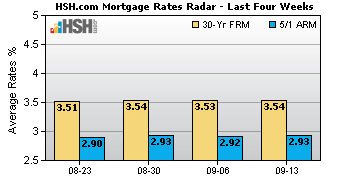

Rates on the most popular types of mortgages dropped a bit this week according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages fell by four basis points (0.04 percent) to 3.96 percent. Conforming 5/1 Hybrid ARM rates decreased by seven basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 2.98 percent.

At least some investors are pushing money into bonds

"Big declines in stock markets have helped trim mortgage rates a little," said Keith Gumbinger, vice president of HSH.com. "At least some investors are pushing money into bonds, driving down yields on U.S. Treasury bonds to levels last seen months ago, but that hasn't translated into much lower mortgage rates so far."

We may have to wait until the smoke clears

It has been a tumultuous week for stock markets around the globe, with major exchanges and averages falling hard and fast. At one point, the bellwether Dow Jones Industrial Index fell by more than 1,000 points, and subsequent recoveries have failed to hold. Such turmoil, both here and across the globe, has generally been good news for U.S. mortgage shoppers, but the effect at the moment is muted. What it means for Federal Reserve policy is yet unclear, and we may have to wait until the smoke clears to get a sense of what the Fed will do in light of newly restive markets.

It's a fair bet that the mortgage rates are at or very near bottoms right now

"If mortgage rates cannot break lower with all this going on, it's a fair bet that they are at or very near bottoms right now," adds Gumbinger. "That's not to say there might not still be some rate-lowering fallout just ahead, but it looks as though we are pretty firmly entrenched at these levels. If it starts to appear as though the Fed will hold off in September, which is not a certainty despite these market troubles, we would expect to see rates have perhaps a little more space to decline."

Average mortgage rates and points for conforming residential mortgages for the week ending August 25, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 3.96 percent

- Average Points: 0.14

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 2.98 percent

- Average Points: 0.09

Average mortgage rates and points for conforming residential mortgages for the previous week ending August 18 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.00 percent

- Average Points: 0.17

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.05 percent

- Average Points: 0.10

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com’s survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar’s inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.