September 13, 2019

Preface

The global economic climate continues to strongly influence interest rates and monetary policy here in the U.S. President Trump's mercurial and singular approach to trade policy is battering business and perhaps now consumer psyches, damping what would otherwise likely be a set of solid conditions for both. Uncertainty about the outlook for economic growth in many developed economies has seen investors strongly shift money from risk investments such as equities to the relative safety and security of sovereign bonds, driving yields way down, and in some cases to deeply negative rates of return.

Here in the U.S., that investor flight to quality and safety has been fairly intense and persistent, even as yields on many intermediate-term notes and bonds has shrunk. In the just-ended forecast period, the 10-year Treasury yield slumped from about 2.09% to about 1.50%, and you would think that such a puny yield would be a deterrent to investors looking for decent returns. However, with yields for comparable bonds in Germany and Japan well below zero and those in other major economies yielding far below U.S. levels, Treasuries are not only a bet on safety but also one that brings comparably reasonable returns. Of late, certain interest rates have also been dragged further down by mortgage-related buying ["negative convexity"] where hedging the loss of paid-off mortgage bonds from refinancing comes in the form of buying new notes to replace them... which in turn puts additional downward pressure on yields and mortgage rates and perpetuates the refinancing cycle to a degree. Anyway...

Although the global economic troubles that have fostered the current low-rate environment are concerning, the effect on the U.S. has so far been limited, but the longer the trade fight drags on with no agreement (any agreement is better than none) the stronger the drag may become. First, business confidence eroded, agriculture was pinched and manufacturing began a year-long softening trend. Currently, consumer confidence has begun to show signs of slippage, hiring growth has begun to trend lower, and the shine seems to have come off overall economic growth, which is currently reckoned at just 1.9% in the third quarter.

Without stepping too much into politics, the next presidential election cycle is already well under way. An economy slowing as we move deeper into campaign season isn't something the incumbent would like to see, but there is likely to be no urgency expressed by China to get a deal done quickly. To achieve an agreement in the near term would require a greater bit of flexibility in negotiation, but neither side seems all that willing to compromise at the moment. That said, getting any framework in place or even agreeing to agree would likely help restore a level of business confidence and improve the global outlook. Despite any number of admonishments by President Trump, Fed Chairman Jay Powell knows that monetary policy alone isn't likely to be enough to significantly repair a lack of business or consumer confidence, as lower interest rates are only helpful if someone has the confidence to borrow money to invest in a long-term endeavor or debt that can be refinanced.

Recap

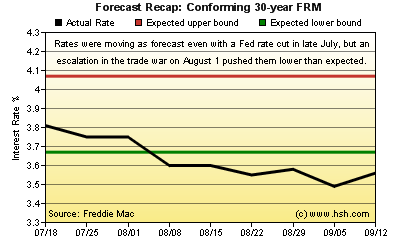

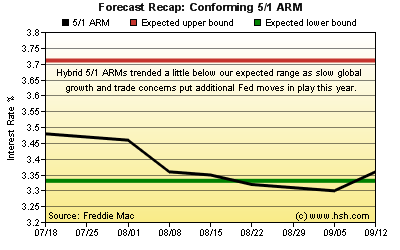

After several forecasts in a row where rates trended lower than we thought (bad for us but good for homebuyers and homeowners looking to refinance) we felt pretty good about this forecast going in. Early on, rates were generally behaving as planned but the August 1 escalation and expansion of tariffs turned the outlook darker and investors again scrambled for safety. As a result, we missed the mark again; our July forecast called for conforming 30-year FRMs to trend in a range between 3.67% and 4.07%, but the downshift in rates left us with a 3.81% top and 3.49% bottom for rates for the period, and with a downward bent nearly throughout. As well, we expected that the initial fixed interest rate for a hybrid 5/1 ARM would hold a range of 3.33% and 3.71%; although this forecast suffered from the same influences as the 30 FRM one, the 3.48% to 3.30% peak and valley values were somewhat closer to our expectation, if also generally trending lower for much of the nine-week forecast period.

We do wish our last forecast or two were closer to the mark, but they weren't. In general, we usually feel fairly confident in assessing how the economic and inflationary climate should be over a period and can even incorporate the possibility that items like a trade "hurricane" might form, but it's just not possible to factor into any forecast the timing or size of such an outbreak.

Forecast Discussion

Much of what happens to mortgage rates in the next nine-week period depends on whether or not some progress in trade talks can be made between the U.S. and China and how central banks act or don't act.

Some high-level discussions are expected to take place in October between the U.S. and China and there are some hopes for meaningful progress, but that's not something that can be counted on at the moment as the situation remains fluid.

As we write this, and coupled with still mostly favorable U.S. economic data, optimism about an agreement has been sufficient to put at least a temporary bottom on interest rates. Any formal positive steps would likely reinforce this firming trend as investors would look to redeploy funds to areas that could potentially produce returns better than low-yielding bonds would bring. However, the risks are high that no progress is made at all or that the tensions are further heightened, and should this be the outcome, we would likely see a swift reversal of yields and could potentially explore new record lows for interest rates.

We do know that the European Central Bank has met and taken new policy actions, including trimming their already-negative key policy rate by 10 basis points to -0.50 percent (a new record low), and re-started a QE-style bond buying program of about $20 billion Euros per month. The ECB also provided forward guidance that suggests that the below-par interest rate will remain in place until Eurozone inflation is within range of its 2% target and shows signs of remaining there. This should cheer markets a little, but as their policy rate is already negative and previous bond-buying programs all but exhausted available private bonds to buy there is no guarantee that more of the same will have any greater effect on the area's economy. ECB Chair Mario Draghi implored governments "with fiscal space [to] act in an effective and timely manner" to add fiscal to monetary stimulus "to achieve a more growth-friendly composition of public finances." There have been rumblings that Germany might institute some fiscal stimulus to help revive a flailing manufacturing sector, and improving growth there would tend to help lift the entire Eurozone to a degree. The additional of any fiscal stimulus by Germany or any other Euro nation to the ECB's new and expanded measures would strengthen the case for somewhat firmer longer-term interest rates.

With the ECB meeting concluded, all eyes turn to the Fed. Despite bleating by President Trump for the Fed to "get our interest rates down to ZERO, or less" the Federal Reserve is very likely to conclude a two-day get-together with another quarter-point trim in the federal funds rate and offer a pledge to support the expansion in the future as needed. Futures markets remain convinced that up to another 50 basis points will be cut from the funds rate by December, possibly all at once in either the October or December meeting (or parsed proportionally between both). However, by the minutes of the last FOMC meeting and subsequent Fed member speeches, there doesn't seem to be a consensus that bold or even continued actions are yet warranted. The updated Summary of Economic Projections by Fed members that will accompany the close of next week's meeting will be telling in this regard.

Much of what happens to mortgage and other interest rates in the forecast period will depend not on any specific central bank policy change but rather on financial market reaction to any change. For the coming period, the question is "Can the market handle disappointment if the Fed doesn't intimate that it is likely to continue to cut rates in the near term?" but the answer to that question isn't exactly clear.

Although we prefer to couch our prognostications on available economic evidence, the current forecasting climate seems a little different as much depends upon investor moods and collective business psyches. This adds a degree of challenge to an already challenging endeavor. We do expect the economic data for the U.S. to continue to be fair, if moderating (or even modest) as we wend our way through the end of the third quarter and into the fourth, but that from the rest of the developed world to be muted at best. A little optimism -- a brightening in dark skies, if you will -- would go a long way to improving the economic climate both here and elsewhere and carries far more importance than any specific data point or series. Confidence and faith seem to be the key at the moment.

Forecast

As we write this, the typical "after Labor Day trend change" has kicked in for rates, and mortgage and other interest rates are likely to firm a bit for the first time in months. No matter. Such a move will only bring rates back to where they were in perhaps early-mid August or so. Given that the forecast this time relies more heavily on the whims of interpretation and expectations, it seems likely that a period of greater volatility is ahead with more up-and-down swings than the near-steady 2019 decline which we've enjoyed now for over eight months.

Over the next nine weeks, we could again approach all-time lows for the Freddie Mac 30-year FRM series (from 1971); their low-water mark was 3.31% in November of 2012. We probably don't get there, but could be close should pessimism prevail and if rates again tend to hug the bottom of our forecast range of 3.38%; that said, if optimism should rule the day, we could see a top of perhaps 3.79 percent. For the initial rate on conforming 5/1 ARMs (should anyone care), odds don't favor much of a strong move in either direction over the next nine-week period, but we'll set a working range of 3.23% and 3.46 percent.

This forecast expires on November 15. We'll have had two Fed meetings between now and then and will be on the cusp of the holiday shopping season. We'll likely know by then if an additional round of tariffs delayed from September 1 will kick in or not, which could see some holiday sales moved up this year. If so, you might take a minute from early holiday preparations to stop back in and see how this forecast fared.

For interim forecast updates and market commentary, see our weekly MarketTrends newsletter.