The last cost-saving change to FHA mortgage insurance premiums came a couple of years ago, and there were no changes to the program for 2024. Unfortunately, that also looks to be the case for 2025. Lower costs or not, the FHA program can still confer some pretty solid advantages to potential homebuyers.

The last cost-saving change to FHA mortgage insurance premiums came a couple of years ago, and there were no changes to the program for 2024. Unfortunately, that also looks to be the case for 2025. Lower costs or not, the FHA program can still confer some pretty solid advantages to potential homebuyers.

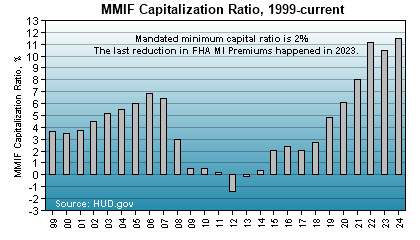

Rising home prices and pretty solid loan performance over time helped the capital strength of the FHA's Mutual Mortgage Insurance Fund (MMIF) to rise to record levels recently. FHA's self-insurance pool is mandated to have a minimum reserve of 2% against losses, and this percentage was up to 10.52% in the 2023 fiscal year. Already close to a record high, the MMIF actually improved on this during 2024, as the reserve ratio closed the 2024 fiscal year at 11.47%, far more than five times the required amount, and likely a record high.

Strong capital levels over the last couple of years led to increasing calls for the FHA to lower costs and 2025 is no different. While the last push was to lower recurring costs for homebuyers and homeowners, the most recent industry pressure is for the FHA to drop its life-of-loan mortgage insurance requirement for borrowers whose loans begin with less than a 10% down payment. Currently, borrowers must refinance out of the FHA program to be able to cancel their mortgage insurance, provided their loan's LTV ratio has fallen below 80%.

An insurance fund that is flush with cash be a good reason to pass some fresh savings onto homebuyers or homeowners. However, since the most recent cut to annual MIP costs was just two years ago, there's little chance that another MIP cut will come anytime soon. As well, since most borrowers finance the upfront mortgage insurance premium (UFMIP) into their loan, there's little upfront savings from reducing this component, either. This leaves a change to allow cancellation of MIP a possibility to help lower the cost of homeownership, but this probably doesn't produce a huge or immediate benefit for homeowners.

Lower costs and better access to credit may see some borrowers more likely to consider an FHA-backed loan. With housing market still sluggish for a range of reasons, it's somewhat more likely that access to FHA funding will improve a bit more this year, as lenders are eager to find borrowers to serve. To do so, it's reasonable to think that at the process of reducing or removing so-called "overlays" will continue. Most commonly, this is a situation where a lender requires a higher credit score than the minimums that the FHA allows. Since some lenders will remain stricter than others, borrowers with less-than-stellar credit should shop around to find these more aggressive lenders.

Lower costs and better access to credit may see some borrowers more likely to consider an FHA-backed loan. With housing market still sluggish for a range of reasons, it's somewhat more likely that access to FHA funding will improve a bit more this year, as lenders are eager to find borrowers to serve. To do so, it's reasonable to think that at the process of reducing or removing so-called "overlays" will continue. Most commonly, this is a situation where a lender requires a higher credit score than the minimums that the FHA allows. Since some lenders will remain stricter than others, borrowers with less-than-stellar credit should shop around to find these more aggressive lenders.

While the recently lowered recurring mortgage insurance premiums make an FHA loan more attractive, FHA loans offer other valuable features, too. Add lower down payment and credit-score requirements into the mix, then factor in that the FHA doesn't use risk-based pricing to set rates -- so borrowers aren't penalized for having weaker credit scores -- and FHA mortgages can be a more accessible financing option for many borrowers. As an added bonus, these federally-insured FHA loans are assumable, so if mortgage rates should rise from here and hold there for a time, the lower-rate FHA mortgage can be passed along to the next homeowner when it comes time to sell.

With housing markets more sluggish in 2024 and into 2025, home sellers may be somewhat more accepting of borrowers using FHA-backed loans to buy homes. FHA-backed loans carry more stringent contingencies than do conforming loans, and can require more effort on the part of the home seller to complete the transaction. When it's a full-blown sellers market, as it has been in recent year, some sellers are unwilling to consider offers that require FHA approval.

Carla Blair-Gamblian, a home loan consultant for Veterans United Home Loans in Columbia, Missouri, says that FHA loans will always have a place in the market whether their costs should rise or fall.

"Not everyone can qualify for a conventional loan, so comparing [conforming loans] to FHA loans across the board may not yield the best picture of what loan product is best," she says.

Here are the advantages of FHA mortgages in 2025:

Lower credit score and down payment requirements

The FHA requirements for credit score and down payments are far lower than for conventional loans. Borrowers can technically qualify for an FHA loan with credit scores of at least 580 and a down payment of just 3.5 percent, according to HUD. Borrowers with a 10% down payment may be eligible with a FICO score as low as 500.

”While an FHA-backed mortgage with FICO 580 is theoretically available to borrowers with a down payment as small as 3.5% (and FICO 500 with a 10% down payment), many lenders add 'overlays' on these minimum requirements,” says Keith Gumbinger, vice president of HSH.com. “Loans with the lowest credit scores tend to default at a much higher rate, and lenders are afraid that if they issue too many loans that later fail, HUD will no longer allow them to write FHA-backed mortgages.”

Chris Fox, Executive Vice President of Amerant Mortgage in St. Louis, says that borrowers must have credit scores of at least 620 or 640 to qualify for most conventional loans. Fox also says, though, that this is a bit of a misleading benefit. He says that not many lenders will approve any loan, conforming or FHA, for borrowers with credit scores under 620.

Related: The evolution of FHA mortgage rates

FHA mortgage rates

FHA mortgage rates are typically lower than mortgage rates on conforming loans. FHA Borrowers with credit scores of 660 will often qualify for the same interest rate as would conventional borrowers with a score of 740, says Blair-Gamblian.

One important difference between conforming and FHA mortgages is that unlike conventional mortgages, FHA does not use a risk-based pricing arrangement. This means that borrowers who don't have the best credit aren't penalized with a higher interest rate, and that can be a strong reason to consider an FHA-backed loan, even if there can be drawbacks on the mortgage insurance side, discussed below.

Related: Learn about FHA borrower requirements

Closing costs

FHA loans allow sellers to pay up to 6 percent of the loan amount to cover buyers' closing costs, says Tim Pascarella, president of Ross Mortgage Corporation in Troy, Michigan. In conventional loans, sellers can only pay up to 3 percent.

"For a lot of homebuyers, that's a big benefit," says Pascarella. "A lot of buyers, especially first-time buyers, can save enough money for a down payment, but then they have nothing else. An FHA loan allows sellers to contribute more to closing costs."

FHA loans are assumable

FHA borrowers have yet another advantage over conventional borrowers: FHA loans are assumable. When it comes time to sell, buyers can take over sellers' existing FHA loans instead of taking out new mortgages at whatever the current mortgage rate is at the time. This is especially advantageous in a rising-rate environment.

"In an environment of rising interest rates, [an assumable loan] can give sellers an advantage over their neighbors," says Dan Green, a licensed mortgage officer and CEO of Homebuyer.com.

Assuming an FHA loan isn't always simple, though. While buyers will have to meet all the typical mortgage requirements, they may need a much larger down payment depending on the seller's equity.

For example, if a home is sold for $200,000 and the buyer wishes to assume a remaining $160,000 FHA loan on the property, the buyer must come up with $40,000 in cash to reach the selling price. A borrower's making a required 3.5% down payment ($7,000) still leaves a $33,000 gap to fill. If one is available, the buyer might have to take out a second loan to come up with that amount, which may or may not negate the benefit of the lower interest rate on the loan they are assuming.

Despite numerous advantages, there are also downsides to FHA mortgages in 2025.

Related: Learn all about FHA ARMs

FHA allows "Streamlined Refinances"

Unlike most of the conventional and conforming mortgage markets, the FHA program allows a borrower to do a true streamlined refinance. For a 30-year fixed-rate loan, this means only needing to reduce your "combined" interest rate (the loan's contract rate plus MIP premium rate) by 0.5%. but there may be no credit check, no appraisal of the property and no income or employment verification required. This could allow you to save money if mortgage rates should fall, and there is no limit on the number of times you can use this benefit, provided it produces what HUD calls a "net tangible benefit" to you.

Unlike the assumability feature, this advantage has the greatest benefit when mortgage rates are high and likely to decline over time, which are today's market conditions.

FHA mortgage insurance premiums

The biggest downside of FHA loans has long been the costs associated with upfront and annual mortgage insurance premiums. The 2023 change to MIP costs has helped improve that a bit, at least as far as recurring costs go.

The upfront mortgage insurance premium is 1.75 percent of the loan amount. That's $5,250 on a $300,000 mortgage loan. Although you can pay it out-of-pocket, this cost is usually added to the principal balance of your loan. So your loan amount is actually $305,250.

Then, there are annual mortgage insurance premiums to consider. Unlike Private Mortgage Insurance (PMI), which has a range of costs depending on the borrower's credit score and down payment, FHA Mortgage Insurance Premiums (MIP) go by down payment only. Borrowers with less than a 5% down payment are charged 0.55% of the outstanding loan amount each year, while borrowers with more than a 5% down payment are charged 0.50% per year for loans with terms greater than 20 years. For a borrower with a $300,000 loan and just a minimum 3.5% down payment, this means an MIP of over $130 per month. With the 2023 change that's actually now a few dollars per month less than a similar conventional loan for a borrower with great credit.

Annual MIP rates are lower for borrowers who are taking out 15-year FHA-backed mortgage loans. Borrowers putting less than a 10% down payment are charged 0.40% of the loan amount each year, and those with more than a 10% down payment are charged 0.15% of the loan amount each year.

In both cases, FHA MIP are much higher for borrowers who look to take out "jumbo" FHA-backed mortgages in high-cost markets.

If you're looking to make only a minimum downpayment when purchasing or refinancing, it's important to know how the intersection of costs due to mortgage insurance and interest-rate differentials will affect you. Use HSH's FHA Calculator and low downpayment mortgage comparator to see FHA loan costs over your anticipated time frame, and to compare them against conventional low-downpayment products.

FHA mortgage insurance for the life of the loan

With conventional mortgage loans, borrowers don’t have to pay for private mortgage insurance if they come up with a 20 percent down payment. Conventional borrowers can even request that private mortgage insurance be dropped once their mortgage balance falls to 80 percent of the value of their home. Quickly-rising home prices in recent years means that many folks who made small down payments with conventional loans have been able to cancel PMI policies, saving them money every month.

That's not the case with FHA loans, and perhaps the biggest drawback to taking one.

With FHA loans, borrowers who closed their loans after June 3, 2013 and who made less than a 10% down payment must make mortgage insurance payments every month for the life of the loan, no matter how much equity they accrue over time. Borrowers who put 10% down or more must make MIP payments for the first 11 years of the loan before the insurance can terminate. Unfortunately, at least through the last fiscal year (2024) there are still no public plans to change MIP cancellation policies.

"The only negative of an FHA loan is its cost," says Pascarella. But if a solid credit score and down payment are a stretch for you, an FHA loan might be your only option.

This article was updated by Keith Gumbinger.

(Image: Karen Roach/iStock)

More from HSH.com:

Thankful for sharing this useful post!

Yo got my attention when you said that you can qualify for an FHA loan with a down payment for as low as 3.5 percent. I'm sure that my mother is going to be glad to know what you said because she's planning to buy a house. Her savings are not enough to cover 20% down payment for a house, so I'll share your blog with her.

It sure was nice to know that FHA loans require lower down payments compared to conventional loans which means that you can pay for a down payment of just 3.5%. This is something that I will make sure to share with my father because he's interested in buying a house. He said that he couldn't afford a too high downpayment for a house since he has other bills that he needs to pay monthly, so I'll share your blog with him.

Thanks for going over the lower credit requirements of FHA loans. I need to get one of these loans, and my credit score is probably not what it needs to be. I'll work on that so I can get a loan sooner for my needs. Thanks!

This article's first point is now moot... Sorry.

We think there's a good chance that the suspension of the MI premium reduction will be lifted at some point and lower costs will again kick in. We've re-updated the article to reflect the reversal. - HSH

Can I get an fha loan if I buy a home from a family member?

Sandy, Thanks for commenting. If you plan on taking out a mortgage loan and not through one of your family member, than yes, you can apply for an FHA loan. Thanks, Tim Manni, HSH.com

If I have a FHA loan and I paid 20% down payment, do I have to pay PMI?

Why would you take out an FHA loan if you have 20% to put down.. typically the down payment is the issue. I'm confused ...perhaps I'm missing something but why wouldn't you go to a credit union (which typically doesn't have the fees regular lenders have - well my credit union doesnt)if you have the down payment of 20%

I like how there are still options for people who don't have the greatest credit score who want to buy a house. I think it is really interesting that you could get the same interest rate as someone with a better credit score. I think it also really neat that if you decide to sell that house you can just transfer the loan to the new buyer.

You won't get the same interest rate as someone with a better score.. the upside to an FHA loan to someone who does have a really good score is that THEIR interest rate will be very comparable to that of a conventional loan, but if your score is low you won't get the same interest rate - down payment is usually the thing that prevents people from getting a conventional loan

Sorry I came late to the article. I have a credit score of 693 and looking at at least 20% down, maybe more for a mortgage no more than $85000 as I know my budget limits. I could get approved for. Should I go for a FHA loan or try for a conventional first. I don't want to have to pay out PMI insurance which is why I will put down at least 20% because I don't want a mortgage over $450 a month.

End your financial worries now: I can smile that God-fearing man, who had secured $ 76,000 Usd and two of my colleagues have also received loans from this man, without any difficulty. I advise you not to choose the wrong person, you will definitely apply for a cash loan for your project and each other. I wrote this post, because Mr. Favour Henry, made me feel blessed their loans. It's through a friend that I met this honest and generous God fearing man who helped me get this fund to pay for the loan of your life, you need financial help, you're stuck, do not have access to bank credit, or not in favor of the bank to finance your construction, real estate development, the development of your business your own business, you must have seen and earn money, bad credit or need money to pay bills or debts. Therefore, we recommend that you go there, please contact and meet with you for the services you ask for it. Contact address: [email protected]

This article http://www.fhahandbook.com/blog/do-fha-loans-require-pmi/ and this http://themortgagereports.com/14691/fha-mip-mortgage-insurance-premiums-mortgage-rates basically says "Annual MIP Required for the Life of the Loan, in Some Cases." Shouldn't that be mentioned in your article?

Ms, That fact is mentioned in our article. In fact, there is an entire section titled "FHA mortgage insurance for the life of the loan". -Tim Manni, HSH.com

It's really nice to hear that, "The FHA requirements for credit score and down payments are far lower than for conventional loans." My wife and I have only been married just of a year and a half. We are really wanting to find an get into our first home. It sounds like an FHA loan is worth looking into. We are relatively young to be married and are still trying to build a credit score. Thank you for sharing this information, it was really helpful.

Logan, We're so glad you found this info useful. Please reach out if you need more info. Thanks, Tim Manni, HSH.com

Hello, I have a credit score of 610, 620 and 664 according to FICO.com I own a home free and clear, no mortgage, in Lutz Fl 33548... which has approx value of $215-$230 k. I am looking to borrow $50k to pay off car loan of $14k as well as some credit cards $5k ..and cash in the bank for emergencies and home improvements. I do NOT want to run credit unless you feel there is a program that might help me. I am trying to improve my credit score and every month it is going up a little. By consolidating my debt%u2026.It will put me in a better financial situation as well as help me repair my credit. Regards, Ann Gray

Ann, Thanks for writing in. You're right, you should continue to improve your credit score. You need to contact a mortgage lender (we are not mortgage lenders) to see what assistance is available to you. If you can get your score up you should research a home equity loan or a home equity line of credit. Thanks, Tim Manni, HSH.com