Do you have to pay your mortgage if your house is destroyed? The answer is yes; your mortgage obligation does not disappear even if your home does. That's why mortgage lenders require you to purchase homeowners insurance to get a home loan. The idea is that the insurance payout enables you to continue making your mortgage payments and includes a provision for temporary housing so that you can keep going.

Do you have to pay your mortgage if your house is destroyed? The answer is yes; your mortgage obligation does not disappear even if your home does. That's why mortgage lenders require you to purchase homeowners insurance to get a home loan. The idea is that the insurance payout enables you to continue making your mortgage payments and includes a provision for temporary housing so that you can keep going.

Whatever your location, you need a disaster-readiness plan. And you should prepare financially as well. Understanding what happens to your mortgage in a natural disaster is part of that.

What happens if a hurricane destroys your house

Hurricanes wreak havoc because they combine two of nature's most damaging forces -- wind and water. If you live near the coast, your best defense against hurricane damage is to purchase enough homeowners insurance coverage to replace your home.

Your lender is unlikely to cancel your mortgage if your house is destroyed. For this reason, mortgage lenders require you to carry at least a standard policy. It's up to you to seek additional coverage to ensure that you'll be able to replace your home to your satisfaction. You are responsible for paying your mortgage, and the insurance payout should enable you to continue to do so while also providing housing.

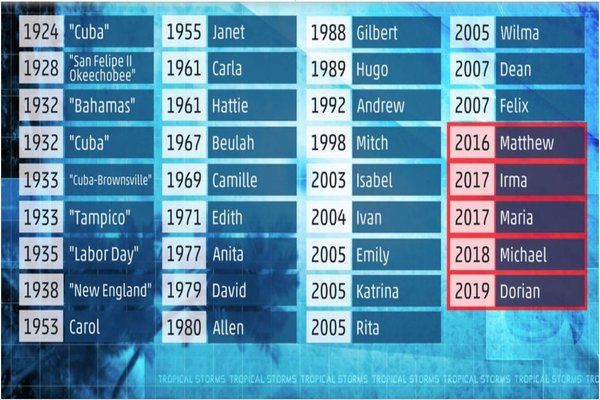

Category 5 Hurricanes since 1924. Source: NOAA

Flood damage vs wind damage

Standard homeowners policies cover wind damage. So, if hurricane winds or tornadoes wreck your home, you should be OK. However, if a storm surge or flood carries off your house, a standard policy won't make you whole. You'll still have a mortgage if your house is destroyed by flooding.

If you live in a flood zone, your mortgage lender should normally have required you to purchase flood insurance. That would be lucky.

However, half of all flood damage claims, says FEMA, come from outside designated flood zones. And few who live there buy flood insurance, which is unfortunate when a natural disaster strikes. The National Flood Insurance Program's website says that for all practical purposes, "Everyone lives in a flood zone."

Without insurance, if you sustain damage, you may receive low-interest loans from the federal government to recover. But you'll have to pay them back. Buying flood insurance is the only way to fully protect yourself from flood-related hurricane damage.

Related: Is Flood Insurance Worth It?

What happens to your mortgage if your house burns down?

If fire guts your residence, your homeowner's insurance policy should cover the damage. And for alternative housing while you rebuild. That is a standard provision of homeowners insurance.

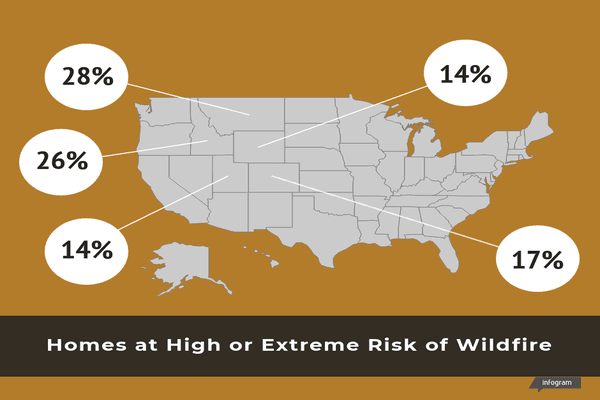

According to Verisk Wildfire Risk Analysis, Mountain West states are in the top 7 for having the highest percentage of households that are at high or extreme risk from wildfire.

Credit: Rae Ellen Bichell / Mountain West News Bureau

What happens to your mortgage if your house is destroyed by fire? The lender doesn't cancel your loan. But your insurer should eliminate the obligation by paying off your balance. And by providing you with temporary shelter until you rebuild or move. If your home just requires repair, that's covered as well. You should be able to carry on with your mortgage payments while rebuilding.

But if that's not possible, you need to contact your mortgage lender as soon as you can. For instance, if your employment is interrupted or terminated because of the fire, or your insurer is delaying payment, let your lender know.

Next to your insurance company, your mortgage lender is your most important contact if your home is lost to fire.

Related: Facts About Homeowners Insurance

Earthquake damage

After an earthquake, you still have your mortgage even if you no longer have your home. And few homeowners carry earthquake insurance. It's expensive, with premiums running between 10% and 20% of the covered amount. And deductibles are high.

Earthquake insurance usually pays for damage to the structure, temporary living expenses and personal property replacement. But you may still have hardship because of the deductible, and because payment might not come immediately. If that is the case, contact your lender right away.

So if an earthquake destroys your home, you still have a mortgage obligation. And, if you're uninsured, you'll have to find a way to make your payments, while also finding and paying for a place to live.

You'll need to seek other aid from government programs. And contact your mortgage lender right away for options.

What aid is available when your home is destroyed?

Most federal aid for disaster relief comes from the Small Business Administration. It takes the form of low-interest loans -- up to $200,000 -- to repair or rebuild. You can also borrow up to $40,000 to replace personal property like cars, electronics, furniture and clothing.

Grants from FEMA can supplement insurance payouts and SBA loans. They currently max out at $34,000 per household. You can use a grant for basic home repairs that aren't covered by insurance, temporary housing, and disaster-related medical and childcare expenses.

The Federal Housing Administration (FHA) offers its Section 203(h) program to help homeowners rebuild or repair their homes. You can get started without having to make a down payment.

For more information, go to DisasterAssistance.gov.

Does homeowners insurance pay off your mortgage if the house is lost?

When you owe money to a mortgage lender, it receives a security interest in your home. To protect itself, your lender requires you to carry homeowners insurance, and sometimes flood insurance. Your coverage must be at least enough to pay off your home loan balance.

Your insurer pays the cost of repairs (less any deductible) if your home sustains damage. If the home is not safe to live in, the standard policy also covers living expenses elsewhere while you repair your home. You should be able to continue making your mortgage payments.

If a covered disaster completely destroys your house, your standard homeowner's insurance policy includes a "loss of use" or "additional living expense" protection, providing temporary housing until you recover. It pays off your mortgage, freeing you of that obligation.

Whether you'll receive enough to rebuild your home in addition to paying off your mortgage depends on what coverage you purchased when you selected your policy. "Replacement value" coverage is not standard and you pay extra for that option.

If your home is damaged or destroyed by an uncovered event, you still have your mortgage obligation. And you have to repair or rebuild your house at your own expense. In that case, help will most likely take the form of government-based aid and forbearance from your lender.

I can't pay my mortgage. What are my options?

If the disaster makes it impossible to make your monthly house payments, request a mortgage forbearance from your lender or loan servicer.

Typical forbearance agreements allow you to make partial payments or skip payments for up to six months. If necessary, your lender may extend this protection for an additional six months. Understand that interest still accrues during the time you aren't making full monthly payments. The good news is that your lender won't charge late fees or report you to credit bureaus.

Understand that lenders are not obligated to offer you this help, but most will because that is better for them than foreclosing. When the Administration declares a disaster area, it encourages lenders to help out, but can't require them to do so.

Find today's mortgage rates now