Q: I have a 30-year fixed rate at 3.5 percent. When will my payment include more principal than interest?

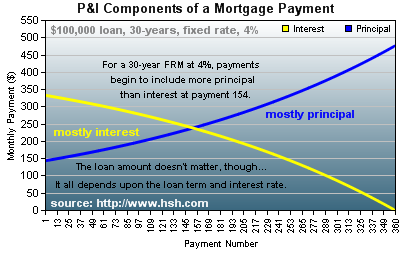

A: In a fixed-rate mortgage , the amount of your monthly payment will not change, but the composition of the payment will over time. The tipping point for a fixed-rate mortgage--when the payment becomes more principal than interest--is a function of the interest rate and term. You might be surprised to find that the amount of the loan doesn't come into play at all!

In your case, a 3.5 percent 30-year fixed mortgage rate will see a payment comprised of equal parts principal and interest at about payment number 120. If your rate was 3 percent, that would move up to about payment number 84. If it was 4 percent, you would be waiting around until payment number 154, about 13 years after you began making payments.

To see this for any loan, you can use HSH.com's mortgage calculator. Below the calculator, click on the "Amortization Schedule" tab, then scroll down to the year displayed where total annual principal and interest payments are pretty close (the calculator's payment component chart can help you here, too), then open up the year to find the exact payment when balance is achieved.

If you prefer a print-and-take away version for your files, you can use our mortgage calculator's to print the amortization schedule you created. This will give you a side-by-side breakout of principal and interest, including the payment number.

Related: What's the difference between car loans and mortgages?

More from HSH.com

This article was written by Keith Gumbinger. With over 35 years as an expert observer of the mortgage and consumer debt industries, Keith's insights have been featured in tens of thousands of articles across prestigious publications like The Wall Street Journal, USA Today, The New York Times and more. He has authored multiple consumer guides on first mortgages, refinancing, home equity, and more, and is the primary researcher and writer of HSH.com's MarketTrends newsletter.