December 28, 2017: “Tax reform in NJ: Should you buy a house and other pocketbook questions”, an Asbury Park Press review of 2018 tax law changes by Michael L. Diamond included an outlook from Keith Gumbinger, HSH.com’s vice president:

What will happen to interest rates?

Why we ask: The tax law could add to the deficit and add to economic growth, both of which could cause interest rates to rise, making it more expensive to borrow money.

The Fed is expected to gradually raise rates three more times in 2018, which would affect loans such as home-equity lines of credit and credit cards, said Keith Gumbinger, vice president of HSH.com, which tracks rates.

The U.S. also might need to issue more debt and offer higher returns to pay for the tax cuts, which could lead to higher interest rates, he said. But Gumbinger doesn’t expect a sudden spike in rates. “The general pressure for higher rates does seem to be forming and becoming somewhat more durable,” he said. “You’re going to pay a little bit more in ’18 than ’17.”

December 19, 2017: “Lenders warm up to first-time, struggling buyers”, a CentralJersey.com syndicated feature by Marilyn Kennedy Melia included a review of market conditions from Keith Gumbinger, HSH.com’s VP:

More mortgages requiring a down payment of just 3 percent of a home’s purchase price will be made, as well as loans to people with lower credit scores – 620 and higher –forecast the lenders, surveyed by Genworth Mortgage Insurance.

“While these loans are in fact widely available, not all potential homebuyers and borrowers are aware of them,” says John Clifford, Genworth senior vice president.

Still, a different hurdle, “actually finding that home,” still will prevail in 2018, says Keith Gumbinger, of mortgage data site HSH.com. “There’s just not a big inventory of homes on the market.”

Moreover, while a borrower with a credit score between 580 and 620 might be able to receive an FHA-insured mortgage, “some lenders are leery of making these,” Gumbinger says.

Borrowers may want to shop a couple of different banks and/or mortgage brokers to see what they might qualify for – and the rate and fees on the loans. “Rates are higher when credit scores are lower,” Gumbinger says. “While a borrower with a 740 credit score might qualify for a four percent loan, someone with a 680 score might pay 4.5 percent.”

December 22, 2017: “Four Ways To Make The Most Of Your Mortgage”, a Forbes item from Marcus Arkan included some data from HSH.com:

Since a mortgage is leveraged against real estate, interest rates tend to be lower than other loans available to consumers. According to HSH.com, a trusted mortgage resource, in mid-2016 the average interest on mortgage loans was below 3.7%. Compare that to credit cards, where the national average APR is approximately 16%, and it’s difficult not to see the immediate benefit.

November 30, 2017: "How to Shop for a Continuing Care Retirement Community", a Kiplinger's Personal Finance excerpt about senior finances by Patricia Mertz Esswein and Eileen Ambrose included a bit of advice from HSH.com vice president Keith Gumbinger:

If you don’t have a credit line, set one up months before applying to a CCRC, says Keith Gumbinger, vice president at mortgage research firm HSH.com. Banks are less likely to extend a credit line if they expect the homeowner to repay the debt within two or three years, he says.

November 28, 2017: “Fannie, Freddie to up loan limits by $43,500 in most of Bay Area next year”, a San Francisco Chronicle update on changing market conditions by Kathleen Pender included some context from Keith Gumbinger, HSH.com’s vice president:

More importantly, borrowers can get a Fannie or Freddie loan with as little as 5 percent down. In the jumbo market, “theoretically you can find (a loan with) 10 percent down, but 20 percent is more commonplace,” said Keith Gumbinger, a vice president with mortgage website HSH.com.

Also, Fannie and Freddie will guarantee loans with FICO scores as low as 620. In the jumbo market, some lenders will accept scores in the low 700s but most want 740 to 760, Gumbinger said.

And Gumbinger says the higher limits will give Fannie and Freddie a bigger market share at a time when Congress wants to reduce their footprint.

November 1, 2017: “7 clever ways to cut the costs of buying your first home”, an Atlanta Journal Constitution review of homebuying conditions by Rose Kennedy included some advice from HSH.com vice president Keith Gumbinger:

One key factor: your credit score. According to Kiplinger, a score of 740 or higher will set you up to obtain the best interest rates. Check your credit report months – or even years – before you’re sold on the idea of buying your first home, giving yourself plenty of time to boost your score. “What you don’t want is to have to address a bunch of mistakes on your credit report while actively looking for a home and trying to get approved for a mortgage loan,” HSH.com vice president Keith Gumbinger told Kiplinger.

Choose a home where you could stay five to seven years. “You’re going to spend thousands of dollars to get into the home. To get out of it is going to be equally expensive and may possibly cost more when you do it in less than five years or in a down market,” Keith Gumbinger, vice-president of HSH.com, told Kiplinger.

November 2017: “Best Financial Services at Warehouse Clubs”, a Kiplinger review of financial service offers by Lisa Gerstner included some mortgage-shopping advice from HSH.com VP Keith Gumbinger:

It’s worth your while to request quotes from lenders through Costco, but you’ll want to compare the interest rate and overall package of fees with those from other lenders. To search for the best deal, shop among local lenders, too. “Keep in mind that fees are fungible—just because fees A ,B, C and D are capped doesn’t mean that legitimate costs aren’t being made up elsewhere in the transaction,” says Keith Gumbinger, of mortgage-tracking site HSH.com.

September 13, 2017: “Local home prices still struggling to recover from housing crash”, a Bakersfield Californian review of local housing market conditions by Steven Mayer included expertise contributed by HSH.com vice president Keith Gumbinger:

Not only have home prices in Bakersfield not fully recovered from the declines suffered during that national crisis, Bakersfield is the second-least recovered metro area on a list of 100 major metro areas across the nation, according to HSH.com’s home price recovery index.

It’s not an ideal place to be, said HSH.com Vice President Keith Gumbinger. But it’s also not as dire as it sounds.

Even in metro areas like Bakersfield that remain well below their boom-year price peaks, homeowners have seen significant price recoveries since hitting their bottom values, Gumbinger said.

And single-family home prices in some areas were inflated to such a degree that even when they return to a “normal” value they may still be below their previous price peak.

August 7, 2017: “A Mortgage Mystery: What Happens to ARMs When Libor Goes Away?”, a Wall Street Journal forward-looking analysis by Christina Rexrode included a quip from HSH.com vice president Keith Gumbinger:

Global investors could also balk at that substitute, preferring something less dependent on the whims of the U.S. central bank, said Keith Gumbinger, vice president of the mortgage information website HSH.com.

Having an outside group mandate a new reference index for ARMs could also help to quell concerns that banks could use a switch to reap more profit from customers.

August 2, 2017: ” Some cash-out refinance tips for homeowners”, a nationally-syndicated column by Ellen James Martin included some comments from HSH.com VP Keith Gumbinger:

“Expect to jump through more credit hoops than you did when you first bought your house years ago,” says Keith Gumbinger, a vice president at HSH Associates (hsh.com), which tracks mortgage rates throughout the country.

Prudent borrowers closely examine their credit reports before applying for a home loan, Gumbinger says. Under federal law, each year you’re entitled to one free credit report from each of the three largest credit bureaus: Equifax, Experian, and TransUnion. Just go to this website: annualcreditreport.com.

“Now as much as ever, people with low FICO scores are punished and may have trouble getting a mortgage at any interest rate. But people in the 700s and above are rewarded with the best rates available in the market,” Gumbinger says.

August 2, 2017: “Are 40-Year Mortgages Really a Thing?”, a NerdWallet consumer piece by Marilyn Lewis included calculations and context from Keith Gumbinger, HSH.com vice president:

For another, when a mortgage is stretched over 40 years, it takes longer to build equity in a home. That increases the odds that real-estate prices could drop, leaving you owing more on the mortgage than the home is worth. To cover that risk, 40-year lenders charge a slightly higher interest rate, says Keith Gumbinger, vice president of HSH.com, a mortgage information company.

July 31, 2017: “The $9,000 tab that surprises homeowners”, a CNBC consumer advisory from Kelli B. Grant included some additional context from HSH.com vice president Keith Gumbinger:

Ask the seller to see copies of the property’s recent utility bills — and not just the electric bill.

“If you’ve been renting, you probably never saw a water or sewer bill,” said Keith Gumbinger, vice president at mortgage site HSH.com. “You might not have budgeted for that.”

Anticipate future costs, too, Gumbinger said. Check to see if there’s a property tax hike or revaluation going into effect, if the local utility providers have announced rate changes, or the condo or co-op board is proposing a maintenance fee increase.

Leave a buffer in your savings and budget for home maintenance costs. New homeowners tend to have a slew of unexpected expenses at the outset that can add up quickly, said Gumbinger — like realizing that now you need either a lawn mower or a lawn-care service to handle your yard.

“There’s an upcycling of purchasing stuff for the house, that tends to be more than you’d expect,” he said.

July 17, 2017: “Almost half of Americans have buyer’s remorse about their house”, a NerdWallet discussion of homebuyer regrets by Abigail Summerville included some comments from Keith Gumbinger, HSH.com VP:

While many homeowners have regrets, it’s hard to pinpoint where exactly they went wrong during the buying process, said Keith Gumbinger, vice president of HSH.com, one of the nation’s largest publishers of mortgage and consumer loan information.

“So many variables go into the decision-making” of buying a home. “It’s hard to specifically say, ‘Wow, I should’ve done A or should’ve done B,'” Gumbinger said.

June 28, 2017: “7 first-time homebuyer mistakes to avoid”, a CNN/Money article picked up by the Denver Channel included advice from Keith T. Gumbinger, HSH.com’s vice president:

Getting pre-approved for a mortgage serves two important purposes: First, it gives you a realistic understanding of how much you can spend on the house. Second, it shows sellers that you’re serious and gives you slightly more standing if you’re competing for homes with all-cash buyers.

Make it less stressful by gathering up relevant financial documents like bank statements, tax returns, and pay stubs, and by checking your credit report for errors in advance. “Given the competitive interest rate environment and the competitive housing market, it’s a good idea to be prepared and organized before you start the process,” says Keith Gumbinger, vice president of HSH.com.

June 26, 2017: “4 costs you haven’t factored into your homebuying budget”, a CNN Money piece on the costs of buying and owning a home by Beth Braverman included a quote from HSH.com VP Keith Gumbinger:

“Once you’re done with all the fees and the deposits for reserves, you may end up bringing many more thousands of dollars than you thought to the closing,” says Keith Gumbinger, vice president of HSH.com.

June 23, 2017: “Do You Earn Enough to Buy a Home?”, a New York Times national look at home costs and salary requirements by Michael Kolomatsky included research and data provided by HSH.com

June 22, 2017: “Have a Bad Credit Score? It Could Soon Get Better – but Is It Enough to Buy a Home?” a Realtor.com review of changing credit conditions by Daniel Bortz included some color from Keith Gumbinger, HSH.com’s VP:

How will this affect home buyers overall?

While 11 million consumers stand to receive a modest boost of up to 20 points to their credit score, the policy change might not be enough for all of them to qualify for a mortgage, says Keith Gumbinger, vice president at HSH.com, a mortgage information website.

“A lot of people who have liens or judgments against them already have crummy credit to begin with,” says Gumbinger. Thus, “a 10- or 20-point increase isn’t going to make a difference for a lot of borrowers.” Moreover, some tax liens and civil judgments already meet the new reporting requirements. If that applies to you, your credit report isn’t going to improve—or if it did and you really are responsible for those black marks, they could reappear later once your accusers get the extra info they need.

Those who stand to benefit the most from the policy change, says Gumbinger, are borrowers who are on the cusp of qualifying for a home loan. For example, if you have a 570 credit score and receive a 10-point boost because tax liens or civil judgments are removed from your credit report, you might be able to qualify for an FHA loan, which requires a minimum 580 credit score. But the bad news for these consumers is that reporting agencies can refile tax lien and civil judgments to meet the new standards. In other words, “people’s tax liens and civil judgments may disappear temporarily, but many of them are going to come back again,” says Gumbinger.

June 14, 2017: “How Trump Plan Would Ease Mortgage-Lending Rules”, a Consumer Reports market advisory by Tobie Stanger included a bit of analysis from HSH.com VP Keith Gumbinger:

“Right now, private lenders are at a disadvantage compared with their competitor, the federal government,” says Keith Gumbinger, vice president of HSH Associates, a mortgage information website headquartered in Riverdale, N.J. The change, he adds, could allow more borrowers to get bank loans.

Gumbinger, the mortgage information expert, acknowledges the risks and benefits of loosening regulations for borrowers and lenders.

“Any time you expand a definition of what’s qualified, there could be some enhanced risk,” he notes. “But with Fannie Mae’s changes, the market is adopting a higher level of debt already.

“These individualized tweaks that allow lenders to go after certain reasonable niche audiences is not a bad thing,” he continues. “What we have to avoid is the layering of risk like we had before: a subprime borrower with no down payment and alternative income stream.”

May 26, 2017: “Affording a home in Atlanta”, an Atlanta Journal-Constituion review of local housing costs included data provided by HSH.com

May 24, 2017: “It’s getting more expensive to own a home in New York: study”, a New York Post discussion of housing market conditions by David K. Li featured some commentary from Keith T. Gumbinger, HSH.com’s vice president:

HSH vice president Keith Gumbinger speculated that first-quarter bump could have been driven by the region’s mild winter, which brought more buyers to the market than usual.

“But there are opportunities out there. There’s a 30-mile window (around New York where) you can find some fairly reasonable responses (for home purchase).”

HSH’s affordability index is based on a region’s median-priced property, with a 20 percent down payment and 28 percent of a buyer’s gross income going to the mortgage and home insurance.

“No doubt living in any major metropolitan area is going to be expensive,” Gumbinger said.

“But there are opportunities. The question is, can you deal with the commute?”

May 17, 2017: “4 Things You Need to Know About Moving After You Retire”, a Money article by Elizabeth O’Brien reviewing homeonwership choices for retirees included some commentary from HSH.com VP Keith Gumbinger:

Buy or rent? Generally speaking, you are likely to at least break even on moving, acquisition, and selling costs if you stay in a home for five years, says Keith Gumbinger, a vice president at mortgage-information website HSH.

May 9, 2017: “Home Buyers’ Top Mortgage Fears: Which One Scares You?”, a Realtor.com article by Daniel Bortz included some soothing words for fearful potential homebuyers from Keith Gumbinger, HSH.com’s VP:

Fear No. 1: Not having enough money for a down payment

Being able to assemble a down payment is often the most daunting concern among home buyers, says Keith Gumbinger, vice president of mortgage research site HSH.com. But that’s largely because a lot of home buyers think they absolutely need to fork over a 20% down payment to get approved for a mortgage, which isn’t the case.

[…]

You should also bear in mind that credit is just one factor that affects the strength of your loan application, says Gumbinger. In fact, “for most home buyers, your credit score is going to determine whether you’re able to get a great interest rate,” says Gumbinger, “not whether you qualify for a loan.”

May 5, 2017: “5 Smart Ways to Put Your Home Equity to Work”, a Fiscal Times consumer advisory piece by Beth Braverman that included some cautionary words from HSH.com vice president Keith Gumbinger:

Tapping into that equity can be tempting, but as the housing bust of mid-2000s taught us, it’s also risky. “Frivolous purchases and things of that nature are great, but you should find a way to do them without borrowing from the equity in your home,” says Keith Gumbinger, vice president of mortgage information web site HSH.com.

April 23, 2017: “Cheaper Mortgages Could Spur Housing Market”, a Wall Street Journal market update by Laura Kusisto that included some context from Keith Gumbinger, vice president of HSH.com:

“Almost the entirety of the Trump bump [to mortgage rates] has been washed away,” said Keith Gumbinger, a vice president at HSH.com, a mortgage-information website.

That, in turn, could spur the housing market, economists said. A decline in mortgage rates can reduce monthly mortgage payments or allow buyers to purchase more expensive homes than they otherwise could afford.

Economists said a surge of additional buyers this spring wouldn’t be entirely welcome. “It’s driving more demand into a market that doesn’t have much in the way of supply,” Mr. Gumbinger said.

April 20, 2017:“How to use this new formula to boost your credit score” , a CNBC.com outline by Kelli B. Grant included a snippet of advice from Keith Gumbinger, HSH.com VP:

Do check your score regularly, and pay attention to takeaways provided that tell you why your score is what it is. Be cautious about making major changes ahead of a big purchase, like a home or car, said Keith Gumbinger, vice president at mortgage site HSH.com.

April 19, 2017: “Local Mortgage Stories for Today’s Home Buyers”, a National Center for Business Journalism advisory for writers by Dorianne Perrucci suggested that reporters and writers contact HSH.com VP Keith Gumbinger for mortgage analysis and more:

Reporter’s Resources

• Bankrate.com and HSH.com update loan rates daily and offer mortgage calculators, in addition to mortgage news and analysis. Greg McBride at Bankrate and Keith Gumbinger at HSH can provide expert commentary on mortgage news and trends.

April 13, 2017: “If you only lost $30,000 to these money mistakes, count yourself lucky”, a CNBC.com consumer update by Kelli B. Grant featured some clarity provided by Keith Gumbinger, HSH.com’s vice president:

Most people have a sense of whether their credit is good or bad, but what often surprises them is that there are break points, or buckets, where pricing changes, said Keith Gumbinger, vice president at mortgage site HSH.com.

“It’s not as though you can’t get a mortgage if your credit score isn’t fantastic, but the cost of your credit is almost certainly going to be higher,” he said.

April 2, 2017: “Mortgages Today”, a NAR Real Estate Today Radio interview with HSH.com Vp Keith Gumbinger. Click the link to listen.

March 21, 2017: “The Comprehensive Guide to an Early Retirement”, a Money advisory piece by Elizabeth O’Brien included some context from HSH.com vice president Keith Gumbinger:

Cut Your Housing Costs

Consider a hypothetical family in the Minneapolis area, where prices are in line with the U.S. average. They would save more than $50,000 over 10 years by staying in a starter home vs. upgrading to one 30% bigger, according to Keith Gumbinger, a vice president at mortgage-information website HSH. That estimate includes mortgage, property tax, insurance, and utility and maintenance costs.

HSH and other firms offer online calculators to help you determine the maximum mortgage you can swing based on your income and other financial details. But “you don’t have to borrow the max,” Gumbinger says. If you are looking to power-save, keep your housing spending to 30% or less of income, he says.

March 20, 2017: “Detroit Market Among Short List Of Affordable Housing”, a CBS News/Detroit local market update by Scott Ryan included a discussion with Keith Gumbinger, HSH.com’s VP:

Mortgage expert Keith Gumbinger says the rust belt’s identity has changed for the better — reinventing the area as a hub for technology.

“In Detroit, you guys had a rebirth of downtown is what I’m lead to believe, I’m seeing that there’s more automotive jobs coming back in again,” he says.

Noting that ‘boom and bust’ real estate cycles don’t do much for the typical homeowner, Gumbinger says real benefits come in the form of slow, steady market growth over many years.

“A lot of those market places suffered from population losses, from 1980s into the ’90s — earlier in the last decade – you’ve had a lot of the population in exodus which opened up a lot of available housing stock, and that helps to keep homes more affordable,” says Gumbinger.

He says in Detroit, you have to consider the Dan Gilbert factor: Buying downtown buildings and bringing jobs into the city.

“It’s the type of thing you want to do — you want to buy low … and sell high but in order for it to get high you’ve actually got to put in the time, put in the infrastructure – put the investments in and go after the factors that will support making a city a metro-business great and obviously Dan Gilbert has done a great job,” says Gumbinger.

March 16, 2017: “Wedding or new home? How to pay for both”, a CNBC spring advisory by Kelli B. Grant featured some advice from HSH.com VP Keith Gumbinger:

Nearly half of couples end up spending more than they planned to on their wedding, according to The Knot. That can have consequences for your home purchase if the purchase overlaps with your engagement or occurs shortly after the wedding.

“Your mortgage qualification is going to be largely based on your income, and your credit,” said Keith Gumbinger, vice president at mortgage site HSH.com. “The last thing you want to do is disturb your credit in any way.”

March 2017: “Protect yourself from rising interest rates”, an AARP Bulletin market conditions update by Eileen Ambrose included some advice provided by Keith Gumbinger, HSH.com’s vice president:

Mortgages

Inflation and the economy have more impact on fixed-rate mortgages — the most common type of mortgage — than Fed action, says Keith Gumbinger, vice president with HSH.com, a mortgage information site. Rates may rise if the economy continues to improve and inflation heats up, he says.

Tip: If buying a house, consider an adjustable rate mortgage (ARM) with a fixed rate for five years, Gumbinger says. ARMs have been out of favor, but now are one percentage point less than a 30-year fixed loan. Be aware, the rate can rise in five years.

Home equity lines of credit

Within three months after the Fed raises its rate, people will see a bump in the rate — and in their payments — on an outstanding line of credit, Gumbinger says.

Tip: Borrowers usually pay only monthly interest on the sum borrowed for the first 10 years, and then must start repaying principal. If bigger repayments will be a problem, contact the lender to explore your options, Gumbinger says.

March 16, 2017: “What the Fed rate hike means for homebuyers”, a CNN/Money analysis of changing market conditions by Kathryn Vasel helped consumers understand these impacts with some color and context from Keith Gumbinger, HSH.com’s VP:

But Wednesday’s hike was widely expected, meaning the markets had already priced it in. So many experts don’t see rates moving much higher in the coming weeks.

“The last couple of times the Fed made a move, the rates firmed up in advance of the decision, and when it happened they kind of faded,” said Keith Gumbinger , vice president of HSH.com.

And it’s not just the Fed that can influence mortgage rates.

“The global economic picture is a little warmer and things are pretty good. Markets aren’t just reacting to what the Fed is doing, but the prospects of the rest of the world as well,” said Gumbinger.

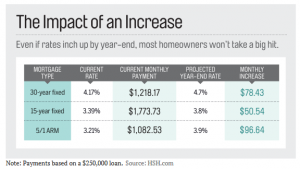

March 14, 2017: “Mortgage Rates Are Set to Jump”, a Money consumer cost advisory by Beth Braverman included some payment calculations and mortgage rates projections from Keith Gumbinger, vice president of HSH.com.

March 7, 2017: The Housing Markets That Will Consume The Most, Least Of Your Salary”, a Financial Advisor Magazine extract of popular HSH.com content by Karen DeMasters included calculations and analysis from HSH.com for the five most and least housing expensive markets in our latest market report.

February 07, 2017: “How to Improve Your Credit Score”, a Consumer Reports consumer advisory by Beth Braverman included some expertise from Keith Gumbinger, HSH.com’s vice president:

“Some credit scoring models are now shifting to “trending data,” which look at your credit patterns over time. That minimizes the impact of one-time events, but it also means that it may take longer for better habits to start to make a significant difference when you try to improve your credit score. “Delinquencies or late payments take time to work their way into the report,” says Keith Gumbinger of HSH Associates, a company that analyzes consumer debt markets.”

February 4, 2017: “Take the Stress Out of Applying for Your Mortgage”, a syndicated SmartMoves column by Ellen James Martin included tips and hints from Keith Gumbinger, HSH.com’s vice president:

"With so many moving parts, the process is nerve-racking for many folks not in the finance field. First, you’re under pressure to gather all your personal financial information. Then you worry your loan could fall through, which could cost you the chance to acquire your dream home," says Keith Gumbinger, a vice president at HSH Associates, which tracks mortgage markets throughout the country.

"Rates have been very volatile in recent weeks and could be more so as 2017 progresses," says Gumbinger, who’s worked as a mortgage market analyst since 1984.

There are many puzzling twists and turns, especially with adjustable loans. That’s why it’s critical you know what you’re getting into before you commit to any mortgage product, fixed or adjustable," Gumbinger says.

He says that both first-time buyers and those with more experience need as much lead time as possible to educate themselves on mortgage basics, to cull through alternative home loan choices, and to compare lenders and rates.

Gumbinger says real estate agents are usually a good bet for sound advice on finding a qualified lender. But he says you should look well beyond the suggestions of agents.

"For referrals, I recommend you use what I call the Satisfied Customer Index, also known as friends and family," he says.

"Well before you’re ready to apply for a loan, you can bring the whole mortgage picture into much clearer focus by supplying basic documents related to your financial life," Gumbinger says.

January 26, 2017: ” Mortgage Rates Break Out of Downward Cycle”, an MReport market update by Timothy McNally included some context provided by Keith Gumbinger, HSH.com’s VP:

The movement in the rate should not be taken as sign of a continual trend, as the ongoing volatility will likely continue for some time. “Rates have been rather volatile since November, and such moves are not that unusual,” noted HSH.com VP Keith Gumbinger.

Gumbinger goes on to state that “it’s a reasonable bet that headlines of higher mortgage rates won’t be exactly welcomed by homebuyers or homeowners looking to refinance,” but he doesn’t think that the increase in the rate will have a meaningful effect on borrowers who are in the process of buying a home, as the costs incurred due to the increase are rather minimal.

January 20, 2017: “How Much Does It Cost to Sell a House? Here’s a Reality Check”, a a Realtor.com home seller update by Cathie Ericson saw HSH.com’s VP Keith Gumbinger add some valuable information:

“While buyers tend to pay more in closing costs, sellers aren’t completely off the hook. You can expect to spend an additional 2% of your home’s price on this expense”, says Keith Gumbinger, vice president at mortgage information resource HSH.com.

He added that “Closing costs tend to be fixed, including transfer taxes, escrow expenses, and notary fees. You’ll also pay at closing any outstanding property taxes, a prorated share of the water and sewage bills, and the remainder of your mortgage.”

January 12, 2017: “Are Mortgage Rates Back on a Downward Trend?”, an MReport review of mortgage rate trends by Brian Honea featured a review and outlook for mortgage rates Keith Gumbinger, HSH.com’s vice president:

Keith Gumbinger, VP of HSH.com, stated, “The small decline was consistent with my overall expectations. I think we are probably close to the bottom of a working range at the moment with limited additional downside for rates unless we start to see some economic softening (whether here or abroad). It seems to me that the recent decline may be reflective of a lessening of the investor exuberance that occurred post-election, as the difficulty of effecting meaningful change in a fractious political environment may be starting to be seen.”

Back to HSH.com in the News — 2016