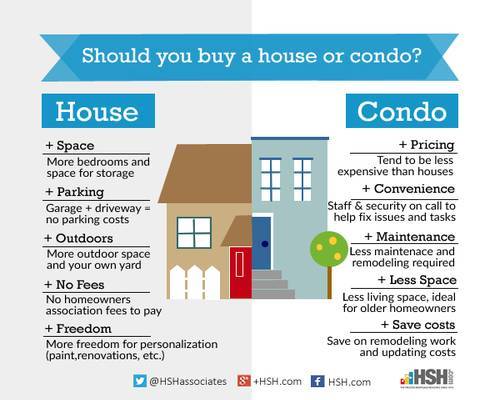

The choice between purchasing a condo or detached house can be difficult for first-time homebuyers and repeat homebuyers alike. Your decision will affect not only the price of your home, but also where you'll live, your home's initial condition, your responsibilities as a homeowner and even your lifestyle.

Here's a look at factors you should consider:

Personal control

Generally speaking, you'll have more freedom in a house, says Jane Peters, a Realtor at Power Brokers International in Los Angeles.

With a house, you can paint the walls any color you want and do extensive remodeling to make the house fit your needs. A house will also give you outdoor space for a garden, swimming pool or larger dog. Many houses also feature a garage, carport or driveway where you can park one or more cars and store bicycles or other outdoorsy or seldom-used belongings.

"You're your own boss in a house," Peters says. "You can do whatever you want."

Price

Condos tend to be significantly less expensive, even half-off compared with houses in some locales.

"Where I live," Peters says, "you're not going to get into a decent house for less than $1.2 million. For a condo, you could get in at maybe in the $600,000s."

That differential means you probably could purchase a newer or nicer condo for the same price as an older house in the same neighborhood, says Hope Peek, an associate broker at Peek Properties in Chevy Chase, Maryland.

"Within the price range, typically the house needs more work or more updating," she says.

Location

Where you want to live can also dictate the kinds of properties from which you can choose. You won't often find single-family detached housing in most center-city downtowns, and you may not find many condo or attached housing units in rural areas.

Suburbs usually offer a mix of properties, but even then, a town or area that is your first choice for a place to live may or may not have the kinds of property you want to buy at a price you can afford.

Finding exactly what you want or need in a location that is exactly where you want it to be may prove elusive.

Related: Essential Steps to Successful Home Buying

Maintenance

Houses typically require a lot more maintenance, and you'll be on the hook for all the time and money involved. If you buy an older house, you'll probably want to update it and you might have to take care of deferred maintenance the prior owner overlooked or couldn't afford.

"If you live in a house," Peek says, "you're responsible for all the maintenance."

A condo requires less effort because it's typically smaller and the homeowners association is responsible for maintenance of the building and common areas.

With a condo, you won't have to arrange for the work to be done yourself, but you will have to pay homeowners association dues and possibly special assessments. Monthly dues can range from a few hundred to several thousand dollars.

What's more, Peek says, "you'll still have a kitchen and bathrooms, and that's where most of the maintenance is. You'll still have to change your air filter. But you're not cleaning rain gutters."

Condo association dues can function like forced savings for maintenance, reducing the risk that you'll have to use a credit card or equity line of credit for home maintenance or repairs.

"With a house, there can be a bigger risk," Peek says. "If you don't take care of the maintenance, you can get into bigger (financial) trouble. With a condo, you don't have to deal with those issues."

That assumes the condo association is well-managed, which not all are.

Related: A Homeowner's Maintenance Checklist

Financing

If you opt for a condo, the homeowners association's health will factor into your financing and can even impact the mortgage rates you qualify for, says Jim Pomposelli, a mortgage banker at The Federal Savings Bank in Chicago

"It adds a little bit of complexity to the transaction because you have to get both the condo building and the borrower approved," he explains.

The risk of a poorly managed condo association can also add a quarter or eighth of a percentage point to the interest rate on your loan, Pomposelli says. That will cost you a bit more throughout all the years that you own your home.

"That doesn't mean condos are bad. It does mean it's an extra layer from a financing standpoint."

Related: How to Finance a Condo

Privacy

When buying a single-family detached home, you'll get the chance to decide on how much space you want or need between yourself and your neighbors. That's not the case with condos, where you'll be sharing at least one wall (and often more) with the unit next to you.

That's also the case when you're outside your home. By definition, a condo will have shared spaces -- everything from common hallways to common parking areas to community-shared amenities such as open space or pools, so it might be hard to escape your neighbors. With a single-family detached home, you can even put up a fence if you like to help create a space isolated from the folks next to you.

Space and size

Another factor to think about is how much living space you want, how many bedrooms you need and how most homes are configured in the area where you want to live, Peek suggests.

Condos tend to be more prevalent and popular in densely populated urban areas where land is more expensive. The typical condo might be too small for you. Or the typical house might be too large.

"If you only need one bedroom, there are not a lot of small houses. Most houses are much bigger," she says. "There are not a lot of three-bedroom condos either."

Plus, if you need more space in the future, it's at least possible to add on to a single-family home. That's not going to be the case with a condo.

The bottom line is that the condo-or-house decision is a very personal one that requires thoughtful consideration of all these factors when you buy a home.

This article was updated by Keith Gumbinger.