017's current high water marks. However, that's more of a later than sooner sort of prospect.

Forecast

The next nine weeks seem to us to be likely to be a period of muddy water. In terms of GDP growth, the second quarter will no doubt be stronger than was the first, but even after a faster start already seems likely to slip back to something in the low 2 percent range or so when all is tallied. Between now and early August, we expect to see plenty more mix-and-match economic news; all generally fair, but without enough collective strength to push rates much higher. With this expectation, and given the experience of the last two forecasts, we have no reason not to move down our expected range for rates. Over the next nine weeks, and as reported by Freddie Mac, we think that the average conforming 30-year fixed-rate mortgage will wander between 3.85 percent and 4.2 percent, while the average rate for hybrid 5/1 ARMs manages a 3.01 percent to 3.25 percent pair of bookends.

This forecast expires in early August. It'll be high summer by then, the midst of vacation season. If your of a mind to, perhaps you might put aside that beach read and drop back in to see how well this forecast turned out.