August 4, 2017

Preface

In what is now the third-longest expansion on record, the economy continues to rumble along, alternating spurts of growth and stumbles but never managing to escape an overall modest to moderate speed that has been the hallmark of this particular cycle. More recently, major economies around the world have begun to find a little more reliable traction of their own, and for the first time since the days of the Great Recession, it seems as though the entire train is actually moving, at least a little, with central banks outside the U.S. at least contemplating trimming their QE programs, with some even raising rates, too.

In what is closing in on almost 10 years ago now, the Federal Reserve was the first to move forcefully, using unconventional tools and policies to try to address the massive liquidity crunch that beset financial markets. It has of course been the first to take steps to move away from emergency-level interest rate and other measures, too, and seems set embark on another unusual adventure in winding down its massive balance sheet.

The Fed has lifted short-term interest rates four times in the last year and a half or so; all have largely been non-events as far as the markets are concerned. Interest rates generally remain within shouting distance of record lows, indications of stock market volatility are at very low levels, and there remains more evidence that inflation isn't gaining serious traction than those that indicate that it is.

With two rate increases under its belt this year (and three in the last 8 months), and in the context of what is at least another soft spot in inflation, the Fed doesn't seem inclined at the moment to raise rates again anytime very soon. Instead, it has other plans to implement.

Recap

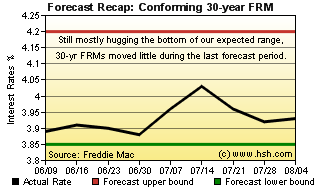

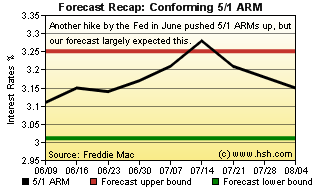

Mortgage and other interest rates found very little reason to move during the last forecast period. Aside from a one-week blip where the average 30-year FRM flared over 4 percent on comments from ECB president Mario Draghi, they held below that mark over the last nine weeks. One June 2, when we looked forward, we expected that the average conforming 30-year FRM would hold a range between 3.85 percent and 4.20 percent, but never got close to testing the upper bound, as the market produced a low mark of 3.88 percent and a high of 4.03 for the period. For conforming 5/1 Hybrid ARMs, we thought that a 3.01 percent and 3.25 percent pair of fences would contain the most popular ARM, and were pretty close, as a 3.11 percent low and 2.38 percent high were tallied during the period. All in all, and despite one holding to the lower end of the forecast and the other to the upper end, we will call the last forecast a success.

Forecast Discussion

At its June meeting, the Federal Reserve revealed details on how it plans to begin the protracted process of winding down its balance sheet. Essentially, and in increasing steps over the next year or so, it will no longer reinvest all inbound proceeds from maturing bonds. In essence, it will wean itself -- and the financial markets -- away from its direct influence.

Just as QE's purchasing of MBS and Treasuries were unprecedented moves, so will be the process of extrication from the these investments. As such, the Fed wants to move slowly and predictably and gauge the reaction of the financial markets as it goes, and is hoping for a non-event sort or process.

Argubaly, it wants to get its new wind-down plan in place and on autopilot before the end of Fed Chair Yellen's term, which is slated to end in January. Although there remains a good chance she will be re-appointed by President Trump, there is no guarantee that this will be the case, and a change in Fed leadership may have unpredictable effects on the financial markets. As such, having the most complex of Fed policy moves in recent years in place before a change in leadership might occur is likely the best course of action to minimize market disruptions. Conventional policy moves (changing the federal funds rate) are well understood by markets and any Fed chair can (and is expected to) change it as conditions warrant. However, markets appear to have developed a level of trust and comfort with the present composition of the Fed and this is key to getting the new policy in place and functioning... and soon.

With this in mind, the September meeting seems right for kickoff... or at the very least, an announcement that the process will begin on or before the next Fed get-together in late October/early November. Preparing the markets for the coming change, the Fed noted at the close of its July meeting that the new plan would be enacted "relatively soon", and there was little discernible market reaction. Given that the September meeting is a "quarterly" one, with fresh economic projections and a press-conference discussion thereafter, it is a chance to both reflect on the current state of policy, review the outlook for growth and inflation and discuss possible outcomes and what-ifs regarding the new policies in light of new projections.

So for the time being at least, it will be "out with the conventional and in with the new" as it pertains to Fed manipulation of interest rates. Although the initial direct impact on interest rates is expected to be slight (as the program starts small) there is no easy way to know if financial markets will react poorly and kick rates higher for a time. Of course, in the midst of all this, there is still the economic situation to consider; the second and third quarters of the last few years have tended to be the strongest of each year, and we appear to be in this pattern again this year. Even with no inflation at present, ever tightening labor markets and a firming global economy may begin to concern financial markets to a greater degree as they would tend to suggest that a day of inflation reckoning is growing closer. To the extent this mind set begins to set in between now and October is a key factor as to how benign mortgage rates will be.

That's not to say that these are the only items influencing interest rates. The global political climate remains tense with Korea, China, Russia, Qatar, Venezuela, and plenty of other global issues (remember Brexit?) that will continue to keep investors nervous to varying degrees at the same time. Sovereign bonds in the U.S. and other places make a nice place to safely park money and even earn a little return and so the conditions that have helped keep a lid on interest rates for years now show few signs of abating but may even intensify in the days just ahead.

Forecast

For mortgage rates, we've not quite been in a period of stasis since early this year, but opportunities for breakout movement have been quite limited. Broadly, we expect this to continue until we begin to close in the next Fed meeting on September 19-20. The first full business week after Labor day is often a time when a new pattern for rates is established, and with the Fed meeting fast on the heels of that, perhaps some enhanced volatility will be seen. That said, it's nothing we've not already seen this year, and there is no expectation that any sudden surge in interest rates will push us into new territory soon.

Over the next nine weeks, mortgage rates will probably spend the next few in a familiar place, hanging a little under (or over) the 4 percent mark. We think that the average conforming 30-year fixed-rate mortgage as reported by Freddie Mac spends the next nine-week period between 3.80 percent and 4.15 percent. Meanwhile, the average initial rate for conforming 5/1 Hybrid ARMs likely wanders between 3.05 percent and 3.35 percent. If this holds true, and by the time the period ends there will be just 12 weeks left in 2017, with not much time for our long-range expectation for rates this year to bear out.

Both the Fed and the NFL will be past their respective kickoffs by the time this forecast comes to a close on October 6. While enjoying early Autumn, why not drop back and see if this forecast split the uprights or clanked off the post?