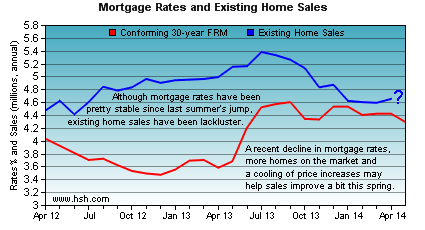

Home sales and prices continued to show signs of recovery in April, according to the latest data from the National Association of Realtors (NAR) and the Federal Housing Finance Agency (FHFA). The slow and steady growth of sales and prices seems to match the path of mortgage rates over the past few months. The conforming 30-year fixed-rate mortgage averaged 4.42 percent in April, the exact same as March and only a few basis points off from February's monthly figure.

Home sales

Sales of houses, townhomes, condominiums and co-ops increased 1.3 percent in April to a seasonally adjusted annualized pace of 4.65 million homes, according to NAR. That figure was up from a 4.59-million pace of sales in March, but down 6.8 percent from the 4.99 million pace set in April 2013.

In a statement, NAR Chief Economist Lawrence Yun said this year's sales should generally trend upward, but likely will remain lower, in total, compared with last year.

More homes were for sale at the end of April. Supply jumped 16.8 percent to 2.29 million existing homes, a 5.9-month supply at the current pace of sales. That was up from 5.1 months' supply at the end of March. At the end of April 2013, for-sale supply stood at 5.2 months.

Homes sold quickly in April, NAR President Steve Brown, co-owner of Irongate Realtors, in Dayton, Ohio, said in the association's statement.

"The typical time on market shrunk in April, with four out of 10 homes selling in less than a month," Brown said. "Homes that show well and are properly priced tend to sell the fastest."

The median number of days on market for homes sold in April was 48, down from 55 in March. A year ago, the median was 43. Short sales and foreclosures typically took longer to be sold.

Home prices

The median price for homes sold rose to $201,700 in April, up 5.2 percent compared with April 2013. Foreclosures and short sales accounted for 15 percent of April sales, a drop from 18 percent in April 2013.

Prices might hold stronger than otherwise would be expected since sellers haven't jumped into the market in full force.

"More inventory and increased new-home construction will help to foster healthy market conditions," Yun said.

Separately, the FHFA reported that its home price index rose 1.3 percent in the first quarter of 2014, the eleventh consecutive quarterly increase. The seasonally adjusted index is based on mortgage data from Fannie Mae and Freddie Mac.

The index rose in 42 states and the District of Columbia. The top states in terms of price appreciation were:

- Nevada

- The District of Columbia

- California

- Arizona

- Florida.

Regional differences

Not all U.S. regions experienced the same trends.

Sales in the Northeast remained at an annualized pace of 600,000 in April, 6.3 percent slower than April 2013. The median price was $244,000, down 0.4 percent from a year ago.

What salary do you need to afford a median-priced home in your metro area?

Sales in the Midwest fell 1 percent in April to a pace of 1.03 million, 9.6 percent slower than a year ago. The median price in the Midwest was $157,200, 5.8 percent higher than April 2013.

In the South, sales increased 1 percent to a pace of 1.94 million, 3.5 percent slower than April 2013. The median price was $173,200, up 3.2 percent from a year ago.

In the West, sales rose 4.9 percent to a pace of 1.08 million, 10 percent slower than a year ago. The median price was $291,200, 9.7 percent higher than April 2013.