October 26, 2018

Preface

After a summer of near immobility, mortgage rates broke higher as the calendar turned to autumn. Dating back to perhaps the stock market rout called Black Monday way back in '87, the end of the third and beginning of the fourth quarter of each year seems to feature fits of volatility that the summer months usually don't.

The catalysts for these market convulsions vary from period to period, reflective of the climate in which they occur. For this particular one, a combination of strong growth and firming inflation provided the fuel, but the spark came from the Federal Reserve itself. For the first time in years, the Fed decided to no longer provide "forward guidance", removing its characterization of the stance of monetary policy as "accommodative" at the close of the September FOMC meeting. In the ensuing weeks, markets have struggled to interpret how close the federal funds rate is to a "neutral" position and in turn how to adjust investment holdings and expectations.

Hopes that the Fed was getting close to a neutral stance and even perhaps considering a pause at some point next year were mostly dashed by Fed Chair Jay Powell, who in a discussion after the September meeting noted that “Interest rates are still accommodative, but we're gradually moving to a place where they'll be neutral." He also added that “We may go past neutral. But we’re a long way from neutral at this point, probably."

The Fed has essentially instructed the markets to watch the economic data, not the Fed. That's fine, except this particular construct of the market has grown up doing little but watch the Fed. Economic data is noisy, often inconclusive and only available in arrears, and for the first time in a while, the markets need to peer forward into the darkness without the Fed's flashlight to help guide them.

Perhaps lost in the noise and conversation is that in October, the Fed has taken the last step in its auto-pilot portfolio reduction process. It is the first time in about ten years that the Fed has been fully out of the mortgage market; some influence is expected be seen for a while yet in Treasuries, where the Fed will mop up some excess supply. The Fed expects this to most likely occur in the mid-point of each quarter during the Treasury's quarterly refunding, where lots of new debt is placed into the market. During those times, this may to temper any increase in interest rates that might come when a fresh spurt of supply hits the market.

This alone seems a recipe for continued volatility, even without taking into account all the other global items that influence interest rates.

Recap

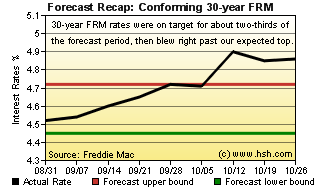

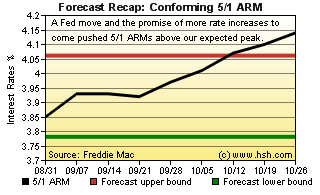

We admit getting lulled to sleep by the long, lazy period for mortgage rates, and certainly regret moving our expected ranges down for the just-closed forecast period. Even if we didn't it wouldn't have helped much, but we would have at least been a little less wrong.

For the period, we expected that conforming 30-year FRMs as reported by Freddie Mac would run in a range of 4.45% to 4.72%. While this was good for two-thirds of the nine-week period, rates jumped out of our expected boundary in the latter third. For the forecast period, the market presented us with 4.52% to 4.90%, so while we were good in terms of the bottom of the range we were much less so with the top. After a fairly long stretch of little significant movement, we thought a 27-basis point range would be sufficient, but a gap of 38 is what we got.

This was much the case with hybrid 5/1 ARMs; we thought a 3.78% to 4.06% pair of fences would hold; while closer to containment, the average offered rate here ranged from 3.85% to 4.14%, rising above our expected upper bound even as the 29-basis point move barely exceeded the 28 we expected to see.

All in all, not our finest forecasting moment.

Forecast Discussion

We have entered a very different stage of the economic expansion, which is closing in on becoming the longest such streak in history. Questions abound: With labor markets tight, why isn't inflation rising more quickly? Can U.S. growth continue above potential, and if so, for how long? Will foreign investors continue to buy U.S.-backed debt even as issuance continues to rise? Where is the neutral rate for the federal funds? Could the beginnings of the next recession really be just four quarters from now? What about the effects of ECB unwinding its stimulus? Brexit effects? Slowing growth in China? Italy's financial woes?

Perhaps more important is "How will the Fed and markets react if growth begins to slow?" as it seems likely to do?

We might also ask "What happens to housing amid near-record high home prices and 7+ year highs for mortgage rates?" but given the reaction in housing markets seen in recent months (cooling sales, rising inventories, less robust price gains) we think we know the answer to that one, and it seems a cold winter is forming for housing.

It's not likely we'll get complete answers to any of these questions (and maybe not even partial ones) but these and more are on the minds of investors, whose choices of where to allocate funds will push interest rates around.

What does seem likely in the coming months is an economy cooling a bit after a hot couple of quarters. Even then, GDP growth slowing from the 4s to the 3s is still above levels believed to be sustainable, and this likely means that the Federal Reserve will raise interest rates again come December. This will be the case even if inflation falls a bit short of hoped-for levels, as it seems to have done in the third quarter. Growth measurably above the economy's "potential" and still-tightening labor markets will continue to absorb resources and help to firm inflation as we move into 2019, and the Fed's moves in December (and beyond) are attempts to try to attenuate nascent price pressures.

As another move in the federal funds rate theoretically moves us closer to whatever "neutral" may be, it bears noting that one investor's definition of neutral may be another's definition of restrictive... it all depends upon how dependent your investment strategy or positioning relies on a given level of interest rates to produce expected returns. With inflation running somewhat less than 2% but the federal funds rate positioned somewhat above 2%, it's certainly a fair assessment for some that rates are at least neutral already, if not mildly restrictive.

Even if the Fed itself does not know where "neutral" may lie, it has for years provided investors with a sense that rates were low and at times would remain so for extended periods. Starting in September, this is no longer the case, as the last vestige of "forward guidance" was removed from the statement that closes FOMC policy-setting meetings. To a degree, this has set the markets adrift, something you see reflected in the volatility in interest rates and equity prices. Due to this change, and because the Fed wants investors to follow the data and not some expectation of future Fed policy, periods of considerable volatility can be expected to appear in financial markets.

To us this means that while the general trend for interest rates in the near term does seem one that will feature an upward bias, such a move is unlikely to happen in a straight-line pattern. More likely, as the data ebbs and flows, we'll see bouts of rising rates, then some tempering, followed by rising rates, then tempering. As such, we expect that mortgage rates will nudge their way higher over time. If inflation should begin to run reliably warmer, this would tend to favor less backing and more filling for rates, but for the moment, that sort of pattern for prices isn't yet evident.

Forecast

The next nine-week forecast period will coincide with both the end of the quarter and the end of the year, spanning a number of holidays and events. It is not unusual to see financial markets again become quiet after about mid-month November as the holiday season begins to kick in. As such, and even though we do think there is yet some overall upward bias for mortgage rates between now and the end of the year, we believe that recent spate of volatility will cool somewhat, leaving the average offered rate for a conforming 30-year fixed-rate mortgage holding a range of 4.74% to 5.08% between now and December 28. For hybrid 5/1 ARMs, there's somewhat less likelihood of any decline in rates in the coming two months, and we think that a 4.07% to 4.33% pair of fences will contain the average offered rate for the most popular ARM.

This forecast expires on December 28. We'll be past Christmas at that point, so please do come back see if this forecast warranted a gift or a lump of coal.

Also, to follow rate movements and their influences on a more frequent basis, check out or subscribe to our weekly MarketTrends newsletter.