June 22, 2018

Preface

Opposing forces for interest rates are in place as we come to the summer of 2018. A vibrant economy in the U.S. is seeing the Fed continue to raise interest rates, and inflation has returned or surpassed Fed targets for the first time in years. Tight labor markets, firming wages and changes to tax policy are providing support for stronger economic growth, and nascent trade wars at the moment seem more likely to foster higher prices than provide tempering to economic growth. With this as a backdrop, higher short-term interest rates and continuing normalization of monetary policy seems all but assured.

Then, there's the rest of the world, where a less-sturdy economic climate and more limited price pressures are seeing other central banks continue to provide considerable support to try to get their economies reliably back on track. Earlier this year, the European Central Bank cut their bond-buying program in half (from 60 billion euros to 30 billion) and recently announced that they would halve that again come October before a likely December end to the program. To be sure, it may be that they were simply running out of bonds to buy anyway, given the way the program was designed, with limited corporate and not unlimited government bonds the target of purchases. While announcing this tapering, the ECB also pledged to keep their key interest rate below zero through at least next summer, and possibly longer. As such, the stimulus spigot there remains wide open.

To this, mix in a sprinkling of market concerns about Italy's economy and political path, the stumbling mess that Brexit is becoming, a wobbly political climate in Germany and fresh worries about the viability of the common currency and trade market. Further to the east, Japan's only progress from years of deflation and subpar growth seems to have faltered again, leaving the central Bank of Japan to maintain an "all in" policy of near zero percent interest rates and nearly unlimited bond buying.

Meanwhile, "trade wars", or rather, changes in tariffs on any number of commodities, finished goods and services have the potential to broadly trim global growth while pressing prices higher, with the pain not necessarily spread evenly or even fairly among our major trading partners. Each of these abrupt changes -- even just announcements -- have sent investors scurrying out of stocks and into bonds.

There are plenty of reasons for investors to remain on edge and hedging their riskier bets with safe and sound investments; as always, not only is the U.S. the most reliable game in town, we are also offering yields far above those available in other developed economies.

Given the above, If you're starting to suspect that interest rates may be coming into a fairly flat spell, well, you just may be right.

Recap

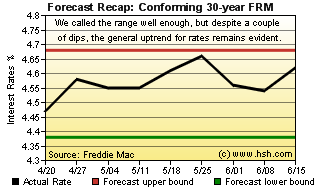

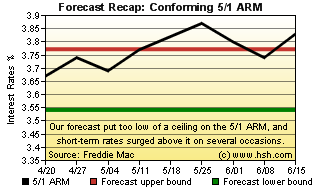

Turns out, our last forecast was a bit of a mixed bag. We got the most important component right, as we expected that the average conforming 30-year fixed-rate mortgage would hold a range between 4.38% and 4.68%, and the most popular home-financing vehicle wandered between 4.47% to 4.66% during the period. We were less successful in our expectation for the 5/1 Hybrid ARM, where we thought that a 3.54% and 3.77% pair of fences would contain the most popular ARM. While the low value of 3.67% was within bounds, rates rather exceeded our expected limit, climbing as high as 3.87% over the forecast period. In all, a fair forecast, if a little less accurate than we had hoped.

Forecast Discussion

With countervailing forces in place in the market, it may be hard for rates to move meaningfully or strongly in one direction or the other for a time. With its latest move in short-term rates -- the seventh such move of this protracted Fed cycle -- the federal funds rate now has a target range of 1.75% to 2% and is now (or soon will be) at a level that begins to impart some drag on the economy. With core inflation and base interest rates both at about 2%, the so-called "real" rate of the fed funds is back to about zero, so any additional move that puts short-term rates above core inflation will begin to be economically restrictive, if only barely so. As the Fed has now penciled in two more increases in the federal funds rate over the next six months, most probably in September and December (but perhaps before then), it may only be a matter of months before we're at a point where the economic brakes are being tapped.

While the Fed strongly influences short-term interest rates with its policy moves, financial markets generally determine the position of longer-term ones, and it is these in turn that influence fixed mortgage rates. At the moment, our longer-term bonds have yields at levels not seen in many years, and by all accounts investors continue to show a great appetite for them. A ten-year bond returning close to 3 percent seems to be compelling to investors, but with shorter-term yields being pushed up from the bottom by the Fed, one has to wonder about how long this preference will last. The gap between, say, a 2-year Treasury note and a 10-year version has gotten extremely narrow of late; given the differences in risk, it may be that investor appetites may begin to shift in time. Should this occur, longer rates would be likely to rise.

Of course, this may also not come to pass. With only a narrow gap to close, some analysts have begun to discuss the implications of an interest-rate "inversion", where short-term rates provide a higher yield than do long-term ones. For some, such a happenstance is a clear signal that a recession is coming, as the implication is that the Fed has raised short-term rates high enough to quash both inflation and economic growth. However, given the direct manipulation of long-term rates by central bank QE policies, it's hard to know if an inversion comes whether or not it actually is a clear, unfettered market signal, or if a recession will actually be the outcome of the situation. To be sure, a group of economists that include former Fed chairman Ben Bernanke have all gone on record recently stating that they believe that the next recession could be only two years away. To the extent that investors believe this, it may be that they will look to continue to snap up as many longer-term investments as they can, as lower bond yields and smaller returns may again be just over the horizon.

In general, while there remains upward pressure on longer-term rates from solid growth and rising inflation there is also reasonable downward pressure from seemingly unlimited investor appetite for safety, security and decent yields. These appear to be the forces in place as we look deeper into summer. While it's hard not to expect that firmer rates should be in the cards, but it must be acknowledged that there remain powerful headwinds tempering that uptrend.

Forecast

In the first quarter of 2018, 30-year FRMs rose in nearly a straight line by a total of about 50 basis points, a considerable move. In the not-yet-completed second quarter, the move has been a valley-to-peak change of just 26 basis points, only about half as much as seen in the first, and the move upward was more erratic as well. The next nine week period will cover only about two-thirds of the coming quarter, but the diminishment in the amount of change over the last two suggests to us a bit of increasing stasis, or at least somewhat more stagnation in the longer trend for at least a while.

Over the next nine weeks, we think that the average rate for the conforming 30-year FRM as posted by Freddie Mac will hold a range of 4.53% to 4.80%, while the hybrid ARM will likely see a pair of 3.76% to 3.98% bookends to contain it. For fixed rates, these would be among the highest rates in seven-plus years and won't provide much by way of support to an already challenging housing market. For 5/1 ARMs, it would be closer than not to eight-year highs, but for both, these are the regions we've been walking in already, if perhaps deeper so.

At the cusp of summer, it's hard to fathom that this forecast takes us nearly to its end. As you look to the mad scramble into fall, why not check back in and see if we're on or well wide of the mark?