When is the right time to refinance your home? When interest rates fall by 1%? or .5%? What's the magic number?

When is the right time to refinance your home? When interest rates fall by 1%? or .5%? What's the magic number?

Rule for refinancing?

Some finance professionals like to cite rules like "refinance when you can get a rate X percent lower," but basing a decision on a general rule can be costly. How much does it cost to get that low rate? What are the monthly savings? How do you define savings? Will you have the new loan long enough to recoup the cost of refinancing? What is your refinance breakeven period?

It may seem that the time to refinance is when you can get a cheaper rate and lower monthly payments. No doubt lower rates and smaller monthly payments are an attractive combination, but when it comes to refinancing, those benefits alone may not be enough.

Related: How to Save Without Refinancing Your Mortgage

Real life numbers

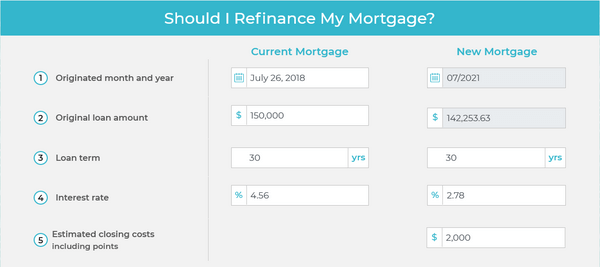

For many borrowers, now is a very good time to consider refinancing. The reason is that interest rates have fallen significantly over the past couple of years. For example, Freddie Mac reported that the average offered rate for a conforming 30-year fixed-rate mortgage in late July 2018 was 4.56%; in the same week in July 2021, that rate had fallen to 2.78%, a substantial reduction.

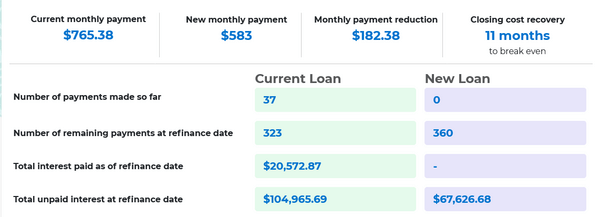

These numbers have real meaning. A $150,000 mortgage at 4.56% comes with a monthly payment of $765.38 for principal and interest over 30 years. Lower the rate on this three-year-old loan to 2.78% and the monthly cost falls to $588. That's a monthly savings of $182.38 a month or $2,188 per year. If it cost $2,000 to refinance, the homeowner would recoup the cost (break even) in about 11 months.

Refinance calculator

How can you determine your breakeven point and see if refinancing is right for you? Try HSH.com's easy-to-use, online mortgage refinance calculator.

First, input the original loan amount, interest rate, and start date of your current loan. The calculator will return your current mortgage balance, how much interest you have paid to date, and how much interest you will pay if you keep the loan for its lifetime.

Next, enter the interest rate available to you today and the calculator shows your current payments, your new payment, and the difference between the two.

Finally, input the cost to close the loan. The calculator then compares your closing cost with your monthly savings and shows how long it will take to recover the expense of new financing. You'll also see that the total interest cost for the new loan ($67,627) is less than the remaining interest cost if you kept the old loan ($104,966).

Understanding the numbers

The calculator shows you the difference in payment between the new and old mortgage. However, it is not enough to only look at the difference in payment. That's because the difference in payment isn't necessarily savings.

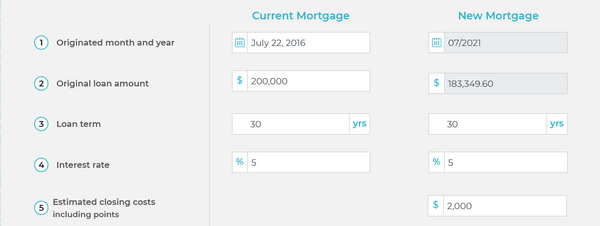

To see how this might be, try the calculator again. Input a $150,000 loan starting 5 years ago with a 5% interest rate. For the new loan, input the same 5% interest rate and a cost of $2,000. Clearly, there should be no benefit to refinancing at the same rate.

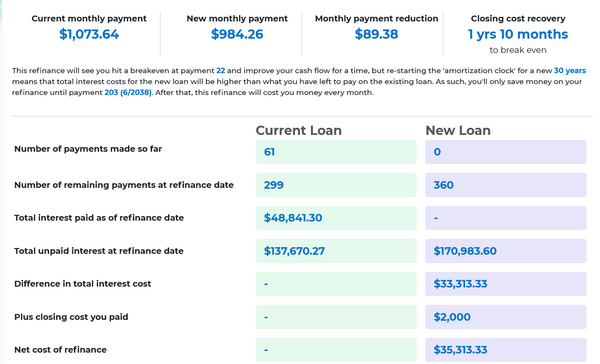

But after you calculate, you'll see a "savings" of $89.38 a month and a breakeven of 1 year and 10 months.

This may seem strange. Don't the numbers show what borrowers need to know? No, because in this case, the "savings" is just the result of taking the remaining balance of a 30-year loan and stretching it out over a new 30-year repayment period. In fact, it would take a total of 35 years to repay the balance after refinancing. And you can see that refinancing increases total interest costs by more than $35,300 compared with not refinancing at all..

In this case, where you refinanced at the same interest rate, you'll get your money back and actually improve your cash flow for the next 203 months before the total interest cost of the new loan overwhelms the "savings" -- after which your refinanced mortgage will cost you more for the next 157 months (13 years). If your goal is actual interest savings, this isn't the way to go.

How can you tell if there are real savings? Compare the total remaining unpaid interest at refinance date between the new and old loan.

Avoid costly loan churning

If you look only at rates and payments, you can be a victim of loan churning or serial refinancing. Those are scams which stick borrowers with needlessly high costs and bigger debts. Or, you may simply pay too much to refinance.

Loan churning is a form of refinancing in which the borrower appears to benefit but does not. For instance, the Smiths have a mortgage at 4.25%. The lender says they can refinance to 3.875%. The new rate is lower than the old one. The payment is lower and the loan broker shows them the "savings" the new loan offers.

Sounds pretty good. However, this refinance costs thousands of dollars and in fact it would take decades to break even. The Smiths might not notice this because the lender allows them to wrap the refinance costs into the new loan. So they don't pay upfront to close the loan, and they do see the lower payment right away. But every time they refinance, they add thousands to their loan balance and years to their repayment.

Loan churning can be avoided by shopping around for rates and terms. However, loan churning is such a serious problem that the VA issued new guidelines in 2018 to protect borrowers. While the new guidelines only apply to qualified veterans seeking to refinance through the VA program, they're actually useful for all borrowers. You should make sure that any refinance delivers the benefit you expect.

Net tangible benefit

The goal is for the borrower to come out ahead as a result of the refinance. This usually means a lower rate and a smaller monthly cost but not always. According to the VA, there can be several acceptable benefits.

- A fixed interest rate which is at least .5% lower than the old fixed rate

- A rate that is at least 2% lower for borrowers switching from a fixed-rate loan to an ARM

- The lower rate is not produced entirely by charging up-front loan discount fees

Seasoning

To prevent loan churning, the VA says the current mortgage must be in place the longer of

- 210 days after making the first payment, or

- after making at least six monthly payments

Fee recoupment

The monthly payment difference must be large enough to cover (recoup) all loan costs within 36 months. "Loan costs" in this case mean all fees, closing costs, and expenses. Such expenses as taxes, escrow, insurance, and assessments are not "loan costs" because they do not go to the lender. You may be able to live with a longer refinance breakeven period if you plan to keep your mortgage for many years.

Related: What Does a Refinance Cost?

Refinance breakeven

The concept of refinance breakeven applies in other ways. For instance, if you can lower your mortgage rate today that may be very attractive. However, if you're moving next summer you may not own the property long enough to recover refinancing costs. When it comes to refinancing, it's all about the intersection of interest rates, mortgage costs and the time frame over which you expect to be holding the new mortgage.

For more information speak with loan officers and try various refinancing options on the loan calculator.

Compare mortgage refinance offers now

This article was revised by Keith Gumbinger.