Living with parents as an adult used to be a source of shame. Now it's commonplace. But don't be complacent. Many reading this article could be buying a home within months. It may take others a bit longer. But you may be surprised by how easily you can overcome the barriers that are keeping you in mom's basement. Keep reading for some serious myth busting.

Living with parents as an adult used to be a source of shame. Now it's commonplace. But don't be complacent. Many reading this article could be buying a home within months. It may take others a bit longer. But you may be surprised by how easily you can overcome the barriers that are keeping you in mom's basement. Keep reading for some serious myth busting.

Big changes

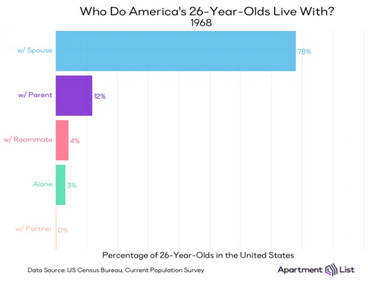

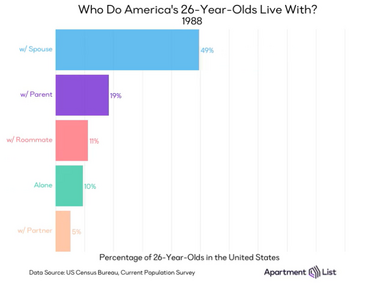

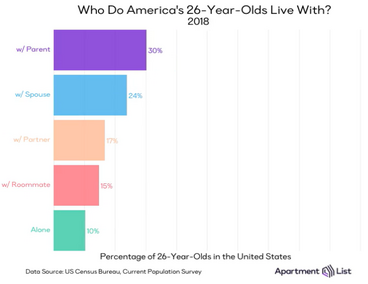

In 1970, 78% of 26-year-old Americans lived with their spouses while 12% lived with parents. By 2018, only 24% were living with a spouse while 30% were living with their parents. In fact, living with parents was the single most popular "choice" for 26-year-olds.

Those numbers were based on US Census Bureau data. And they were compiled by Apartment List, which also put together these great illustrations:

Labeling those living with parents in adulthood as sad losers was always lazy stereotyping. Today, it's simply wrong.

What's stopping you?

In 2018, Apartment List published a different study. A poll for this one found nine out of 10 millennial renters wanted to become homeowners.

But 72% said affordability was stopping them from buying a home. And 62% cited a lack of down payment savings as their big barrier. Meanwhile, other obstacles include poor credit and too much existing debt, including student loans.

But guess what. Those hurdles probably aren't as high as you think.

Related: FHA Home Loan Requirements

Down payment help is at hand

That study said:

We analyze millennial saving rates to estimate that two-thirds of millennial renters would require at least two decades to save enough for a 20 percent down payment on a median-priced condo in their market. Just 11 percent would be able to amass a 20 percent down payment within the next five years.

Er ... OK. But why on Earth would any first-time homebuyer want a 20% down payment? Yes, putting down that much comes with advantages -- most importantly, you avoid paying mortgage insurance. But those benefits are rarely enough to make hanging around for 20 years -- or even five years -- worthwhile. Heck, in some local housing markets, waiting months is costly.

Do you know that there are roughly 2,500 down payment assistance (DPA) programs across the US? These actively want to lend you the funds you need to get your down payment together. Some even give you the money as a gift. And even help with closing costs, too. Best of all, mortgage lenders are cool with these programs.

Related: Guide to Down Payment Assistance in All 50 States

Down payments of 0%, 3% or 3.5%

Even if you can't find a DPA program able to give or lend you thousands (and your family can't or won't help out with a cash gift), you still don't need anything close to a 20% down payment. Two government-backed programs let you put down nothing:

- VA loans -- from the US Department of Veterans Affairs, and exclusively for veterans, servicemembers and others who are eligible

- USDA loans -- from the US Department of Agriculture for those buying in rural and suburban locations. (Half of all US citizens live in areas that qualify -- you don't need to be in the boonies to be eligible.) You'll need a low or moderate income for your area. But you don't need to be engaged in agriculture in any way

Meanwhile, mortgages that meet Fannie Mae and Freddie Mac standards can be had with as little as 3% down.

If your credit score's not so hot, check out mortgages backed by the Federal Housing Administration (FHA loans). Those require a minimum down payment of 3.5% and are easier to qualify for. And even that down payment can come from assistance programs, employers, family or friends.

Related: What Must You Earn to Buy a Home in the 50 Biggest Metros

Take time to boost your credit score

In theory, if you want an FHA loan with the minimum down payment, your credit score can be as low as 580. However, in reality, you're likely to find it easier to get your application approved if yours is 620 or higher.

But don't be satisfied with those low numbers. Because it's close to an iron rule that the mortgage deal you're offered is going to be better the higher your credit score is, all other things being equal. So it's worth making some sacrifices and expending some effort to boost yours as far as you can.

Related: How Rapid Rescoring Can Quickly Repair Your Credit Score

How to boost your credit score

It's not hard to improve yours by following three simple rules:

- Pay all your bills on time -- every time

- Don't let any of your card balances rise above 30% of that card's credit limit

- Don't open or close new accounts (new cards, loans ... anything that makes it onto your credit report) in the months leading up to your making an important loan application

Don't lose heart if your score's currently low. Paying bills on time and gradually paying down the balances on your plastic to that magic 30% should see your score improve noticeably in months rather than years. In fact, those with low scores often see more dramatic improvements more quickly than those with high ones.

Related: 8 ways to increase your credit score to get the lowest mortgage rates

Manage your borrowing

The other obstacle that often trips up first-time homebuyers is existing debt. Lenders want to make sure you can comfortably afford your new mortgage. And, if you're already paying out a big chunk of your income on credit cards and loan payments (student, auto, personal ...) that can be an issue.

In the mortgage industry, this is called your debt-to-income ratio or DTI. And you're unlikely to get approved for a mortgage if your new homeownership costs plus your existing debt payments eat up more than 50% of your monthly income. Many lenders prefer a slightly lower percentage.

What are homeownership costs? They're your monthly mortgage payment, homeowners insurance premiums, property taxes and sometimes homeowners association (HOA) or condo fees. And how are your debt payments calculated? They're your credit cards' minimum payments, plus your actual outgoings on installment loans. You have to add in alimony and child support payments, if those apply.

Related: Buying a Home When Your Debts Are High

Debt reduction

If your debts have spiraled out of control, it may take you a long time to get them back in line. But you know you're going to have to bite the bullet sometime. And the carrot of homeownership may be more effective an incentive than the stick of high interest charges.

If things are really bad, you could talk to a debt counselor. But be wary of sharks. The Federal Trade Commission has a helpful article about your options on its website.

Stop living in your parents' basement

If you have zero savings, a terrible credit score and unmanageable debts, you may be living with parents for a year or years to come. See that as an incentive to get your life back on track. One additional question you might explore while you're still living at home is whether you might buy your parents' home. This could be a path to homeownership that can work for both you and your parents.

But if you have a bit put aside, a respectable credit score and moderate debts, your route to buying a home could be a quick and easy one. Some who read this are going to find a down payment assistance program that's willing to help. And they're going to be visiting their first open houses within a week or two.

Could that be you?

Related: Why are my adult children still living at home?