June 12, 2020

Preface

The economy is in perhaps its worst and most precarious position since the Great Depression (or certainly post-World War II). The wide-ranging COVID-19-related shutdowns are loosening, more quickly in some places than others, and there are starting to be signals that economic activity is beginning to return and the worst of the downturn passing. What comes next remains an open question, one with no simple or knowable answers; we don't know how quickly the resumption of business might occur, how strong the upturn might be or how durable it will turn out. This will of course occur with the ever-present background of a still-spreading virus that has only limited treatment available and still no vaccine or cure in sight. It's too early to tell if resumption of activity will result in new outbreaks, and should they occur, whether or not a return to partial or even wide-ranging lockdown will be the outcome.

Certainly, there have been pandemics before, with large scale outbreaks in the 19-teens, in the 1950s and 1960s (and even in 2009). While they all exacted a terrible toll on lives and activity (as did other significant diseases of their days), none of them caused a wholesale shutdown of any economy, so our experience in what may come will be unique. We do know that the experiment of reopening at varying speeds and with varying controls is underway, but the outcome remains uncertain. As we move forward, and although there is a good chance that there will be an increase in incidence of disease, we must keep in mind that the goal for shutting things down and other social isolating measures was only to ensure that medical systems did not become overwhelmed, not to prevent any potential spread of the disease. Some semblance of balance between wholesale economic closure and reasonable risk-taking and precaution needs to be achieved, but where that lies is unclear.

While the Federal Reserve and then the Congress acted with great speed and vigor in looking to support the economy, there's really little more that the Fed is prepared to do at the moment. Rather, it may rely on forward guidance or even yield curve manipulation to help the market understand its intentions for policy. For Congress' part, partisan spats have prevented (so far) what is expected to be another round of fiscal stimulus of trillions more of future taxpayer dollars, but with this being an election year something will likely get done, and probably before summer recess for the body kicks in. The question there, of course, is "what form will it take?", "where does the money go?" and "who is actually helped by it?" Unfortunately, these are just more questions with opaque answers, but will help dictate how or perhaps whether the nascent rebound proceeds.

Recap

After wicked bouts of market volatility spurred the Fed into action in March, slashing short-term rates to near zero and offering to liquefy almost every financial market to calm the storm, interest rates settled appreciably and market functioning for the most part has been restored. For most, mortgage markets remained open, if somewhat increasingly more restrictive due to 40+ million unemployment claims and million of homeowners in mortgage payment forbearance programs adding a complex layer of risk to the market.

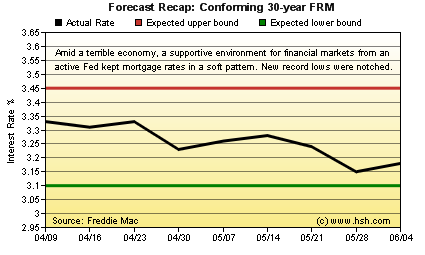

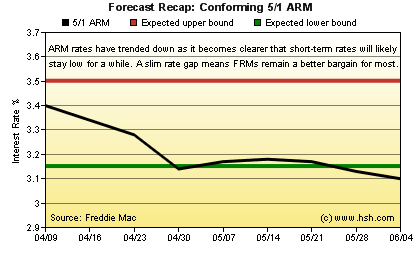

That said, mortgage rates set new record low marks twice during the last nine-week forecast period and were well aligned with our expectations at the time. Back on April 6, we expected the average offered rate for a conforming 30-year FRM as tracked by Freddie Mac to hold a range between 3.10% and 3.45%, and the markets presented us with a 3.15% and 3.33% top and bottom. For the initial fixed interest rate for a hybrid 5/1 ARM, we called for a 3.15% and 3.50% pair of bookends, a set of figures pretty close to the 3.10% nadir and 3.40% peak we saw. All in all, a pretty well-realized set of expectations. Given the fiasco that were the last two forecasts, it feels good to be on the positive side again.

Forecast Discussion

A resumption of economic activity is starting, but by all measures, it will likely be limited and very slow to gather strength. Simply, we are digging out of an unprecedented hole so deep that even incremental improvements on a month-to-month basis will seem outsized even as longer-range comparisons remain awful. With such a backdrop, there are no reasons to expect that the Fed will be making any changes in policy rates or their support stance unless new signs of faltering should emerge.

How fast and solid the rebound might be depends on one of two factors, or perhaps some intermingling of them. If re-opening the economy begins to trim back the ranks of the unemployed (and there are some tenuous signs that this may be the case, if May's employment report can be trusted) we will need to see progress on this front for June, July and beyond in order to have at least some momentum as we move into the fall, when there are some concerns that a new outbreak may emerge. To the extent that there is more forward progress, there is a likely momentum effect that may help us power through partial, regional or rolling lockdowns without much additional economic damage. More jobs beget more spending, more spending begets more jobs and a beneficial cycle might begin to take hold.

The other factor is government fiscal support. Although no doubt beneficial, there are legitimate concerns being expressed that the "bonus" unemployment benefits of $600 per week from the CARES Act has or will distort the ability of businesses to recall workers, some of whom are making far more money at home then they did at work. This is slated to expire in July, although there are discussions in Congress about extending it to the end of the year. Perhaps a better solution would be to taper the $600 support over a period of time, with the end result (where it applies) leaving the recipient with just 100% of their former salary -- putting businesses back on par with the government, as it were (typically, unemployment benefits pay only a portion of lost wages, so there can be an incentive to return to work as quickly as possible). To help support this, there might be a way to adapt the PPP program so that the transition over time is managed in the context of such benefits being paid to workers returning from the rolls of the unemployed -- that is, working but receiving support benefits for a time. This might help businesses keep the doors open and get workers back on the books full time as quickly as possible while still spreading support funds throughout the economy.

Getting money into the hands of actual people, though, is key. As we learned more than a decade ago with the trillion-dollar ARRA, there are few "shovel ready" projects for infrastructure or speedy ways to distribute funds via the federal, state or local contracting process. Yes, projects funded in this way can have beneficial effect and may be useful in addressing some of the more intractable unemployment from permanently-shuttered businesses, as would spending on job retraining programs and more... but there is no immediate benefit, and that's what's required at the moment. State and local governments will also need various forms of support, too, since expenditures and tax revenues have grown even more imbalanced than usual. When or what form any new fiscal support will take remains to be seen in the coming months, and the speed and durability of the economic upturn will likely depend upon their careful placement.

Even without those, we would expect to see improving metrics across a wide swath of the economy. We should certainly celebrate these, and investors likely will, as witnessed by a considerable rise in Treasury yields in recent days as news of reopenings and so-called "green shoots" of economic expression begin to emerge. Such improvements (not only here, but also in the economies of our important trading partners, too) will tend to put some upward pressure on bond yields, and in turn mortgage rates, at least to a degree. Tempering any of these increases that may form is a realization that even with improvement there is a very, very long road ahead to get us back to the kind of economy we enjoyed just a few short months ago. Upward pressure on rates from positive economic news will be counterbalanced by a broader reality and Fed policy that remains at emergency levels and on alert.

For mortgage rates, there are other factors at work, too. As we noted in our June 5th MarketTrends: "...some have asserted that based on historical relationships that mortgage rates should be considerably lower now than they are, perhaps a half percentage point or more. However, at times when the risks of making mortgages are elevated (such as now) those risk premiums expand and those relationships become distorted. Some have proffered that the with the Fed pledging to buy up MBS in any numbers needed to ensure market functioning that rates should be lower. However, the point of the Fed's intervention in MBS markets is not specifically to lower mortgage rates further (as they are already at or near record lows) but rather to keep them from rising, and the markets liquid and functioning, if private investors should turn away from buying these instruments.

The Fed is not looking to compete with private investors, who are willing to buy such securities at a reasonable rate of return, and provided that they are responding and buying up these securities at a market-clearing price and yield, the Fed shouldn't be expected to outbid the market and command it in one direction or the other. In reality, it's not their purpose or goal; proper functioning of that market is."

For mortgage rates to drop further or meaningfully, a lessening of risks to investors needs to happen. This would start to happen, probably gradually, if the economy becomes more functional, and in turn forbearance and unemployment figures begin to retreat. While there has been some leveling off of loans entering forbearance, they continue to edge higher; even with falling initial unemployment claims, they remain at about three times the pre-pandemic record, and even with more than 2 million jobs created in May, more than 20 million folks remain out of work. The incidence of new risk may be slowing, but we don't yet know the outcomes or the ultimate severity of that risk in terms of loss. Until that becomes more clear or risks diminish meaningfully, it will be hard for mortgage rates to decline much.

That's not to say that there isn't a chance of new low-rate records for mortgages to be set in the months ahead. There is. Demands for mortgage credit have been mixed for months but seem to be fair and no crush of business is overwhelming lenders at the moment. In fact, the spring homebuying season was slack this year due to the coronavirus, and while no spike in sales is likely due to thin inventories and high prices, we are likely to see the typical burst of activity spread across the summer months. To any extent that the risks above start to retreat and increasingly hungry lenders look again to try to better compete for new business, mortgage rates could have a little space to fall, at least for folks who are well-aligned with current underwriting standards.

Forecast

What happens over the next nine weeks will probably dictate how the remainder of 2020 rolls out. When this forecast expires, it will be August, and the all-encompassing run to the elections will push everything out of the way at that point and political compromise will be even less likely to occur than now. The Fed is going nowhere fast, we will probably get fiscal stimulus in one form or another, and as the coronavirus dust settles the damage done will become more clear. Between now and the calendar high point of summer, we think that the average offered rate for a conforming 30-year FRM as tracked by Freddie Mac should manage to run in a range of 3% to 3.38%, while the initial fixed interest rate for a 5/1 Hybrid ARM should manage a 2.95% to 3.30% pair of lower and upper stops.

This forecast expires on August 7, 2020. By then, we should have a sense of how the disease has progressed or been managed in a less-restrictive environment, and perhaps have early news of an efficacious vaccine or treatment for it. In the meanwhile, vacation season may mean a chance to escape the confines of home and de-stress -- something we all no doubt could use. When you're feeling back up to speed, drop back and see how this forecast turned out as the summer wends its way along.

For interim forecast updates and market commentary, see our weekly MarketTrends newsletter.