January 8, 2016

Preface

With the Federal Reserve again actively tweaking policy, forecasting future mortgage rates becomes both simpler and considerably more complicated. This is especially the case now, where the central bank is trying to lift short-term rates while at the same time continuing to exert downward pressure on long-term rates through a policy of continual "reinvestment" of inbound proceeds from their investment portfolio.

At the same time, the Fed is alone in the central bank world, as other central banks are either continuing or expanding stimulus program designed to keep rates low and markets liquid as they fight off deflation and weak (if any) growth, as well as addressing other concerns.

Even with a fairly solid domestic economy, will the Fed be able to continue moving rates upward in a wobbly economic world? Most data suggest we're not immune to the troubles of others, as manufacturing and exports are struggling, growth is modest and there are plenty of headwinds to be seen, a combination of factors that require a deft hand by the Fed and will probably produce plenty of volatile times ahead.

Recap

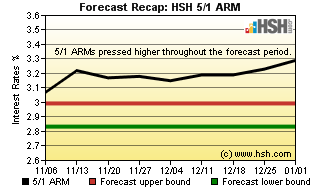

Our last forecast was both right and wrong. Given what appears to be a considerable slowdown in the fourth quarter, we thought that the Fed would not raise interest rates in December. They did, lifting the federal funds rate by a quarter percentage point. However, they also decided to continue to reinvest inbound proceeds from their holdings of Treasuries and MBS, and the combination of the two has predicable effects -- shorter-term products like 5/1 (and other) ARMs bounced higher, while longer-term mortgage products like fixed-rate mortgages remained well tethered.

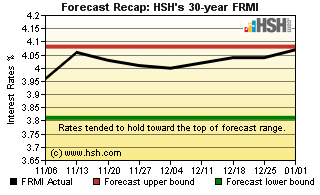

As such, our forecast was caught leaning the wrong way, as markets increasingly believed that the Fed would make a December move, blowing up our ARM forecast for the period. Fixed rates behaved more as expected, but did hold closer to tops of forecast ranges than not, especially as labor markets showed no ill effects from a less-than-stellar global economic climate.

Back in October, we believed that we'd see a range for HSH's FRMI of 3.81 percent to 4.08 percent. With the Fed move looming larger as we moved though the forecast period, rates tended toward the upper end of that range, but managed a 3.96 percent to 4.07 percent pair of boundaries. We did misjudge the path for the 5/1 ARM, which had been remarkably stable for months leading up to this forecast, but history as always turned out to be a poor guide, and our call for the FRMI's 5/1 Hybrid companion of 2.83 percent to 2.99 percent was bad from the outset, as we saw a range of 3.07 percent to 3.29 percent for the period. Conforming 30-year fixed rates met our expectations of holding in a 3.82 percent to 4.09 percent range, as they remained bound by a 3.96 percent to 4.09 percent set of fences. As the song says, two out of three ain't bad, but the 5/1 call was not very good, admittedly.

Forecast Discussion

With notable exception (the Fed's upward push for short-term rates) it seems to us that 2016 may look a lot like 2015... or even 2014. Global events are more likely to shape the trajectory for our interest rates, with the current troubles in China a substitute for the Greek and Eurozone messes of the last couple of years. All of these have the effect of creating a global flight-to-quality/safety of cash into U.S.-backed debt, driving down yields and pulling mortgage rates down along with them to at least a degree. But to what extent... and for what duration? That's hard to know; perhaps the market has begun to build in their expectations for this happening, with much of the downward pull already realized, with any future bad news from abroad also having lesser and lesser effect.

The Fed continues to believe that a tightening labor market here will eventually begin to lift inflation. So far, that's not much been the case, and we may not have yet realized all the deflationary effects of still-falling oil prices and energy costs, let alone the cooling effect on commodity prices from China's waning demand. At some point, these deflationary effects will wane and prices will begin to firm, but there's little appearance of any inflation acceleration to be seen at the moment.

While the Fed has retained a relatively new tool (reinvestment) and employed a much older one (manipulating the federal funds rate) they also have new tools being tested in live conditions for the first time (paying banks interest on excess reserves and employing reverse-repo operations to help enforce the desired overnight target rate). It seems likely that a cautious Fed will want to observe these in real time for a while; coupled with a mixed bag of data (beyond labor strength) this argues that a move in the federal funds at the January meeting is less likely than one a bit later (March or beyond).

For the moment, markets are rather more sensitive to positive than negative economic news, and seem wary that a spate of more positive domestic or offshore data could embolden the Fed to move more aggressively than is presently expected. To be clear, even a difficult start to the new year in financial markets only trimmed a little off the top for most Treasury yields, and the influential 10-year Treasury has remained in a very narrow range since the first week of November. As such, the downside for rates seems very limited to us at the moment.

Forecast

The next nine weeks are likely to be interesting, to say the least. By the time we get through it, we will have passed one Fed meeting and be on the cusp of another, and one which will likely feature the second lift in short-term rates (barring an unforeseen slowdown here).

Should we pass through the period unscathed by economic malaise, we are likely to see firming rates as we close the period, but there isn't much reason to expect significantly lower rates between now and then, either.

For the next nine weeks, we think that HSH's broad market-measuring FRMI will find no way to get any lower than an average of 3.92 percent and won't trend higher than perhaps 4.26 percent. The overall hybrid 5/1 ARM should remain between 3.14 percent and 3.45 percent by the time we hit mid-March. For conforming 30-year fixed rates, there's little difference in pricing between GSE-backed loans and those for private-market jumbos, but we think a 3.93 percent and 4.25 percent pair of fences will be the limits for the most popular mortgage type and term

The week following the end of this comes an important Fed meeting, where updates to economic projections and forecasts for interest-rate policy are due.

This forecast will expire on March 11, 2016. Daylight Savings Time kicks in just a couple of days later. As you look forward to longer, warmer days and the onset of spring, why not take a look back to see if our forecast has produced any green shoots, too?