Two-Month Forecast For Mortgage Rates - February 9, 2018

Preface

A long period of relative quiet for markets and mortgage rates has given way to a confluence of volatility in early 2018. A number of trends and specific events have come together and collectively unnerved financial markets; at this writing, investors seem to be scurrying in all directions, unsure of where to go or how to behave.

In recent weeks has come additional evidence that the economy is solidifying and perhaps accelerating to levels above its "potential", or ability to grow without throwing off inflationary concerns. In recent years, this has become associated with a annual GDP of perhaps 2.6 percent or so, and for a long stretch, annual growth had been running below this level, helping to promote a sense of calm. Faster growth could bring faster inflation, and an accelerated rate of policy change by the Federal Reserve. Such a happenstance isn't problematic per se, provided it is properly hedged and prepared for.

With GDP growth running at better than a 3% clip for two quarters, and then sporting only a slight deceleration in the fourth quarter to an initial estimate of 2.6 percent, and with core PCE inflation (the Fed's preferred measure) rising to nearly the Fed's desired 2% mark, investors have been eagerly searching inbound data for clues that above-trend growth was beginning to move the inflation needle. At least an inkling of that evidence came in the employment report for January, where wage growth legged higher to an annual 2.9 percent, the strongest since 2009, and there appears to have been an acceleration here in the last few months.

Amidst all the other items moving the market -- strengthening global growth, diminishing central bank stimulus, rising short-term rates, changes to U.S. tax policy, increased U.S. debt issuance and more -- this was enough to tip markets over, sparking a global stock market rout that may yet turn into a larger correction. Concerns about inflation returning has driven influential 10-year Treasury yields to multi-year highs, with related concern about a more-aggressive Fed tightening policy more quickly sending equities into a tailspin.

The housing market is already struggling to maintain traction, dealing with the challenges of a limited supply of existing residential properties available to purchase, a slow pace of adding new stock, rising home prices and mounting affordability difficulties. Now at the start of the traditional spring homebuying season, that higher mortgage rates are here isn't exactly unexpected, but certainly not exactly welcome, either.

Recap

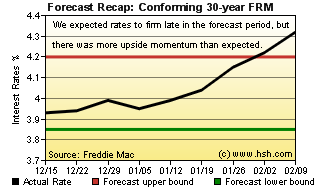

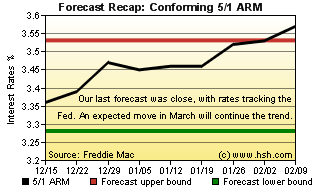

For the most part, our instincts about the direction for mortgage rates coming out of the end of 2017 was pretty good. In the last forecast, we noted that we thought that interest rates would be firming, with fixed rates crossing the 4 percent mark in the weeks after the December Fed meeting, and that this firmness might persist due to the Fed's balance sheet trimming being joined by the European Central Bank's chopping of its QE program. That appeared to be right on the money, with only the early February rout in markets driving rates to levels above our expected ranges. Back in December, we thought that the average conforming 30-year FRM as reported by Freddie Mac would hold in a range of 3.85% to 4.20%; the market presented us with 3.93% and 4.32% borders. At the time, we also expected the Hybrid 5/1 ARM to wander between fences of 2.38% and 3.53%, so the 3.36% bottom and 3.57% pairing were a solid call. We'll call the last forecast "pretty close" overall.

Forecast Discussion

Despite reliably solid figures, we seem to somehow be in an uncertain economic climate, or at least one with conditions rather foreign to a lot (if not all) investors. First, we're closing in on the second longest U.S. expansion on record; longevity itself is not the issue, but this long, mild period of growth has been marked by a lack of worrisome imbalances, and one where policy makers have tended to try to err on the side of caution. Even inflation lower than desired has been more of a central bank problem than one for the average man on the street, who sees prices in a very different manner than those observed from a macroeconomic perspective. We are now in what was considered perhaps the middle of a tightening cycle by the Fed, given that the so-called "neutral" rate for federal funds is currently thought to be perhaps 3 percent of so. Stronger, more persistent growth and/or inflation would tend to move that number higher, but messaging from the Fed in recent years certainly hasn't prepared investors for this possibility, let alone the prospects for a faster pace of rate increases to get us there.

But things are changing. Even if they it is not yet at troublesome levels that might require a stronger policy response, no one could rightfully expect that inflation would remain benign forever. As well, with major economies across the globe performing more in sync, no one could rightfully expect that QE-style programs would remain in place forever. However, with the steadying hand of central banks lightening, markets have become a bit like someone learning to ride a bicycle for the first time, with the rider rather unstable and wobbly as the support wanes. At some point, the rider must learn to balance and pedal on his own; perhaps not yet at this point, but soon, and there are likely to be more episodes of unsteadiness at times as this process continues. It could be said that one such episode was 2013's "taper tantrum", where the prospect of running without support terrified the markets; that's less the case today, but perhaps is still unnerving.

To be sure, stock markets will do what stock markets do. They often wax and wane, get too far ahead, fall back, regroup and power on after a fashion. In fact, selloffs in stock markets can be good news for bond markets, as investors look for places to park cash until waters calm, driving prices up and yields down.

Unfortunately, the stock market's vacillations don't much change the key fundamentals underpinning the rise in interest rates, which believe it or not has essentially been in place for more than 20 weeks now, with rates generally edging higher over that time, if often in a backing-and-filling pattern. Even with a modest easing (so far, revisions to come) in the fourth quarter, economic growth is fundamentally strong, and will perhaps be enhanced with the effect of tax reform just starting to show. Inflation has begun moving higher, with 2017's decline fading behind us; central banks around the world have begun to raise interest rates (i.e. U.S., Canada, England), or are curtailing QE-style programs (ECB, Bank of Japan) and the Fed has accelerated its balance sheet runoff in January, and is set to do so again in April, then July, then October, when it will remain in "full" runoff mode for an indeterminate period.

With actions by the Fed pushing bonds into the market on an increasing basis, January also saw more supply become available as ECB's bond-buying program was cut in half during the month. Expected to run until at least September, there is a chance that the program may come to a halt sooner, something investors weren't planning on. In addition to this, but perhaps worse (at least in terms of timing) came the Treasury's January quarterly refunding announcement, where it was revealed that billions more in new bond supply than expected would be released starting in February. With more bonds available but no seeming commensurate pick up in investor demand, yields and interest rates had no choice but to rise.

These interest-rate influencing fundamentals -- stronger economic growth, firming inflation, bond supply and demand, Fed policy -- aren't much affected by what happens with stocks, at least not on a lasting basis. With this group all in place and agreement at the moment, it is hard to expect that mortgage or other interest rates have much space to decline, and not during the next nine week period.

Forecast

The likelihood of lower mortgage rates between now and April 20 isn't non-existent, but the prospects for a meaningful decline are slim. Soothing words from new Fed chair Jay Powell, a softer inflation report or two, a softening of consumer sentiment or a more durable decline in equity prices might bring a dip here or there over this time, but more likely is that mortgage rates remain on an upward path. As such, the real question is "How far will they go?"

The answer to that depends upon whether or not the recent rise to today's levels was the bulk of the potential increase this economic and market climate can support, or if it is only a portion of a much larger upward move. For our part, we think that it is a portion of an increase that still has some room yet to run. Also, and although we're not yet convinced of it, futures market still place a high probability of a lift in the federal funds rate in March, but a lot can happen between now and then, and a more persistently volatile market environment may give the Fed temporary pause. However, crucial to this will be whether or not the February employment report shows another move up in wages, which spurred on the bond market rout.

Over the next nine weeks, we think homebuyers should prepare for somewhat higher mortgage rates. For the average conforming 30-year FRM as reported by Freddie Mac, we think we'll see a range of rates from 4.20 percent to 4.52 percent. For conforming hybrid 5/1 ARMs, much depends on whether or not the Fed raises rates in March, but we think that fences of 3.46 percent and 3.88 percent should contain the most popular ARM.

On a cold day in mid-winter its nice to think that spring will be fully a month old when we next return to contemplate the next mid-term path for mortgage rates. After you file your taxes, stop back and see how we did with a bold forecast at a difficult time.

For interim forecast updates and market commentary, see our weekly MarketTrends newsletter.