December 8, 2017

Preface

As 2017 winds to a close, we can't help but wonder if this might be the last year where we see long periods of 30-year fixed mortgage rates below the 4 percent mark. The U.S. economic expansion will soon become the second longest on record, and remarkably seems to have accelerated somewhat over the last six months to a GDP growth rate above 3 percent. Some reviews of the potential stimulus from a U.S. tax code change suggest that GDP growth could rise as much as 0.8 percent as a result of new tax structures, so there is a prospect that somewhat faster growth may be just ahead.

One result of the change in tax code would be increased issuance of Treasury bonds to finance the deficit, so more supply would be coming on line even as the Federal Reserve continues to curtail its reinvestment of inbound proceeds from the investments it holds. More supply may not be met with more demand, but with interest rates across the globe still much lower than ours, it is likely that foreign investors will continue to mop up most of that supply, so the natural effect of more supply pushing yields higher would tend to be muted, for now.

That said, with short-term interest rates on an upward path, and as we noted in the MarketTrends newsletter a few weeks ago, the Treasury will be looking to issue more short-term instruments rather than long-term, so it may be that the relative scarcity of longer-dated bonds will keep their prices supported and yields from rising much, also tempering any rise in rates. That said, it may instead be that investors are more strongly drawn to a two-year investment at 2 percent than a 10 year investment at 2.4 percent; if so, any lack of investor interest would tend to see long rates move higher, too.

The economies of many countries around the world are also growing in sync, some central banks are beginning to pull back on QE or low-rate stimulus programs and it appears that disinflationary trends that have kept price pressures low are abating to some degree. How these items intertwine will certainly influence how 2018 goes as a whole, but also will have some near-term effects for our forecast period, too.

Recap

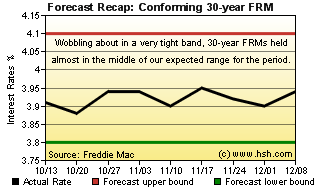

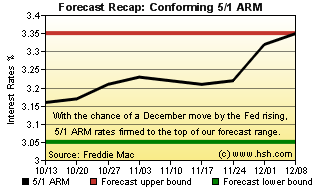

We felt pretty good about the ranges we set for the last forecast, and the market fortunately rewarded our vision. Back in early October, we thought that the averages offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac would hold a nine-week range of 3.80 percent to 4.10 percent, and we mostly held close to the center of that range, running a 3.88 percent to 3.95 percent range for the period. Conforming Hybrid 5/1 ARMs also ran within our expected borders of 3.05 percent to 3.35 percent and trended from 3.16 percent to 3.34 percent, rising late in the forecast period as the financial market increasingly prepared for an expected rate hike by the Federal Reserve in mid-December. All in all, we'll pat ourselves on the back for a pretty good forecast.

Forecast Discussion

The December lift in the federal funds rate is all but a done deal at this point. An economy that has run at greater than a 3 percent GDP rate for two quarters (and possibly three) should easily be able to withstand an overnight intra-bank lending rate a quarter of a percentage point higher, even if it would be the highest nominal rate since 2008. While overnight short-term rates have little direct influence on long-term ones, the regular and routine lifting of the "official" interest rate floor will tend to help firm interest rates all along the spectrum to varying degrees. As such, a move by the Fed in December will probably be enough to lift fixed mortgage rates back over the 4 percent mark during the forecast period, although it might not happen immediately or all at once. At time this year, and certainly of late, mortgage rates have been edging higher at times only to stumble back.

There are other factors that suggest some firmness in rates is coming, too. Certainly, its debatable how much economic boost will come from a change to tax policy (or when), but some is likely to come. Even if not immediate, more important to our forecast is that investors must prepare for expected effects from the tax code changes, and expectations of possibilities to come were the key factor in boosting mortgage rates in the aftermath of the presidential election and into the early part of 2017. As those prospects faded, so did mortgage rates, but a revival of them may add a bit to upward pressure for rates. Of course, should faster growth occur, the Fed may deem it necessary to hike rates faster. It's too early to consider this, but the possibility exists, and these decisions will be made with a new Fed Chairman in the post, as Janet Yellen leaves in early February and will be replaced by Jerome Powell. While thought likely to continue existing policies of gradual changes to policy and divestiture of the balance sheet, a change at the top (and among the group of policymakers) does inject some measure of uncertainty as to how the Fed will act in the months to come.

The Fed's process of winding down its balance sheet also starts to accelerate in January, doubling from a current monthly reduction of $6 billion in Treasury bonds to $12 billion and to $8 billion in MBS and agency debt from a current $4 billion per month. So far, the overall effect on mortgage rates has been largely benign, but the reductions have also only been nominal. As they become more material we may see some additional effect on rates, and this will also come in conjunction with the European Central Bank halving its QE program from $60 billion euros per month to $30 billion euros in January, so there will be more bonds in general for global investors to absorb in just a few weeks' time and late in the forecast period that will likely foster a firmer interest rate climate, too.

The Fed and other central banks have hoped for years that inflation would become a reliable force again, but that hasn't much been the case. However, a rising global economic tide does seem to be lifting the inflation tide just a bit of late, at least enough to quell worries of deflation. Deflationary pressures have emerged for various reasons and for irregular periods of time for a number of years, confounding forecasts, but these forces are not well understood and may or may not have persistent influence on long-term trends. Whether they can reliably or regularly hit a given target aside, from where we sit it would appear that prices are firming a bit over the last six months. We'll know more about trends in the Fed's preferred measure of inflation when the end of January rolls around and the initial report on the fourth quarter comes, but core PCE moved from 0.9 percent in the second quarter to 1.4 percent in the third, and the Fed's own Beige Book recently noted that "price pressures have strengthened since the last report", so it may be that core inflation has continued to move higher in the last quarter of 2017. If inflation has picked up a little, the prospects for more aggressive Fed action in the future will increase, too.

Higher short-term rates, more economic growth, more bonds for investors to buy and possibly more inflation, too. With such items appearing quickly in the windshield, it's difficult to find a way to expect anything but firmer rates in the offing.

Also, Ms. Yellen returns to the private sector on February 3, and we thank her and wish her well as we welcome Jay Powell to the helm.

Forecast

All the above being said, there are still some tempering influences on mortgage rates and interest rates in general. We do expect them to firm up but there are yet limits on how far they can or will go between now and early February. However, we are adjusting our expected range for the mortgage rates as reported in Freddie Mac's weekly PMMS, leaving just a little space for them to decline from current levels but opening up the upper end a little bit. Over the next nine weeks, we think the average conforming 30-year FRM will wander between 3.85 percent and 4.20 percent; the average offered rate for a 5/1 hybrid ARM will likely trend between 3.28 percent and 3.53 percent for the period.

This forecast expires on or about February 9, 2018. It'll be fully mid-winter at that point, and the groundhog will have seen his shadow (or not) by then. Why not stop back and see if our rate forecast turns out better than his weather outlook usually does?