Homeowners: How do mineral rights and fracking affect you?

If you own property in a place where oil and gas might lie below, you could soon find a "landman" at your door with a lease.

Read it carefully.

A landman represents an energy company that wants to drill as deep as a mile underground, although there'll be plenty of equipment above ground, too. And while the lease may not mention "hydraulic fracturing," it's likely to refer to "methods and techniques … not restricted to current technology."

As a homeowner, the lure is twofold. First, you could earn an upfront signing bonus that could be worth $10,000 an acre. Then, if the driller discovers natural gas or oil, you could receive royalties of up to 20 percent as long as wells keep flowing.

There's also a carrot for your community: more construction jobs, at least temporarily, and a local economic boom if the wells strike oil or gas. And there's an even bigger one for America, so big, in fact, that President Obama endorses hydraulic fracturing, or "fracking," to provide cleaner fuel and "energy independence."

But homeowners should weigh the promise against the peril, because the peril falls directly on you. Hydraulic fracturing on your property or in your neighborhood could affect your mortgage, your property values and your home insurance.

Fracking opens natural gas

In the U.S., the easily found energy has already been tapped. Recent demands from emerging nations sent prices soaring, and oil that was less than $15 a barrel 20 years ago - before fracking - is now priced at nearly $100 a barrel. While natural gas prices have declined due to greater supply because of fracking - a good thing for consumers (see map) - experts say it is still profitable for energy companies.

"If the price of oil and gas were at their historic lows, we probably wouldn't be having this conversation," says Austin, Texas, attorney John Fleming.

How natural gas prices have decreased since 2008

--state_map--

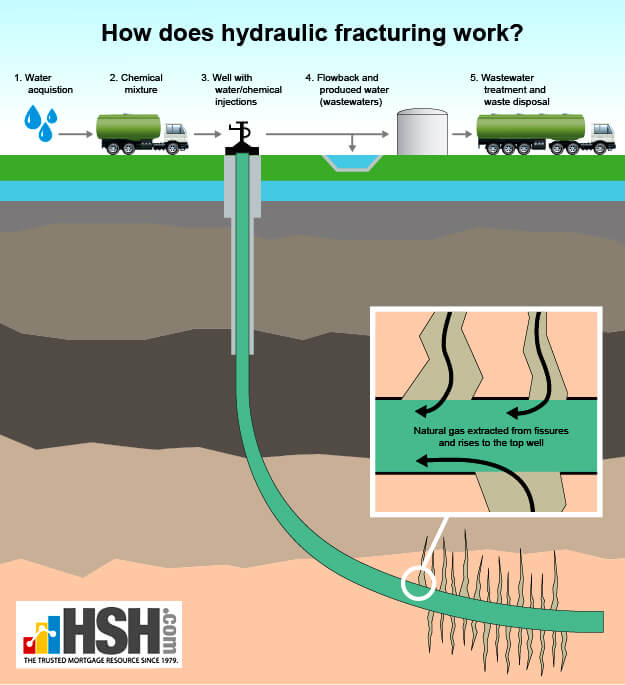

Hydraulic fracturing combines two procedures working in tandem: horizontal drilling and pumping in large amounts of water. A drill bores into the earth, usually between 2,000 feet and a mile, then drills out horizontally in all directions, like an underground spider web.

Next, millions of gallons of water are pumped in under high pressure. The water "fracks," that is breaks open, the microscopic pores of clay that surrounds much of the oil and natural gas still underground, and allows it to escape up the well.

But the process is not without risk.

Hydraulic fracturing has the potential to pump out radioactivity, contaminate groundwater, crack home foundations and cause air pollution. Critics say this potential damage is open-ended and could continue forever.

Effect of fracking on environment

A traditional well might use 100,000 gallons of water. A "frack" well could use 10 million gallons, says Cornell University engineering professor Anthony Ingraffea. And, in addition to water, there are sand and toxic chemical additives like ethylene glycol (antifreeze) used to keep the oil and gas flowing once it escapes from its shell, according to a former Ashland Oil chemist who has worked with frackers who spoke on the condition he would not be named. (The exact mixture a drilling company uses is considered a trade secret.)

In addition to what is put in, there's also what is brought up. Besides the oil and gas, the water, or "flowback," may bring up radon, methane and other substances.

Fracking supporters caution that the risks shouldn't be blown out of proportion because the water content is so large relative to the chemicals.

"I would not hesitate to consume a spoonful [of most of them] in a glass of water," says the former Ashland Oil chemist. Coal, which is burned for power in the U.S. and many parts of the world, not only causes more air pollution than natural gas, but also puts more radioactivity into the atmosphere.

The water used must eventually be trucked away and disposed of. The oil and gas, however, require miles of pipeline to reach their destination, which can create another opportunity for pollution.

The litany of possible risks also includes ground fractures that could lead to minor earthquakes, foundation cracks and contamination of groundwater. Theoretically the deeper the drilling, the fewer the problems, which is why states like New York have a 2,000-feet minimum limit for fracking.

Rewards greater than risks?

Many argue that the rewards far outweigh the risks, including academics like Terry Engelder, professor of geosciences at Penn State University. He describes fracked oil and gas as "an environmental gift waiting to be unwrapped."

Clean natural gas will cut the carbon dioxide emissions that are currently creating global warming, he claims in presentations, and, more importantly, provide the "bridge fuel" that will take this country into the age of wind and solar power. As for pollution, he says the word "'toxic' is overused."

Engelder admits that opponents call him the "Dr. Strangelove" of the fracking debate. But his arguments resonate with President Obama, who says the new energy boom can create more than 600,000 jobs by the end of this decade and turn the U.S. into "the Saudi Arabia of natural gas."

Real estate and fracking

So it's not surprising that the war over fracking is being waged everywhere.

Ohio has a "frackgate" scandal where lawmakers are accusing Gov. John Kasich of creating an "enemies list" of legislators and environmental groups who oppose his plan to frack in state parks.

In North Carolina, singer-songwriter James Taylor has a television ad opposing fracking. And the American Petroleum Institute (API), the heavily funded trade association that represents both the oil and natural gas industry, has hired former beauty queen and soap opera star Brooke Alexander to appear in a barrage of "Energy Tomorrow" commercials.

But for all the heat, there's surprisingly little illumination - especially from those who should provide guidance for the real estate industry.

- Despite spending millions of dollars on ads, the API did not respond to repeated requests to explain its position on fracking.

- The National Association of Realtors (NAR) is in the neutral corner. "Fracking and mineral rights are two issues that are still new to NAR and we have not fully researched their impact on home values or sales at this time," says spokeswoman Jenny Werwa.

- Also sitting this one out is the National Association of Home Builders, whose spokesman Paul Lopez says, "We do not have a position on fracking."

- And bankers providing mortgages for properties that face fracking won't get guidance from the American Bankers Association. "We have no position on fracking, no guidance and there's been no policy debate," says Executive Vice President Bob Davis, who did say that it was essentially a "local issue, and banks respond to their local communities."

Location, location, location

According to FracTracker, a resource for oil and gas issues, fracking is being done in at least 21 states, ranging from upstate New York to Montana and from Virginia to California. One in 20 Americans now lives within a mile of a fracking operation, according to The Wall Street Journal.

While fracking is under attack in upstate New York, where major loan companies refused to refinance properties encumbered by gas leases, it is welcome in Texas, with its long history of oil and gas drilling.

"Fracking has no more effect here than vertical drilling," says Realtor Keith Hackfeld, owner of Hackfeld Realty, which sells properties in the Midland-Odessa, Texas, area. "I've never run across any questions about financing." In fact, he says, fracking is "going on up the road from my parents' house."

Austin attorney John Fleming, who is also general counsel of the Mortgage Bankers Association, says fracking "does not impact local real estate values differently than a conventional operation." However, Fleming is concerned about the effect of fracking's heavy water usage on Texas's fragile water supply.

What you must know before you sign

Regardless of your area's attitude toward fracking, you are responsible for your home. If your mortgage is guaranteed by a federal guarantor - Fannie Mae, Freddie Mac, FHA - you should be aware that they have regulations that may affect your mortgage. These include:

- Transferring mineral rights on your property without the written consent of your lender

- Storage, use, disposal, discharge or release of environmentally hazardous material, specifically gas, on your property

- An active well or planned drilling within 300 feet of an existing property

The "Hazardous Substances" section of your mortgage details the lender's position on the presence and disposal of hazardous materials that may affect the value of the property, so you should review your mortgage agreement to see your liability.

Can you insure your property?

The key to owning real estate in any market is being able to insure your home or property, since without it banks will not provide a mortgage.

Insurers are becoming more cautious about fracking as it becomes more widespread. Spokesman Brad Hilliard of State Farm, the nation's largest home insurer, says his company asks clients in advance about business activities on properties it insures, and requires additional information if hydraulic fracturing is involved. "Damage from earth movement, including earthquakes, whether caused by fracking or something else, is an excluded loss under State Farm's basic homeowner's policy," he says.

Nationwide Insurance garnered national publicity when it said it would refuse to cover risks associated with fracking. But Robert Hartwig, president of the Insurance Information Institute (III), which represents property insurers, says that's the position of the whole industry. Water pollution and other perils associated with fracking simply aren't in the policy.

"If there is a problem," says Hartwig, "get a good attorney and sue the driller."

Are the mineral rights yours to sell?

Critics and supporters agree that state rules on fracking vary and there's no national standard. The federal government generally has a hands-off policy. The sole exception is a tentative move by the U.S. Department of Agriculture to require an environmental review prior to issuing mortgages under its Rural Housing Service program to those who have leased their land to drillers.

Another legal wrinkle: The developer may have kept or sold your mineral rights: For example, homeowners in Naples, Fla., found out that the mineral rights under their property were already sold. "Homebuilders and developers have been increasingly - and quietly - hanging onto the mineral rights," according to a Reuters report, even in urban areas.

A title search should reveal whether the buyer also owns the underground rights, but it would have to go back 100 years, warns real estate attorney Elizabeth Radow of Radow Law in Larchmont, N.Y. One couple found a driller outside their window because of a lease signed in 1918.

The decision ultimately may not be yours

The lack of any definitive answers about fracking leaves it up to local homeowners, farmers and ranchers to gather information and come to their own conclusions about whether to sign a lease.

But it's not always their decision. Frackers and their landmen generally try to obtain a square mile - 640 acres - to drill. A "compulsory integration" or "forced pooling" law, common in many states like New York, allows the majority owner sof this tract to determine if they want fracking. For example, if one person owned 60 percent of the acreage and 35 others owned the rest, that single vote would decide.

And just because an energy company bought all the mineral rights in a certain area doesn't mean that a monthly check is around the corner.

Rules vetted by the U.S. Securities and Exchange Commission allow energy companies to book their reserves based on properties they lease, so there's an advantage to gobbling up as much property as possible with the expectation that it may some day be drilled, says Radow.

Estimating underground reserves is guesswork. What is certain is that energy companies will probe the earth all across this country where oil and gas have previously been found, such as Pennsylvania, where Edwin Drake drilled the first oil well more than 150 years ago.

Royalties start when the oil and gas come out, but Geology.com warns that while gas may flow at a very high rate for the first few months, "you can bet the whole check that production … is going to drop rapidly." In Pennsylvania, a number of landowners who leased their property to Chesapeake Energy are suing the gas driller over declining royalty payments.

Before you lease your property…

The advice from Hartwig of III - "get a good attorney" -- should be heeded before the lease is signed, not after.

A study of a lease signed with Chesapeake Appalachia LLC, a subsidiary of Chesapeake Energy, shows just how airtight it is, granting open-ended rights to the driller in terms of new technologies and access to the property. Disputes between the landowner and driller must be resolved by arbitration rather than through the courts.

Real estate attorney Radow says most leases give the driller the right to transfer or flip its interest to another company, so any relationship with the original driller would end.

Another contract feature is the right to retain the lease, year after year, as long as the driller shows "progress," which could mean something as little as parking a truck on the property.

For homeowners, the issue of hydraulic fracturing is certainly complex. While the prospect of a new income stream may be alluring, the downsides could be calamitous for a homeowner. If you live in an area where there is the possibility of hydraulic fracturing, be sure to check with your lender, your insurer and an attorney before you give up your mineral rights or sign a lease.