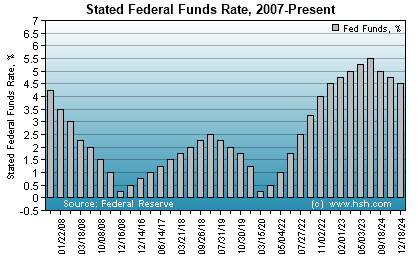

This graph lists the stated Federal Funds rate, as released by the Federal Reserve. The last change to this rate occurred: 12/18/2024.

Find out how changes in the federal funds rate may affect you.

We're often asked: Does the federal funds rate affect mortgage rates?

|

HSH grants permission to utilize this graph,

providing that the graph and its contents are not altered in any way.

Until December 2008, the Federal Reserve set an explicit target rate for the Federal Funds. Since that time, the central bank has instead expressed a target range for the overnight intrabank lending rate. Post-2008 data shown here is the top value for the target range. Learn more about federal funds.

Here are the figures from which the graph was derived,

and a history of the federal funds rate back to 1995.

| Date | Change (Basis Points) Increase Decrease |

Level or Max Rate (Percent) |

|

| 2024 December 18 November 7 September 18 |

... ... ... |

25 25 50 |

4.50 4.75 5.00 |

| 2023 July 26 May 3 March 22 February 1 |

25 25 25 25 |

... ... ... ... |

5.50 5.25 5.00 4.75 |

| 2022 December 14 November 2 September 21 July 27 June 15 May 4 March 16 |

50 75 75 75 75 50 25 |

... ... ... ... ... ... ... |

4.50 4.00 3.25 2.50 1.75 1.00 0.50 |

| 2020 March 15 March 3 |

... ... |

100 50 |

0.25 1.25 |

| 2019 October 30 September 18 July 31 |

... ... ... |

25 25 25 |

1.75 2.00 2.25 |

| 2018 December 19 September 26 June 13 March 21 |

25 25 25 25 |

... ... ... ... |

2.50 2.25 2.00 1.75 |

| 2017 December 13 June 14 March 15 |

25 25 25 |

... ... ... |

1.50 1.25 1.00 |

| 2016 December 14 |

25 | ... | 0.75 |

| 2015 December 16 |

25 | ... | 0.50 |

| 2008 December 16 October 29 October 8 April 30 March 18 January 30 January 22 |

... ... ... ... ... ... ... |

75 50 50 25 75 50 75 |

0.25 1.00 1.50 2.00 2.25 3.00 3.50 |

| 2007 December 11 October 31 September 18 |

... ... ... |

25 25 50 |

4.25 4.50 4.75 |

| 2006 June 29 May 10 March 28 January 31 |

25 25 25 25 |

... ... ... ... |

5.25 5.00 4.75 4.50 |

| 2005 December 13 November 1 September 20 August 9 June 30 May 3 March 22 February 2 |

25 25 25 25 25 25 25 25 |

... ... ... ... ... ... ... ... |

4.25 4.00 3.75 3.50 3.25 3.00 2.75 2.50 |

| 2004 December 14 November 11 September 21 August 11 June 30 |

25 25 25 25 25 |

... ... ... ... ... |

2.25 2.00 1.75 1.50 1.25 |

| 2003 June 25 |

... |

25 |

1.00 |

| 2002 November 6 |

... |

50 |

1.25 |

| 2001 December 11 November 6 October 2 September 17 August 21 June 27May 15 April 18 March 20 January 31 January 3 |

... ... ... ... ... ... ... ... ... ... ... |

25 50 50 50 25 25 50 50 50 50 50 |

1.75 2.00 2.50 3.00 3.50 3.75 4.00 4.50 5.00 5.50 6.00 |

| 2000 May 16 March 21 February 2 |

25 25 25 |

... ... ... |

6.50 6.00 5.75 |

| 1999 November 16 August 24 June 30 |

25 25 25 |

... ... ... |

5.50 5.25 5.00 |

| 1998 November 17 October 15 September 29 |

... ... ... |

25 25 25 |

4.75 5.00 5.25 |

| 1997 March 25 |

25 |

... |

5.50 |

| 1996 January 31 |

... |

25 |

5.25 |

| 1995 December 19 July 6 |

... ... |

25 25 |

5.50 5.75 |

What are federal funds?

Money ebbs and flows in and out of banks every day. At the end of a day, banks are required to have a certain amount of cash ("reserve") parked with the Federal Reserve, an amount which is determined by the amount of deposits a bank holds. This amount changes from time to time.

In a given day, some banks may see a large outflow of cash while others see a large inflow, so a bank could have a deficit or a surplus. Those with a deficit of funds can borrow from those with a surplus to meet their end-of-day reserve requirements. These loans are made on an intra-bank, overnight basis.

What is the federal funds rate?

The federal funds rate -- currently expressed as a range of interest rates -- is essentially the interest rate the Federal Reserve wants a reserve-lending bank to charge a reserve-borrowing bank for the use of borrowed funds overnight. This is a way for a bank with surplus funds to be able to earn interest on those excess reserves.

Monetary companions to the federal funds rate

To help control the amount of money in the banking system, the Federal Reserve itself also pays interest on reserve balances (IORB), but at a rate slightly less than the federal funds rate. A bank may choose to park funds with the Fed and earn a risk-free return rather than lend them out. Having a risk-free reference rate can influence the interest rates it charges to make loans that carry risks.

Banks can also borrow directly from the Federal Reserve itself using a Fed-run credit facility called the "discount window", where the Fed sets "discount rates" based upon the kind of collateral being pledged by the bank ("primary", "secondary" and "seasonal"). Although the Fed at times has worked to downplay it, discount window borrowing by banks is said to carry a discount window stigma, since it may suggest that a bank may be in a weakened financial condition and can't find another bank to lend it the reserves it needs at a price it is willing to pay.

Click here for a list of indexes for Adjustable Rate Mortgages.