It used to be that being a homeowner could offer some big tax advantages, not the least of which are perks related to that mortgage you pay every month. When the Tax Cuts and Jobs Act (TCJA) changed certain aspects of the tax code starting a few years back, it became much less of a certain thing than it used to be.

Although mortgage rates weren't all that favorable in 2024, there are always some homeowners who refinanced their mortgages, most typically to take cash out of the property.

Also, and while no one was glad to see those high mortgage rates in 2024, it's also true that higher mortgage rates can make the mortgage interest deduction more valuable to more homeowners.

If you refinanced your mortgage in 2024, there are some specific "dos" and "don'ts" you need to know prior to filing your income taxes, as well as a few pointers that might help you lower your tax bite.

What follows may help to reduce your federal income taxes and get you prepared for mortgage-related tax issues in 2024 and beyond.

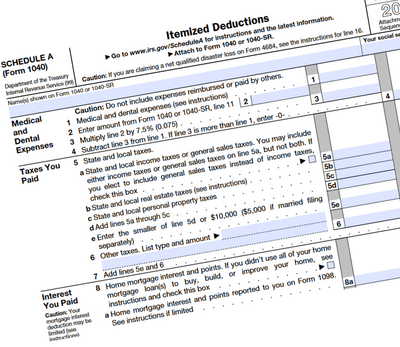

Do: Itemize to claim your mortgage interest deduction

The personal exemption put in place by the TCJA has risen for tax year 2024 to $29,200 for married couples filing jointly. This increased standard deduction may or may not make it worth your while to itemize your return to get the break the mortgage interest deduction can bring. As has been the case last year, TCJA made things a bit more complicated as there is also a $10,000 limit on deducting State and Local Taxes (SALT, which of course includes income and property taxes).

If the total of the two (plus any other itemizable deductions you may have) total more than $29,200 ($14,600 for a single filer), it's probably worth it to itemize your return, but there's no simple answer as to whether it is or isn't.

As an example, if you are in a high-tax state and will hit the $10,000 SALT cap, that leaves you with $19,200 gap to fill with mortgage interest (and potentially other deductible items) before you get over the threshold where itemizing may make sense. For a married couple with a mortgage at 6%, you'll need a loan amount of $321,800 to have paid $19,200 in interest in the first year of the loan. Of course, a loan with a higher interest rate requires a smaller loan amount to reach this level of interest cost; for example, with a rate of 7% and a term of 30 years, a mortgage of only $275,600 will hit that interest cost in its first year.

Since interest costs diminish over time from there, hitting this mark in future years can be increasingly difficult. For example, the amount of interest paid in the second year of the $321,800 loan example above totals only $18,957, so you would need other deductible expenses to help close the gap. As well, the standard deduction is often increased to account for inflation, so the second-year (and subsequent years) gap may increase.

That said, it's easier for single borrowers to leap to a place where itemization probably makes sense -- $10,000 in SALT expenses leaves just $4,200 in mortgage interest (and other items) to cover -- and at 6% with a 30-year term, that happens with a loan amount of just over $70,400. If you're in a state where state and local taxes total $10,000 or more, any loan amount above $70.400 may make it worth itemizing to increase your deduction.

Of course, if you're in a low-tax state, you'll need a larger loan amount to overcome the standard deduction threshold. Paying no state and local taxes at all isn't reality, but if it was, you would need a $451,550 loan at 6.5% to reach the $29,200 standard deduction with mortgage interest alone.

So, is it worth it to itemize your return or not? You have to run the numbers to find out, or let your tax professional figure it out for you. If it is worth it, you'll be filing a 1040 Schedule A.

What if I did a cash-out refinance?

Unlike a traditional "rate-and-term" refinance, a cash-out refinance sees you replace an existing mortgage with a new loan and take a draw of equity at the same time. You end up with one new loan with a larger loan balance.

Are the proceeds from a cash-out refinance taxable?

No. Since you're actually taking a loan against your home -- borrowing your own money -- proceeds from a cash-out refinance aren't treated as income for tax purposes.

You can use the proceeds from a cash-out refinance for any purpose, but you won't be able to deduct any interest you pay on those funds unless they are used to "buy, build or substantially improve" your qualified primary or secondary residence. And of course, you'll only be able to deduct this interest if you are itemizing deductions on your tax return.

If you haven't yet done a cash-out refinance but are considering one, you can reckon how much equity you have in your home and then find lenders who may be able to help you with a cash-out refinance.

If you already did a cash-out or rate-and-term refi and will itemize your deductions, you'll need to understand which mortgage debt limits apply to your situation.

Related: Essential tax questions and answers for homeowners

Which tax-deductible mortgage amount limits apply to you?

If you purchased a home prior to December 14, 2017, the good news is that certain of the old limits on mortgage interest deduction still apply to you. Purchase-money mortgages prior to that date retain the allowance for the deduction of interest on loans of up to $1 million if you are single or married filing jointly ($500,000 each if married and filing separately). This so-called "acquisition" debt for your primary or secondary residence isn't subject to the new limits for purchases made in 2018 or beyond.

Deductible mortgage amounts are lower for purchase-money mortgages (called "acquisition debt") taken after December 15, 2017; $750,000 (single or married filing jointly) or $375,000 each if married filing separately.

So, if you took a $900,000 mortgage in February 2016 and refinanced it in February 2019 in a straight rate-and-term refinance transaction, interest paid on the entire remaining balance of nearly $852,000 would still be eligible for the mortgage interest deduction, as the old limits for acquisition debt are carried forward.

From the IRS: Refinanced home acquisition debt. "Any secured debt you use to refinance home acquisition debt is treated as home acquisition debt. However, the new debt will qualify as home acquisition debt only up to the amount of the balance of the old mortgage principal just before the refinancing. Any additional debt not used to buy, build, or substantially improve a qualified home isn't home acquisition debt."

Just for reference, the IRS considers an improvement to be "substantial" if it:

- Adds to the value of your home,

- Prolongs your home's useful life, or

- Adapts your home to new uses.

Things can get more complicated if your existing loan amount was above the new limits and you did a cash-out refinance. Even if you took the proceeds and used them to "buy, build or substantially improve" the home against which the loan was taken, this would be considered a new acquisition loan, and would be subject to the new lower maximum loan limits. However, your original acquisition debt portion would be carried forward. Essentially, this new mortgage is treated as a brand-new loan and is subject to the new limits, with only the acquisition portion eligible for the tax deduction.

For example, you have $852,000 remaining on your existing mortgage and you did a cash-out refinance for $31,000 to renovate your basement. Even though it is used to improve your home, the new loan amount is above the new $750,000 threshold and only interest on the acquisition debt portion ($852,000) can be deducted. Interest on the other $31,000 would not be deductible, even though it was used to improve the home, because it is above the new or carried threshold.

In this case, it would be the same as if you did a cash-out refinance and used the proceeds for something other than "buy, build, improve" purposes as interest on the amount above the original acquisition debt isn't deductible. As with the example above, let's say you refinanced the $852,000 and took an additional $31,000 in equity out of the property to pay off some credit card bills. Only interest on the $852,000 would remain eligible for the mortgage interest deduction; the remaining $31,000 would not.

However, if you are below the $750,000 limit -- say, with a $600,000 loan amount -- and then pull out $100,000 in equity to improve your home -- your new total loan would be below the $750,000 limit and all the interest you pay would be tax deductible. Conversely, if you pulled out $100,000 to pay off credit card debt and buy a car, only the acquisition portion ($600,000) would remain eligible for the itemized tax deduction.

"Example 1: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home with a fair market value of $800,000. In February 2018, the taxpayer takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible."

For reporting purposes, which is which, and who provides proof?

While your lender or servicer will provide you with Form 1098 (mortgage interest you paid), the existing form provides no breakout for interest that is considered acquisition debt (and is deductible) and that which isn't considered acquisition debt (and isn't deductible). This means you are responsible for figuring out which is and which isn't, so you'll need to closely track (and keep good records) of how you used proceeds from your cash-out refinance. Tracking the loan's principal amounts separately in a spreadsheet may help you keep things straight, and an amortization calculator can help you here, too.

Here's an interactive worksheet we located that may also help you to figure out your interest deductibility: Mortgage Interest Deduction Worksheet.

Note: The "grandfathered" debt referred to in the document deals with mortgages originated before 1987. As this was now 37 tax years ago, unless a loan written back then had an original term in excess of 30 years, this doesn't likely apply to too many folks. Even if you did, much of your payments would be comprised of principal with little actual interest paid, so you would likely use the standard deduction instead.

Do I get to write-off private mortgage insurance premiums as I did in other tax years?

Not for 2024, at least not so far. Congress originally allowed homeowners to deduct mortgage insurance as part of the Mortgage Forgiveness Debt Relief Act of 2007. As the deductibility of mortgage insurance premiums isn't a permanent part of the tax code, the ability to deduct them relies on routine reauthorization by Congress, and there is no guarantee that they will do so. As an example, deductibility ran through tax year 2017, expired, then was reauthorized retroactively in 2020 to cover tax year 2018 and 2019. This was also the case when a so-called "extender" in the "Consolidated Appropriations Act, 2021" reauthorized the deductibility of PMI and FHA MI premiums for the 2021 tax year.

Should the deduction return later on and you filed a 2022, 2023 or 2024 return with itemized deductions on Schedule A and didn't include your PMI costs, you might consider filing an amended tax return, if it is worth it in your situation.

Related: What homeowners need to know before filing their tax returns

Don't: Raise red flags by erroneously claiming points and fees from your refinance

"People often make the mistake of thinking that the points and fees paid on a refinance are tax deductible just as they may have been when they originally obtained the mortgage on their home," says Jones. "That, however, is not the case."

Jones explains that, per IRS guidelines, points paid when refinancing are not taken in full during the year in which the refinance was obtained. "Instead, the points must be deducted equally over the life of the loan," she says. "To figure the annual deduction amount, divide the total points paid by the number of payments to be made over the life of the loan. Usually, this information is available from the lender."

For example, a homeowner who paid $2,000 in points on a 30-year mortgage (360 monthly payments) could deduct $5.56 per payment, or a total of $66.72 for 12 payments. Taxpayers may deduct points only for those payments actually made in the tax year, according to Jones.

Note: If your 2024 refinance was a second (or more) refinance, the undeducted portion of any points that were to spread among the old loan's remaining term are accelerated into the current year, and so the remainder of those undeducted costs become be fully deductible this year. Of course, any new points paid for the new mortgage will again be spread out over the new loan's term, as before.

Spreading the points paid over the life of the loan isn't the only factor determining whether or not your refinance expenses are fully tax deductible. You also have to take into account whether your original loan was before or after October 1987 (if you incurred mortgage debt prior to Oct. 14, 1987, different rules concerning tax deductibility may apply), whether or not your total combined mortgages exceed the allowable limit for the mortgage interest deduction, and whether or not portions of the refinance were used for home improvement, Jones says. "That last factor can sometimes enable you to write off more expenses during the year of the refinance," she notes.

If you're a homeowner, you certainly should take advantage of every homeownership tax deduction for which you qualify. But to make sure you don't run afoul of IRS tax rules, be sure to consult an accountant or financial advisor regarding your particular situation.

It's also a good idea, Jones suggest, to read IRS Publication 936 where all the nuances concerning the tax deductibility of mortgage refinance expenses are fully explained. "It's not necessarily in 'plain English,' but it's explained nonetheless," Jones says.

Keith Gumbinger revised and updated this article.