The second article in Part II of HSH.com’s guide to reverse mortgages and home equity conversion mortgages (HECMs) provides essential information about loan limits that some borrowers may encounter.

Take-outs and set-asides may reduce available funds

Your home's condition and your fiscal situation can determine the amount of funds you have access to under your HECM or reverse mortgage. After establishing the maximum principal limit amount, an assessment (appraisal) is performed on your home to make sure it is in what HUD deems to be a livable condition. If not, there may be an up-front “set-aside” amount for repairs to get the property in good working order (if the appraiser deems them necessary), and there may be set-asides to cover the long-term costs of taxes, fees and required insurance.

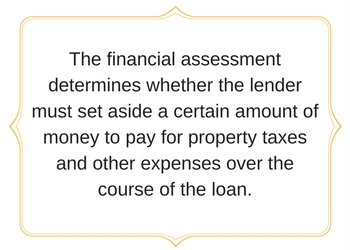

Borrower financial assessment

Once your home has been reviewed, and to determine whether or not you'll be required to have money set aside to cover future taxes, fees and required insurances (called a Life Expectancy Set-Aside, or LESA), the lender performs a financial assessment on you.

Step 1: Reverse mortgage repair considerations

Step 1: Reverse mortgage repair considerations

In order to be eligible for an HECM, your home must be in good, livable shape. If it's not, the property is required to be repaired. When these repairs must be made depends upon their total cost as a percentage of the amount for which you can you can qualify.

According to the Department of Housing and Urban Development, HUD, required repairs that are estimated to cost more than 15 percent of the maximum loan amount must be completed before closing. Repair costs totaling less than this can be completed after closing.

If the amount of repair needed to bring the home up to HUD standards is more than 30 percent of the total amount available, your HECM may not be approved. However, the Valuation Branch of the local HUD office can conduct an additional review of the property to determine if it is acceptable for the program.

Certainly, it's possible that you could pay for certain required repairs out-of-pocket to lower the remaining amount needed below the 30% threshold, then re-apply for the HECM, but whether you can afford this outlay of cash or not depends upon your cash on-hand.

In order to make sure that adequate funds to make repairs are reserved, the borrower must establish a repair set-aside at least equal to 150 percent of the cost of repairs, plus a repair administration fee. This is done at the loan closing.

The lender may charge a fee not to exceed the greater of 1.5 percent of the funds used for repairs or $50 for the administration of this repair agreement.

Once your home is squared away, the lender needs to see what kind of fiscal shape you’re in.

Step 2: Financial “set-asides”

The financial assessment determines whether the lender must set aside a certain amount of money to pay for property taxes and other expenses over the course of the loan. The "set aside" reduces the amount of loan proceeds available to the borrower. This is called the Life Expectancy Set-Aside (LESA).

To figure whether a set-aside is required, the lender subtracts property charges, debt obligations and other living expenses from the borrower's income and assets. The resulting "residual income" is the amount of money left over each month. This figure is compared to a government threshold amount (based on region and family size) that determines whether a borrower has enough monthly residual income to pass the assessment.

The lender runs this assessment to make sure that the borrower has sufficient residual income to be able to meet their financial obligations.

After the assessment, whether residual income is above or below the threshold determines whether or not the lender needs to account for a full or partial LESA.

Residual monthly reverse mortgage incomes by region

|

Family Size |

Northeast |

Midwest |

South |

West |

|

1 |

$540 |

$529 |

$529 |

$ 589 |

|

2 |

$906 |

$886 |

$886 |

$ 998 |

|

3 |

$946 |

$927 |

$927 |

$1,031 |

|

4 or more |

$1,066 |

$1,041 |

$1,041 |

$1,160 |

Regional definition includes these states:

Northeast CT, MA, ME, NH, NJ, NY, PA, RI, VT

Midwest IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, SD, WI

South AL, AR, DC, DE, FL, GA, KY, LA, MD, MS, NC, OK, PR, SC,TN, TX, VA, VI, WV

West AK, AZ, CA, CO, HI, ID, MT, NM, NV, OR, UT, WA, WY

If the borrower passes the financial assessment, he or she can proceed with getting an HECM.

What happens if I fail the financial assessment?

If the lender determines that the borrower does not have adequate cash flow, the borrower's loan application can be declined, or all (or most) of the available loan proceeds could be placed in a Life Expectancy Set-Aside (LESA) and used specifically to pay property taxes and homeowners insurance for as long as those funds last.

LESA amounts are calculated to cover certain property charges, including:

- Required property taxes (whether regular recurring or any special local or state assessments)

- Homeowner’s insurance premiums

- Flood insurance premiums

Because these costs tend to rise over time, a calculation is performed to estimate the amount to cover future payments; this is done by adding the HECM’s current interest rate plus 1.25 percent, then dividing this by 12, and multiplying it against the current month’s LESA dollar amount, according to HUD. In this way, the LESA is increased over the expected HECM term.

Although these funds are reserved for specific future use, you aren’t charged any interest on them until they are actually used to pay the tax or insurance costs. Interest is paid only when funds are used, not at the outset of the HECM.

Other charges, such as Homeowners Association (HOA) fees, Planned Unit Development (PUD) fees, condominium fees and more are the responsibility of the borrower and must be paid out of his or her own funds. Additional information is available in HUD’s Financial Assessment and Property Charge Guide, Section 5.4 and 5.5.

Lenders can use the model financial assessment form and refer to sections 5.4 and 5.9.

Wondering how your credit rating impacts a reverse mortgage? Read on for more information in Part 2 of this guide.

Next: Credit rating impact on HECM and reverse mortgage terms

Previous: Reverse mortgage borrowing limits

I need to see a chart for the "12 month average" of the annual yields on actively traded US Treasury Securities adjusted to a constant maturity of one year. How do I find it?

That's also known as the 12-MAT or MTA, and can be found in our ARM indexes section -- the link can be found at https://www.hsh.com/idxhst.html