October 6, 2017

Preface

Mortgage rates haven't been moving much over the last few months, but the upcoming period will certainly feature many moving parts that could change this quiet period into a somewhat more volatile one. After years of considerable direct influence on both long-term interest rates and mortgage rates (and market liquidity), the Federal Reserve will begin its protracted process of actually reducing its massive holdings of Treasuries, mortgage bonds and mortgage-backed-securities.

As this process unfolds, and depending upon the whims of President Trump, the leadership structure of the world's most important central bank may be changing, or not. This could mean a continuation of Chairwoman Janet Yellen's term (or not), a replacement who espouses similar monetary philosophy or a complete change. What may come is not clear, but as we write this, the President has indicated that he may make an announcement in as little as three weeks' time. While some can point to shortfalls in meeting policy goals for inflation, a long stretch of solid (if unspectacular) growth, low levels of unemployment and measured stewardship of monetary policy are all good things, even if the goal attaining a desired level of inflation remains elusive.

For our part, Ms. Yellen has done a very good job, seems to have the respect of colleagues and markets alike and should be asked to stay on the job (although it is also not clear if she wants to remain). A change at the Fed could inject some uncertainty into financial markets, but depending on the change (if any) may be beneficial (or not) for mortgage rates.

Other factors will come into play as we go though the next nine-week period. Of course, the economy and inflation will have much to say about where interest rate will go. There is some uncertainty about the impacts of Hurricanes Harvey and Irma; presently, it's hard to reckon how much these have curtailed economic activity (or how they may enhance it in the future). Currently, there seems to be a mild uptrend in prices, and projections and statements from Federal Reserve members strongly suggest that another hike in the federal funds rate will come in December. There is of course a meeting of the group at the end of October, but no policy change is expected, then, and the December meeting comes just after this forecast expires.

A lot can happen between now and then, and with lots of moving parts, it's reasonable to expect a bit more volatility in the period just ahead.

Recap

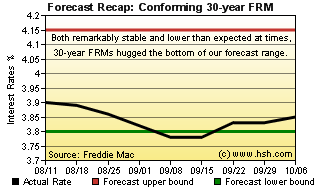

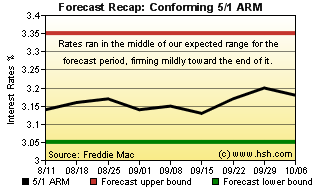

We did fairly well with our last forecasts, even as fixed rates again tended to hug the bottom of our forecast range and even dip a couple of basis points below it. We expected conforming 30-year FRMs to hold a range of 3.80 percent to 4.15 percent, but ran low, with a 3.78 percent bottom and just a 3.90 percent top in the waning weeks of summer. Our expectation for hybrid 5/1 ARMs was solid, though, as we looked for a 3.05 percent to 3.35 percent range, and got a 3.13 percent bottom and 3.20 percent top (rates really barely moved at all), but we think both were are least good enough to call the last forecast a modest success.

Forecast Discussion

As we start the final quarter of 2017, its increasingly looking as though we won't see our expected top levels for mortgage rates this year. That said, there remains a chance that rates may approach (and possibly surpass) the early year peak of 4.30 percent, but a lot would have to break in the favor of higher rates for that to happen. There is still a chance that significant tax reform could be hammered out in Congress before the year's end, and to the extent that it would goose growth next year and beyond it could influence interest rates higher.

Growth is already pretty decent, with GDP having reached a 3.1 percent level in the second quarter, its first foray over the 3 percent mark in about three years. Now well into the third longest expansion on record and likely to become the second longest in just 6 months' time, it's hard to expect that we'll see a long stretch of 3+ growth. The current run rate for GDP in the third quarter had recently been in the low 2 percent range, but has moved up again in recent weeks. If growth can reliably hold near or above its "potential" (a GDP of 2.6 percent or thereabouts) inflation may continue to only percolate at a low level, but a rate closer to 3 percent would likely see inflation move up, too.

And where is inflation? Janet Yellen recently called persistent low levels of inflation "a mystery", as its models have consistently overshot actual inflation. The Fed has noted on a number of occasions that it believes these low-price period are due to transitory factors, but we seem to have moved from episode to episode in recent years, all with a cumulative effect of prices lower than the Fed desires. That said, many major economies are now starting to pick up unison, and this may have an effect on inflation as we go. It bears noting that the trend seems a flat-to-mildly upward one at the moment, with core CPI holding a 1.7 percent rate for the last four months, both import and export prices rebounding strongly after a soft patch in spring and early summer. The Fed's preferred inflation measure (core PCE) has slid lower since the spring, but perhaps the recent uptick in inputs and expectations hasn't yet shown in that measure (the latest data is for August).

In theory, a growing economy and tight labor market should tend to push prices and interest rates higher; low and soft price pressures will tend to keep rates tethered to a great degree. This being the case, and with influential forces on rates still counteracting each other, this leaves only a few items to push rates upward in the period just ahead. Although expected to be mild, there is some unknowable effect on rates from the Fed's program of limiting reinvestment; presently, it appears that the market is ready to absorb the Treasury and mortgage bonds the Fed won't be buying, but they may prefer one instrument over the other, or may eschew mortgage-related items if conditions become somewhat less favorable for them. Suffice it to say that it's hard to know the effects of an unprecedented program, but our bet is some mild firmness for rates as a result. Then, there's a possible changing of the guard at the Fed; should a change to a Fed chair who wants to raise rates or reduce its balance sheet more quickly occur, markets could react badly, and rates could rise as a result. As well, tax policy may play a role; if the economy is doing pretty well (as it is), the question may be "does it need additional stimulus... or would this risk sparking inflation, with higher interest rates as a result?" The devil is in the details, of course, but there is a chance that expectations of higher growth ahead will foster higher interest rates, as was the case after the presidential election last year and at times earlier in 2017.

As we noted above, a lot of moving parts. The economy and inflation are at least relatively knowable and familiar; one is unknowable but can be reckoned to a degree (Fed disinvestment) but the other two are wildcards, to be sure.

Forecast

We've hedged our forecasts to the upside almost all year and this has meant missing the mark to a degree, with rates tending to hold to the lower end of our expected ranges (you can check forecast archives to see). That may ultimately turn out to be the case again, but we do think some additional firmness is to be expected over the next nine weeks, but probably only enough to put us closer to existing range tops than range bottoms. This being said, we don't think that we need to make much change to our last expected range, but we'll cut 5 basis points off of the top end, putting the forecast borders in place with 3.80 percent to 4.10 percent markers for the average conforming 30-year fixed-rate mortgage as reported by Freddie Mac. For hybrid 5/1 ARMs, our current fences will remain at 3.05 percent to 3.35 percent. Wildcards may come back to haunt us, or not. We'll see.

This forecast expires on or about December 8, with a Fed meeting looming and the holiday season in full swing. In the midst of shopping/baking/planning, why not drop by and see if our forecast was a turkey or not?