The Home Affordable Refinance Program (HARP) was a federal refinance program targeting underwater homeowners. First announced in March 2009, HARP is designed for homeowners who are current on their mortgage payments, but who haven't been able to refinance because they have limited equity, no equity or negative equity in their homes.

The Home Affordable Refinance Program (HARP) was a federal refinance program targeting underwater homeowners. First announced in March 2009, HARP is designed for homeowners who are current on their mortgage payments, but who haven't been able to refinance because they have limited equity, no equity or negative equity in their homes.

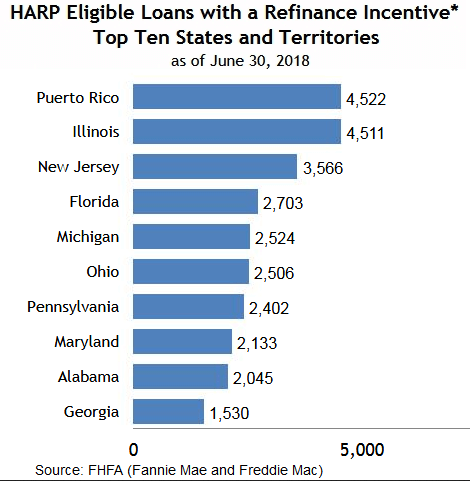

The Federal Housing Finance Agency (FHFA) and the Treasury Department originally estimated that four to five million borrowers would be able to refinance under HARP. Since the program began, almost 3.5 million homeowners have refinanced their homes through HARP, according to the latest statistics from HUD. Given present conditions, it is estimated that fewer than 38,000 U.S. households might still benefit from participating in the program. More than 70% of these eligible homeowners reside in 10 states.

On August 17, 2017, the FHFA announced that the HARP program would be extended again, and will now run until December 31, 2018. At the same time, HARP's replacement, the Streamline Refinance program will also run concurrently, starting with loans originated on or after October 1, 2017.

Note: The HARP program expired on December 31, 2018.

Do I qualify for HARP?

A HARP loan looks a lot like any other mortgage. Since HARP mortgages are backed by Fannie Mae and Freddie Mac, the underwriting process will resemble that of any other conventional mortgage. There will be loan disclosures to sign and supporting financial documentation to remit. Mortgage lenders are looking for borrowers with solid incomes, good assets and quality credit scores.

Here is the full list of HARP requirements:

- The mortgage must be owned or guaranteed by Fannie Mae or Freddie Mac

- The mortgage must have been sold to Fannie Mae or Freddie Mac on or before May 31, 2009

- Borrowers must be current on their mortgage payments with no payments more than 30 days late in the last six months and no more than one late payment in the last 12 months

- Eligible property types are primary residence, one-unit second home and one-to-four-unit rental property

- The current loan-to-value (LTV) ratio must be at least 80 percent. There is no maximum LTV limit for a new fixed-rate mortgage. The maximum LTV for a new adjustable-rate mortgage is 105 percent.

- You cannot have previously refinanced under HARP (unless it was a Fannie Mae loan refinanced under HARP between March and May 2009)

5 ways to prepare for a HARP refinance

Once you determine that you qualify for HARP, it’s time to start preparing your finances. Here are five ways to prepare for a HARP refinance:

1. Ensure Fannie or Freddie backs your mortgage

Fannie Mae and Freddie Mac each have a loan lookup tool which allows homeowners to search for their loan:

To check if your mortgage is backed by Fannie Mae, visit https://yourhome.fanniemae.com/calculators-tools/loan-lookup. If your mortgage is not found, try Freddie Mac's loan lookup at https://myhome.freddiemac.com/resources/loanlookup.

Mortgages not listed on either website are not backed by Fannie Mae or Freddie Mac and, therefore, are not HARP-eligible.

2. Determine if your mortgage is old enough

Only those whose mortgages were securitized prior to June 1, 2009 can apply for HARP. In general, this means that your mortgage must have started in mid-May 2009 or earlier. You can find your mortgage start date by looking at your closing paperwork.

Note: Since it can take up to 60 days to securitize a Fannie Mae or Freddie Mac loan, even if your start date is close to June 1, 2009, you still may be ineligible.

3. Does your mortgage have mortgage insurance?

HARP is designed to help homeowners with or without private mortgage insurance (PMI) and lender-paid mortgage insurance (LPMI). The general rule of thumb is that if you have mortgage insurance, your new HARP mortgage must have the same level of coverage.

Some borrowers have been denied a HARP refinance because of LPMI. If your currently lender won’t refinance because of LPMI, shop around for one that will.

4. You must be current

HARP requires that all homeowners have made their last six mortgage payments on time, with a maximum of one 30-day late payment in the past year. This information is verified against your credit report, so be sure to review your credit reports prior to submitting your HARP application.

5. Organize your HARP paperwork

Since HARP mortgages are underwritten like every other type of mortgage, you will be required to provide bank statements, a driver's license, homeowners insurance information, pay stubs and W-2s. If you're self-employed, you'll have to provide a few years of tax returns to verify your income.

The speed in which you return these items to your lender can dictate your mortgage rate. If you're going to apply, you must follow these tips to be approved and to close as quickly as possible.

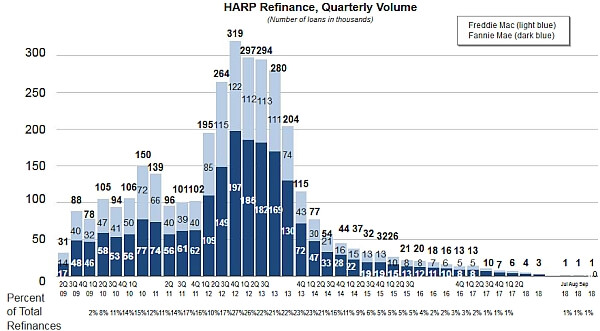

HARP Refinance Trends 2009-2018

Why don’t I qualify for HARP?

While the HARP program has evolved over the years to allow more borrowers to qualify, there are still several reasons why you wouldn’t qualify for HARP, including:

- Bad credit. Some borrowers can't qualify due to impaired credit or too many late payments on their existing mortgage.

- Equity issues. HARP has no maximum LTV ratio for borrowers who obtain a new fixed-rate mortgage, a maximum LTV ratio of 105 percent for borrowers who get a new adjustable-rate mortgage, and a minimum LTV ratio of 80 percent for all loan types. However, lenders typically impose their own guidelines, called "overlays," which may include different LTV rules.

- No re-HARPs. Homeowners can only utilize the HARP program once.

- Fannie and Freddie. You will not qualify for HARP if your mortgage is not owned or guaranteed by Fannie Mae or Freddie Mac.

FHFA Senior Policy Analyst Michelle Murphy says borrowers who've previously been denied for HARP should try again and shop around.

"Call your current lender and share with them that you want to explore a HARP refinance," she says. "If you're denied, find out the reason and don't be discouraged. You may be able to refinance with another lender."

Can I refinance a first and second mortgage through HARP?

In order to refinance both a first and second mortgage through HARP, you must meet two additional requirements, according to MakingHomeAffordable.gov:

- The lender that holds the second mortgage must agree to remain in junior lien position

- You must be able to meet the new payment terms of the first lien mortgage, and demonstrate your ability to do so

Can I refinance a rental property through HARP?

The general answer is "yes," you can refinance a property under HARP if it is a rental. Of course, the loan must still meet all the typical HARP requirements.

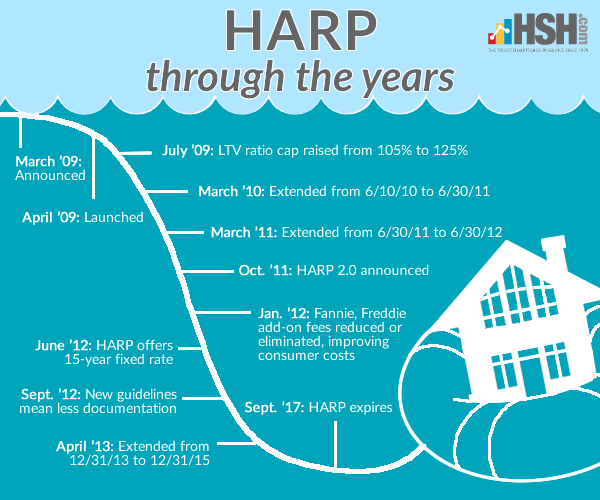

HARP Timeline

Since 2009, there have been many changes and updates to the HARP program. Here are some of the most important changes to HARP since the program began:

(Image: HSH.com)

Am I eligible for HARP 2.0 despite my recent bankruptcy?

According to Fannie Mae, they have removed the "requirement that the borrower (on the new loan) meet the standard waiting period and re-establishment of credit criteria in the Selling Guide following a bankruptcy or foreclosure. The requirement that the original loan must have met the bankruptcy and foreclosure policies in effect at the time the loan was originated is also being removed.”

This indicates that you should be eligible. Freddie Mac usually follows the same policies as Fannie Mae, but there may be some differences.

(Keith Gumbinger, Dan Green and Marcie Geffner contributed to this article.)

(Image: KHL49/iStock)

Related content:

How to refinance when you are self-employed

Refinancing? Use this document check list

Refinance calculator: The best way to finance your refinance

Can I refinance my condo. without taking out a loan. I am interested in a lower rate then 4.50 I owe 60,000 on my loan.

Can a Harp Loan be refinanced

I%u2019ve had a mortgage since 1999, however I refinanced my house in 2013 at a lower interest rate. Would the refinance be a disqualifier for the HARP program.

Can I buy a single family house on the Harp program if it cost less than $65,000

I have a Fannie Mae loan from 2007. I have never refinanced and my interest rate is 6.5%. My condo is worth about $115,000 and I owe $90,000 on the mortgage. I only have an income of $1,000 per month. Do I qualify for the HARP 2?? I was told my DTI would be too high and I would be denied. Is this true?

Fannie Mae's own guidelines note to lenders that "Fannie Mae’s quality assurance process will not... impose any maximum debt-to-income ratio or other underwriting criteria in connection with a Refi Plus (HARP) loan. Fannie's regulator, the FHFA also noted in their release regarding HARP's eventual replacement [Streamline Refinance] that "but as with HARP, eligible borrowers are not subject to a minimum credit score, there is no maximum debt-to-income ratio or maximum LTV, and an appraisal often will not be required.

Is it possible to get less than a 30 year mortgage under HARP?

Of course you can refinance using HARP into a shorter-term loan. While the greatest cash-flow improvements may come from a re-lengthening of the term to a new 30 years, FHFA encourages borrowers to swap to 15- or 20-year terms with lower risk-based fees than those available on terms of 30 years. A HARP refi into a less-than-30-year term offers faster equity building, considerable interest savings and lower rates and fees. It's hard to argue with that!

We refinanced our home in 2013 to take cash out for our towns' college and weddings. Our home is valued around $185,000 - $200,000 with a mortgage balance of $83,400. We have excellent credit and have never in 35 years of owning a home been late or missed a payment on anything.I've noticed they extended HARP through December 2018. My question is why can't we do the no-cost HARP refinance?

Simply put, your loan isn't eligible for HARP, as HARP is for loans owned or backed by Fannie Mae or Freddie Mac that were originated before May 31, 2009. As well, your loan would need to have an LTV above 80 percent, among other things. The good news is that you don't need HARP to do a no-cost refinance - almost any lender can do one for you by adding fees into the loan amount or with no fees and a slightly higher interest rate. That said, it's not clear if a refinance will bring you a better rate or terms than you already have; you'll need to run the numbers to see.

Does Puerto Rico qualify for HARP?

Yes, provided all the other conditions of HARP eligibility are met. According to HARP.gov, and as of September 2016, there were 9,812 homeowners eligible for HARP in Puerto Rico. If you meet the other criteria for the program you should contact your existing lender today to see if they participate. If not, shop around for one that does.

We were told that borrowers on a HARP refinance must be living in the home in order to be eligible... Is that true?

The HARP program is available for your primary residence, which means it must be owner-occupied. If you are not living in the home, it's not your primary residence, and so would be ineligible for a HARP refinance.

In my divorce agreement, I was awarded the family residence in 2010. However, my name is not on the title. So, I would like to know, how can I qualify for a HARP loan without my name being on the title?

Libby, I don't that;s possible. http://library.hsh.com/articles/homeowners-repeat-buyers/how-to-divorce-your-mortgage.html http://library.hsh.com/articles/homeowners-repeat-buyers/divorce-your-house-when-you-divorce-your-spouse.html Thanks for commenting, Tim, HSH

What if I am NOT underwater on my mortgage but just need to lower my high interest rate (currently 6.75%). Can I still get a HARP loan? Thank you.

Kaye, Do you have a Fannie or Freddie mortgage? If you're not underwater, you can shop around with any mortgage lender, you don't have to be confined to HARP which is a voluntary program. -Tim Manni, HSH.com

I'm concerned that my ex-spouse is trying to use the Harp refinance program to remove me from the title of a rental property that is still in both our names. My ex has it rented and makes the payments. Our divorce settlement states that I have no interest in the property except in the case that I have not been paid all the money due me per the settlement. The divorce settlement specifically states I maintain an interest in the rental property until paid in full. Can I prevent a harp refinance that will remove me from the title?

Can I use HARP if I am in a modification and I have bought the home in 2008 but refinance the home in 2012?

I am first time home buyer. Can I finance through HARP? Kathleen

Does receiving any type of government assistance automatically deny my application for a mortgage?

Dawn, That's a really good question. Without knowing what kind of assistance you receive or how much, it's hard to say. That said, no government assistance should trigger an automatic denial -- in fact, it could be the opposite since it's considered guaranteed income. Thanks for commenting, Tim Manni, HSH.com.

Call me. My husband called & talked to someone & he was supposed call us back. We lost the phone but have his name. He said we qualified.

Hi...i am not looking to refinance i am a first home buying..i am looking to get pre approved for an home loan. Thanks

So let's see...another government program to help those who took these loans full well knowing that they would not be able to pay the mortgage in two years. And the government full well knowing, did nothing to go after those lenders who were 100% guilty of making these loans, even after they were found guilty of fraudulent lending practices. They were bailed out. Just another way for big business, once again, to screw people. The new American Democratic way.

Some folk would rather keep their money rather than pay a higher interest rate....

Well, there is another side to this coin. The government, in all its splendor, legislated banks to decrease the criteria for taking out a mortgage on homes and, in some instances, rental property. What were mortgage companies to do?

Hi%u2026 This blog sounds great. Overall is excellent. I love this. But need to improve to explain in deep and listing the factors specifically. But still it%u2019s awesome and knowledgeable. Nice work. I am looking for this type of Blog. I want to refinance through HARP.I just want to know that i am eligible.

I have a HARP Loan and wanted to know if there are refinance options? My mortgage (financed under HARP) is higher then the value of the home. Are there agencies that can help or assist with these types of matters? Thanks for any that can advise.

Allan, Since you already did a HARP refinance you cannot do another HARP refinance. HARP was designed for underwater homeowners (mortgage is worth more than the home), so you are already receiving assistance. If you require additional assistance, I would reach out to your lender right away. Thanks for commenting, Tim Manni, HSH.com

i like this site

Hello, I've tried to apply for the HARP at least 6 times (twice before HARP 2.0) and I have been turned down every time. I don't really understand how a government backed or established program designed to provide assistance doesn't result in any relief for people that REALLY need it!! I'm approximately $25,000 underwater with a $2300 mortgage based on a 6.75% interest rate and I can't get any HELP!!! I've never missed a payment, I've never been late and I got my most current mortgage in 2007. I just believe that the banks are driven by greed and have no intention on letting me out of that 6.75% mortgage no matter what, so they come up with the most ridiculous reasons to turn me down. I don't think any real oversight of the process is really taking place...applications aren't even being submitted as evidence of need, so a case like mine never see's the light idea and ends up sitting a stack of other applications just like mine, somewhere in a backroom awaiting the shredder! I was turned down twice by Navy Federal Credit Union and they stated in one of their responses to me that their reason was because they weren't confident that I would have been able to come up with the closing costs. They followed by offering me a four-month forbearance so that I could place my account in a default status, resulting in a 99% chance at being approved for the HAMP. Upon calling to decline that offer, the representative suggested that I simply miss a payment because while it would damage my credit, it's the only way to gain some relief through approval, again under HAMP. I applied four times with Quicken Loans who advised the first three times that because I had three disputes on my credit reports, Freddie Mac would not approve my HARP request as they (Freddie Mac) are extremely strict in comparison to Fannie Mae. The fourth time, which happens to be this week, I was again denied. However, THIS time, although I was advised that the disputes had been removed and no longer an issue, my credit was now a problem. At the beginning of December, 2015 I was advised by Quicken Loans that I met the minimum credit score requirement of 620...around mid-December, 2015, Quicken Loans advised my mid-score was actually 632. Buttttttt, the concern then became whether or now a score of 640 would make for a stronger HARP application to Freddie Mac. A couple of days later, QL called me to say that they would prefer to submit me with a 640 and that their credit dept. would call me back with a strategy. On January 5th, 2016 they called me to advise that the only strategy would be for me to pay roughly $12,000 within the next 30 days based on a "simulation" and although they couldn't guarantee that would raise my mid-score up 8 points, they thought it "probably" would. I couldn't believe that they had the audacity to suggest that when it's clear that I'm struggling just to make my mortgage every month, which is WHY I'm begging for a HARP refi!!! What can I do, if anything, to get the HARP refi???

DeeJay, We're sorry to hear about your troubles. The first thing to remember is that HARP is a voluntary program for lenders, they are not forced to participate. And while HARP 2.0 does forgo an appraisal and employment history, credit does matter and here's why: If you want a significantly lower rate, say 4%, someone with a credit score between and 620 and 640 is looking at paying 3% in fees at closing to get that low rate. Perhaps that is why the lender was concerned about your ability to pay closing costs. While I know this information doesn't come at a tremendous relief, what I would suggest is submitting a complaint with the CFPB. They are likely to investigate your case. Thanks for commenting and good luck, Tim Manni, HSH.com

We r looking to refinance under the harp program we filed chapter 13 in 2011 pays off April 2016 never late never late on our mortgage payment. What lender can help me

Judy, Thanks for commenting. As long as your loan is guaranteed by either Fannie Mae or Freddie Mac, you can shop around with many lenders until you find the one for you. We unfortunately can't tell you which lender to choose. -Tim Manni, HSH.com

The government should have extended this program to non-federal loan guarantees as well.

My mother, Mildred McLendon(age:81), is in the process of a refi through Quiken Loans. 3.99apr What do you think about this company?

Keep sharing such informative article.

Thanks for the kind words!

I bought my house on my own in May 2005 (I life in Florida) it is a Freddie Mac loan. Since then I have gotten married and I wanted to do a HARP refinance with my husbands name and income included since I do not make enough to qualify at this time on my own, however my husband had a chapter 7 Bankruptcy that was discharged in March of 2013. Can we qualify? I have had one person tell me yes, and another tell me no we have to wait 48 months after his bankruptcy.

Wendy, According to our article above: "According to Fannie Mae, they have removed the "requirement that the borrower (on the new loan) meet the standard waiting period and re-establishment of credit criteria in the Selling Guide following a bankruptcy or foreclosure. The requirement that the original loan must have met the bankruptcy and foreclosure policies in effect at the time the loan was originated is also being removed. This indicates that you should be eligible. Freddie Mac usually follows the same policies as Fannie Mae, but there may be some differences." But also remember, lenders often "overlay" their own requirements and restrictions on top of what Fannie and Freddie require. That's why it's important to shop around, you're likely to get different answers from different lenders. Thanks for writing in, let us know if you have any additional questions, Tim Manni, HSH.com

I want to refinance through HARP.I just want to know that i am eligible.

Harbhajan, Thanks for writing in. You can review the qualifications we listed in the article above, or you can visit this page to determine your eligibility: http://www.harp.gov/Eligibility Thanks, Tim Manni (HSH.com)