Mortgage Rates Radar 08/11/2015: Mortgage Rates In Holding Pattern

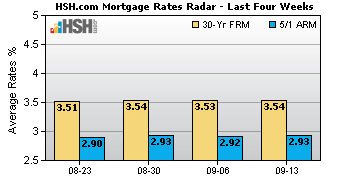

Rates on the most popular types of mortgages edged higher this week, according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages rose by one basis point (0.01 percent) to 4.04 percent. Conforming 5/1 Hybrid ARM rates increased by three basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 3.08 percent.

Investors will continue to watch for clues to the Fed's thinking

"Now that we've passed the events of mid-summer, the FOMC meeting and the July employment report, financial markets have settled in to await what comes next," said Keith Gumbinger, vice president of HSH.com. "Until we get closer to the mid-September Fed meeting, investors will continue to watch for clues to the Fed's thinking, but it appears as though we're on track for ‘liftoff’ of short-term rates in just about a month's time."

Financial markets appear well-positioned for the forthcoming change

The Fed has provided no explicit guidance that the first change to rates in nine years come September is a done deal, but the economic signals suggest that this will happen, barring any economic derailment over the next couple of weeks. Although there may be some last-minute adjustments, financial markets appear well-positioned for the forthcoming change.

Mortgage rates should be largely directionless, as we've seen this week

"Certainly, there are events which could stay the Fed's hand until later in the year, or even into 2016," adds Gumbinger. "Inflation might start to retreat, the job market could crater, or an unforeseen global event could occur. Fed Chair Janet Yellen has expressed an interest in getting the process started sooner rather than later, even if slowly and cautiously, and it would take a significant issue to derail the process at this late date. In the meantime, mortgage rates should be largely directionless, as we've seen this week."

Average mortgage rates and points for conforming residential mortgages for the week ending August 11, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.04 percent

- Average Points: 0.19

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.08 percent

- Average Points: 0.09

Average mortgage rates and points for conforming residential mortgages for the previous week ending August 04 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

- Average Rate: 4.03 percent

- Average Points: 0.17

Conforming 5/1-year adjustable-rate mortgage

- Average Rate: 3.05 percent

- Average Points: 0.09

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com’s survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar’s inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.