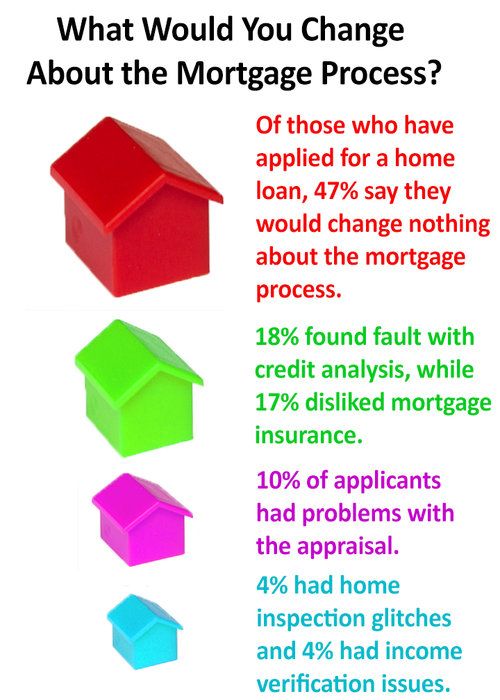

Recent surveys by CNBC and the Consumer Financial Protection Bureau reveal that for borrowers, there is still a lot of confusion and discomfort with the mortgage application process. So HSH.com decided to ask consumers what they'd most like to see changed about the process of applying for a home loan. And here are the responses.

Recent surveys by CNBC and the Consumer Financial Protection Bureau reveal that for borrowers, there is still a lot of confusion and discomfort with the mortgage application process. So HSH.com decided to ask consumers what they'd most like to see changed about the process of applying for a home loan. And here are the responses.

Few applicants deterred by mortgage process

There is good news for home sellers and mortgage lenders -- relatively few consumers say that the mortgage process caused them to miss out on a mortgage.

Just 13% of consumers who applied for or considered applying for a mortgage indicate that processing difficulties kept them from closing. And mortgage analysts at Ellie Mae found that in August 2019, 80% of purchase mortgage applicants successfully closed their mortgages.

So the process seems to be working well for the majority.

Related: What Is Mortgage Preapproval?

Credit analysis most problematic part of mortgage application

Of survey respondents who applied for a home loan, 18% felt that the credit analysis was the most stressful part of the mortgage process. This is understandable because credit approval is not always transparent or predictable. There are several reasons for this:

- Lenders may apply stricter guidelines than the "official" rules supplied by Fannie Mae, Freddie Mac, or government agencies backing FHA, VA and USDA loans. these extra requirements are called "overlays"

- Automated underwriting software (AUS) provides very quick underwriting decisions but is not completely transparent. There isn't a list of rules detailing how it renders a decision based on a unique combination of income, debts, credit, down payment, and assets

- Most lender guidelines allow manual underwriting by human underwriters. And while this permits them to override automated system decisions, it also introduces some uncertainty. Applicants can help their cause when their credit isn't perfect with a well-crafted explanation of the event that damaged their credit, how they recovered from it, and the steps taken to ensure that it doesn't recur

The best way to alleviate anxiety about the credit approval process is to apply before you shop for a home and apply with more than one lender if you think you might experience difficulty.

Related: How to Get Approved for a Mortgage (Factors That Affect Mortgage Approval)

Mortgage insurance not winning popularity contests

For 17% of respondents who had applied for a mortgage, the biggest obstacle was mortgage insurance. This is likely due to two factors: the cost and approval process.

There are two types of mortgage insurance -- private and government. When you have less than 20% down (or home equity if you're refinancing), lenders approve your loan subject to your being able to obtain mortgage insurance. And mortgage insurers insert an additional layer of underwriting.

In addition, the cost of mortgage insurance can vary widely. For those with excellent credit and larger down payments, the addition of mortgage insurance is rather modest. For instance, a $300,000 loan with 15% down and a borrower with a 760 FICO would require mortgage insurance at a cost of $42.15 per month. While the premium for a 97% loan and a 639 FICO would be $465 a month.

If you hate mortgage insurance, it may help to keep a few things in mind. Mortgage insurance allows you to buy a home sooner. If the $300,000 house you want appreciates at a rate of 5% per year, every year that you put off purchasing while saving your down payment adds over $15,000 to the price.

Secondly, if you fall in the more expensive tier for mortgage insurance -- with a small down payment and a lower FICO score -- a government-backed loan might be much cheaper. That's because government-backed loans don't charge more to insure borrowers with lower credit scores.

Related: Types of Mortgage Insurance

Home appraisals can create mortgage roadblocks

For 10% of applicants wishing to buy or refinance a home, the appraisal was the problem. The most common issues with a home appraisal include:

Appraised value: If the appraisal comes in lower than the purchase price, you have a few options: renegotiate the purchase price, challenge the appraisal, start over with a new lender or come in with a larger down payment.

Property condition: If you buy or refinance a fixer-upper, the property may not meet your lender's guidelines. If there is a lot of deferred maintenance, or if health and safety issues are present, your loan options are limited. Explore FHA rehab loans or portfolio products from local lenders.

Unique property: If your property is unique, it can be difficult to value. That's because appraisers rely on sales data from nearby comparable properties to value yours. If your home has unusual features for the area, like a much larger lot, alternative building techniques (log, dome, rammed earth, etc.) or a quirky floor plan, you may have difficulty financing its full value.

Declining values in the area: Standard forms require the appraiser to analyze market values over the last 12 months and determine if they are stable, increasing or declining. If the appraiser checks the "declining" box, your lender may downgrade the appraised value or require you to make a higher down payment

Related: How to Challenge a Low Appraisal

Income verification and home inspections

The other two factors in the mortgage process, income verification and home inspections, only caused problems for four percent of applicants. Income verification is likely to be an issue with self-employed applicants. However, new programs that allow borrowers to use their bank statements instead of tax returns to qualify have alleviated many of those issues.

And home inspections are designed not just to protect the lender -- they protect borrowers as well. If an inspection turns up issues that impact a home's value or livability, you may be unable to close. Options include having the seller correct the problem or to leave money in escrow to correct the issue after closing. Note that you'll have a limited time to take care of the repairs.

Related: The New Non-prime Mortgage (Are These Crazy Programs Right for You?)

The good news: Most applicants are satisfied with the mortgage process

The most popular response, remarkably, was that nothing in the mortgage process needs to be changed. Fully 47% of all respondents who applied for a home loan were satisfied with their experience.

This may surprise anyone who has ever applied for a home loan. In the past, surveys from many sources ranked the stress of getting a mortgage up there with root canals and DMV visits. But improvements in consumer protection laws, disclosure forms and technology, as well as loosening of mortgage credit requirements, have played a large roll in consumer satisfaction with the mortgage process.

Mortgage lenders are approving loans at a high rate. And borrowers with concerns about loan approval have several options, including government-backed and non-prime loans. The best way to remove the stress of the mortgage process is to start early, to get preapproved for your home loan before shopping for a home, and to contact multiple lenders before beginning the application process.