The term "subprime" carries a lot of stigma. In fact, if you want to seriously insult someone while keeping your language clean, just try calling him or her "subprime." Then duck. Many blame subprime mortgages for the Great Recession and home foreclosure crisis nearly ten years ago. But since then, the government, investors, borrowers and lenders have learned a great deal. And today, the so-called "non-prime mortgage" offers flexibility and creativity that might be right for you.

The term "subprime" carries a lot of stigma. In fact, if you want to seriously insult someone while keeping your language clean, just try calling him or her "subprime." Then duck. Many blame subprime mortgages for the Great Recession and home foreclosure crisis nearly ten years ago. But since then, the government, investors, borrowers and lenders have learned a great deal. And today, the so-called "non-prime mortgage" offers flexibility and creativity that might be right for you.

What is a "non-prime mortgage?"

The term "non-prime" has no legal basis. The government has set standards for what it calls "qualified" (QM) and "non-qualified" (non-QM) mortgages. Qualified mortgages meet specific guidelines designed to make them very safe for lenders, investors and borrowers. And QM lenders enjoy extra protection from lawsuits if anything goes wrong with the loan.

Any mortgage outside of those restrictive QM guidelines is "non-QM." You might think of "non-prime" as another word for "non-QM."

Non-QM mortgages are not "bad" or "unsafe." In fact, the Ability-to-Repay (ATR) section of the Truth In Lending Act (TILA) makes it illegal for lenders to sell mortgages without determining that the borrower can afford the payments. Non-QM or non-prime mortgages do make it possible for consumers with unique situations to get mortgages. Some of those situations involve credit problems, but not all.

Related: The Return of Subprime Lending?

Non-Prime Mortgages: Who needs them?

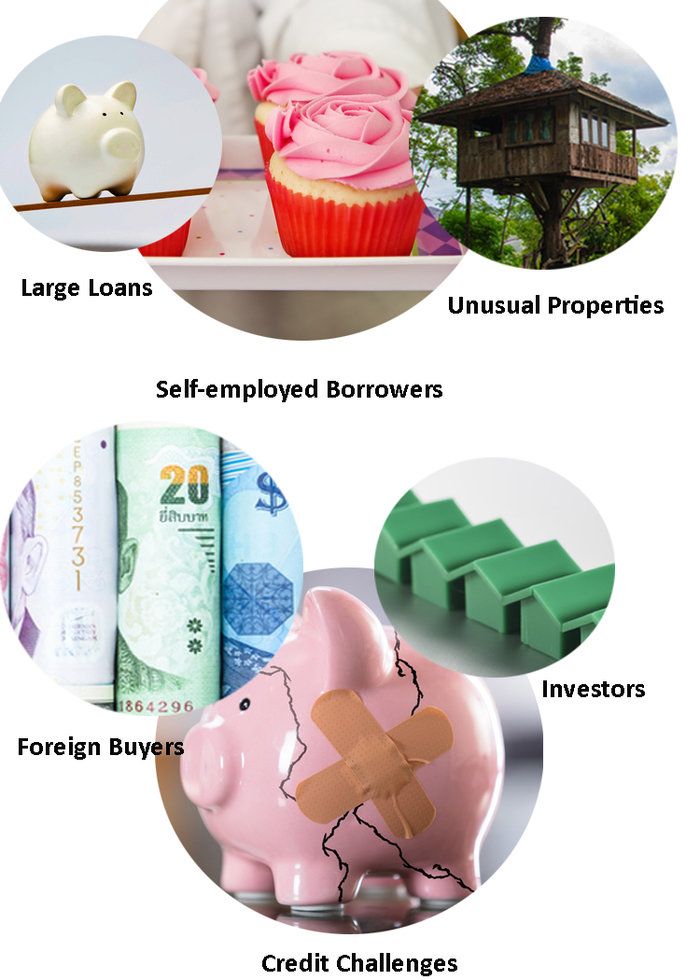

Non-prime borrowers come in many guises:

- Investors with many financed homes

- Property flippers

- Foreign nationals with little or no US credit history

- Homebuyers with recent bankruptcies or foreclosures

- Self-employed applicants with good cash flow but low taxable income

- Buyers of unique properties

- Consumers who want to finance mixed-use buildings (for example, businesses downstairs and living quarters upstairs)

- Homebuyers with poor credit scores

- Borrowers requiring very large loans

- Buyers of non-warrantable condominiums

There are many reasons for using non-QM financing, and not all of them involve bad (subprime) credit. Sometimes, very well-qualified applicants have difficulty proving their income -- either because its source is foreign, or because the business is new, or because money that is available for a mortgage payment is deducted at tax time.

Related: Documents Required for a Mortgage

Non-prime loans for self-employed borrowers

Some non-prime loans are designed for self-employed applicants. You might not have been in business long enough to meet QM guidelines. But what if you're doing the same work you used to perform as an employee? A non-QM lender might give you credit for your self-employed income because it makes sense.

Or what if your income declined last year? Many QM lenders can restrict your borrowing ability if they think your income is trending down. But some business cycles just work that way. For instance, a home developer might spend a great deal upfront -- purchasing land, constructing homes, advertising, and more. The company might show little income, or even a loss, during that time. And then the houses sell and the earnings soar. If you apply for a mortgage during the "down" cycle, you might have trouble getting financing.

And then there are business with a lot of startup costs that they write off or other big deductions that they can legally take. The cash comes in, but the taxable income isn't enough to qualify for a mortgage. And some small business owners put a lot of their personal money into their business accounts -- which traditional lenders might not allow them to count when qualifying for a mortgage.

Non-QM lenders may allow you to borrow if your business is new. They may average your bank statement deposits to calculate your income. And you might get to count business assets when qualifying for your home loan. The lenders make their own rules because they take the hit if you default -- not the government.

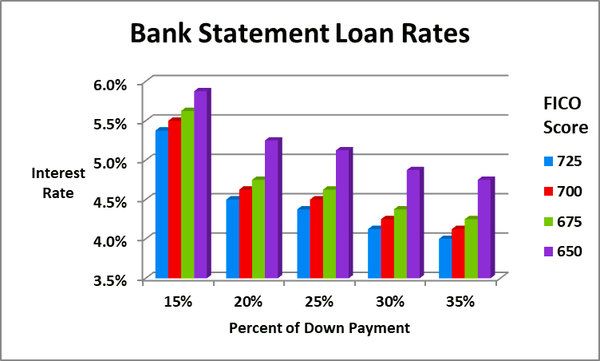

The chart below shows mortgage rates fro one national lender for bank statement loans.

Non-prime loans for people with bad credit

Yes, there are non-prime mortgages for credit-challenged applicants. But they are nothing like the crap-shoot loans of a decade ago. In the past, you could get a mortgage with no down payment, bad credit and no income verification. Today, the lender must determine your ability to repay the loan. You might be able to get away with a low down payment or a high debt-to-income ratio or an awful credit score. But not all of the above.

There are mortgages available for borrowers with credit scores as low as 500. But you'll need a sizable down payment (15% to 25% for most programs) and / or a co-signer. Or additional assets to pledge, like stocks.

Others allow loans to applicants with recent "housing events" like short sales or foreclosures if they are otherwise well-qualified. Ditto for bankruptcy. It really depends on the reason for the event:

- What it a one-time disaster or the result of a pattern of mismanagement?

- Has the applicant corrected problem that caused the event?

- How likely is the event to recur?

Even prime mortgage lenders allow loans to people with foreclosures or bankruptcies in their credit history. But there are waiting periods, even for those whose fiscal disaster was not their fault. If you don't want to wait, you probably have to go non-prime.

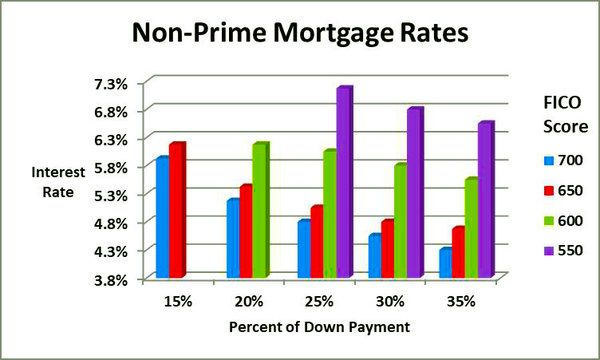

The chart below shows non-prime mortgage rates from a national lender as of this writing.

Non-prime loans for property issues

Sometimes, the problem is not the borrower. It's the property. Mainstream lenders impose some fairly strict guidelines on condominiums they will finance. For instance, no more than 15% of the units can owe past due HOA fees. There are limits to the percentage of units that can be occupied by tenants. So-called "condo-tels," which often operate in resort areas and allow short-term rentals, can't be financed with a QM loan.

There can be limits on lot size (over 10 acres or anything significantly larger than the norm for the area). Buyers may have to get special loans for unusual houses like rammed earth dwellings, log homes (especially kits), tiny homes, dome homes, off-grid anything or even "normal" houses with strange floor plans. For instance, an appraiser might note that anyone desiring to use the only bathroom has to walk through the master bedroom. Or the kitchen might be on the third floor and the dining room an the second. Non-prime mortgage lenders might be more flexible about those issues.

Related: Mortgages for Ugly Houses

Other non-prime loan features

Non-prime loans may have features designed to lower the monthly payment in their early years. What makes them tricky is that eventually, the payment may rise very sharply. Or the loan has a very long repayment period, which reduces the balance at a lower rate and increases the interest cost. These features include:

- Interest-only payments

- Balloon payments

- Terms of 40 years or more

These loans can be right for you if you expect to be able to refinance, sell the property or increase your income before the payment increases.

Interest-only loans allow you to pay just the interest due for several years -- typically five. With a 30-year loan at 4%, the principal and interest payment would be $1,432 per month. The interest-only payment would be just $1,000. But in five years, the balance is still $300,000, and now there are only 25 years left to repay it. The payment jumps to $1,584. Unprepared borrowers may lose their homes.

Balloon mortgages have shorter-than-average terms -- often between five and ten years. However, the lender calculates your payment as though your loan has a 30-year term. At the end of that shorter term, then, you'll still owe a balance. And that entire balance is due -- you need to pay off the loan by selling the home, tapping your savings or refinancing. Why would you choose a balloon mortgage? To get a lower interest rate. If the interest rate isn't lower, there is no reason to take on the added risk of a balloon payment.

Non-prime mortgage rates

Non-prime mortgages are riskier to lenders than QM loans, and so borrowers do pay higher interest rates and fees. How much higher depends on the risk associated with that loan. It's harder to sell a "weird" house in a foreclosure sale if the borrower defaults. Borrowers with low FICOs are more likely to miss payments or default altogether. And condos with a high percentage of renters do end up in foreclosure more often. So expect to pay more for your mortgage if it's riskier to the lender.

Non-prime mortgage rates start higher than QM mortgage rates. And then the lender may adjust them upward depending on the combination of factors that make a loan non-prime. For instance, if you have great credit and qualify for a 4% rate on a bank statement loan, the lender could increase the interest rate or fees if you are buying a non-warrantable condominium, a manufactured home or a ranch. You'll pay more if the property is an investment instead of a primary residence. There can be many, many variables that combine to determine your interest rate with a non-prime mortgage.

This is why it's more important to shop for a non-prime loan than it is for a "regular" mortgage. Rates and terms vary much more widely between non-prime lenders. And they are harder to find and compare. So if you want special treatment, you do have to work for it and pay for it.