If you’re a parent and your adult child is still living at home, you are far from alone. Despite historically low mortgage rates, many young adults just don’t have the financial ability these days to purchase their own home.

Young adults' financial concerns is a contributing factor to lower buyer demand for for-sale homes, according to a new commentary from Fannie Mae's Economic and Strategic Research Group.

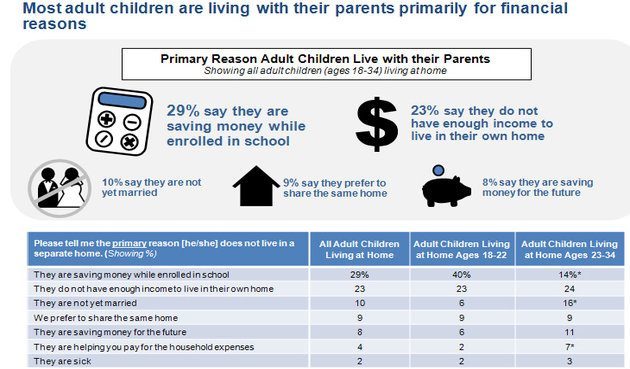

In the commentary, Stephanie Postles, a strategic planning analyst at Fannie Mae, wrote that financial reasons "are the primary response given by parents for why their adult children are not living in a separate home."

Why kids aren’t moving out

Parents said their younger adult children, defined as those aged 18 to 22, were living at home because they were saving money while they were enrolled in school. The vast majority were also unemployed or employed only part-time, another factor that limited their ability to move out into their own homes.

Parents said older adult children, defined as those aged 23 to 34, were living at home to save money while they furthered their education. Other factors for this older age group included inadequate income to move out and being unmarried.

The trend raises questions and concerns about household formation, an important factor in buyer demand for for-sale housing, whether new or resale.

(Image courtesy of Fannie Mae)

More living with parents

According to Postles, an average of 27 percent of 18-to-34-year-old adults lived with their parents between 1990 and 2006. In 2013, 31 percent of that age group still lived at home, a significant increase to a total of about 22 million young Americans.

Young adults, and particularly those in their early 30s, historically comprised a substantial proportion first-time homebuyers. The fact that these young people have delayed their decision to start a new household, regardless of the reason, contributes to lower demand for ownership and rental housing.

The importance of young, first-time buyers

Will this trend continue?

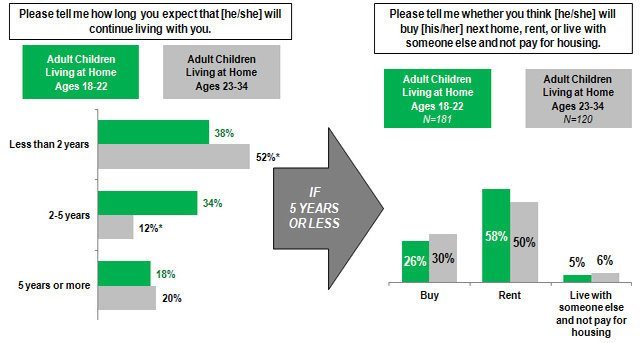

Postles' commentary suggested the trend toward slower household formation among young adults might not continue since it appeared to be driven by economic factors.

"Given that financial reasons account for the vast majority of parents' responses for why their young adult children are living with them," Postles wrote, "it seems likely that these young adult children, especially older young adults, will start to form their own households once they feel confident about their financial situation and future prospects."

(Image courtesy of Fannie Mae)

Related: Stop Living With Parents and Buy a Home