What's the point of mortgage lender reviews? To help you identify the lenders that offer both competitive interest rates and a high level of service.

Understand that grabbing a rock bottom rate won't do you much good if you can't close the loan. Or qualify for that great rate. Or the lender works online only and you prefer face-to-face interaction.

More than just a list

So we're going to provide you with two tools to help you find a great mortgage. The first is a list of top-rated lenders. But some of the best lenders in the US, and perhaps the best for your situation, won't appear on anyone's nationwide "best" list, because they are small.

So the second resource is our tips on finding a great lender yourself. One with a great rate for your kind of loan and your borrower profile. And a loan professional who can close your deal on time and avoid ugly surprises.

Lenders specialize

Many lenders specialize in helping particular types of borrowers. This means that you're relying wholly upon recommendations from friends, family, colleagues or neighbors might be a bad idea.

Of course, it may be fine if you happen to have a similar credit score, down payment and financial situation as the person doing the recommending. But often the lender who offered an exceptional deal to your pal will be hopeless for you.

Related: Shopping for a Mortgage (What APR Can't Tell You)

Best mortgage lenders in 2019

J.D. Power publishes an annual survey of mortgage originators. At the time of writing, the latest of those was the 2018 U.S. Primary Mortgage Origination Satisfaction Study. It says:

Customer satisfaction with primary mortgage originators has increased in 2018 as digital origination channels play a more significant role in the process…

You'll certainly spot some of those online-only companies among the J.D. Power Top 10, which we'll be using to select those for which we write mortgage lender reviews. Remember, these scores are derived by surveys of actual customers of each lender and are intended to measure those customers' overall satisfaction.

However, there is more information available about these companies than published in JD Power's list, and some of that information is highly-relevant. For instance, their BBB rating, and companies 'own information about the client they serve and how they do it.

Unlike JD Powers, at HSH we only focus on mortgages. And we understand the industry and who is known for certain things -- like the lowest rate, the best service, and the specialty programs.

The number next to each is the score out of 1,000 given to the lender by its customers. Keep reading for profiles of each:

Here are those 10 top mortgage lenders in 2019

- Quicken Loans (including its Rocket Mortgage brand) 876

- Fairway Independent Mortgage 873

- Guild Mortgage Company 857

- PrimeLending 850

- Bank of America 849

- LoanDepot 847

- Fifth Third Mortgage 843

- CitiMortgage 840

- Caliber Home Loans 836

- PNC Mortgage 835

The industry-average score was 836. So all lenders on the list did very well. But you'll notice that some big names didn't make the cut.

Those include:

- Chase 834 (so very close)

- Wells Fargo 817

- U.S. Bank 785

Related: In-house Mortgage Financing (Pros and Cons)

Better than all the rest

J.D. Power mentions two other lenders that outscored all those but that are "not rank-eligible because they do not meet the study award criteria:"

- USAA 891

- Navy Federal Credit Union 888

Both these exist to serve the military and veterans. If you're eligible for membership of either, you might want to think about joining before you compare other lenders' quotes. And, if you're already a member, you'll want one or both these on your short list.

Quicken Loans

Fast facts:

- NMLS ID: 3030

- Better Business Bureau: A+ Accredited business

- J.D. Power score: 876

Quicken Loans' customer satisfaction leadership is no flash in the pan. It's occupied the J.D. Powers top spot for nine consecutive years. It also says it's America's biggest mortgage lender, having closed nearly $500 billion of loans in the five years between 2013 and 2018. But others make that claim, too.

And yet it was founded as recently as 1985. That's a long way to come in such a short time.

The key to Quicken Loans' success is its use of technology. Of course, you can still engage with a real, breathing human being by phone, email or fax. But expect to carry out much of your mortgage application process online. No eye contact or firm handshakes here.

And, if you prefer the digital to the human, you can choose Quicken Loans' Rocket Mortgage brand. This lets you go from pre-application to closing without speaking to a single person.

Quicken Loans says it specializes in "plain vanilla" loans. These include conventional mortgages as well as FHA, VA and USDA loans. But if you're not a mainstream borrower wanting a mainstream loan, you may have to look elsewhere.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Maximum origination fees of 1% -- often significantly less

- Mortgage rates that are competitive rather than industry-beating

- Terms ranging from eight years to 30 years

You don't get to be market leader and customer-satisfaction king without doing a whole lot right. But understand that convenience comes at a price. If the only thing that matters to you is the lowest possible mortgage rate, you might want to keep reading.

Fairway Independent Mortgage

Fast facts:

- Value of retail loans issued in 2018: $25.1 billion -- second biggest (Scotsman Guide)

- NMLS ID: 2289

- Better Business Bureau: A+ Accredited business

- J.D. Power score: 873

With 400+ branches across the United States, Fairway may be a good alternative to Quicken Loans and other online lenders, if you value face-to-face encounters. Just how good an alternative will depend on how close your nearest branch is to where you live. There's a locator tool on its website.

At 23 years of age, Fairway is even younger than Quicken Loans. But it, too, has grown fast, closing loans worth $129.4 billion in 2018 alone. And it, too, has some whizzy technology enabling its fast delivery and high levels of customer service. It's especially proud of its mobile app.

Fairway claims you can apply for a mortgage in as little as 10 minutes and close in as little as 10 days. That's genuinely impressive. But "as little as" doesn't necessarily mean you personally will

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Your origination fees will be disclosed in your quote or loan estimate

- Mortgage rates that are competitive rather than industry-beating

- Terms ranging from 10 years to 30 years

You can see why Fairway is biting at Quicken Loans' heels. Watch out for the Fairway HomeStyle renovation loan. This lets you buy a home and fix it up using a single mortgage. And anyone who's ever purchased a fixer-upper will tell you how valuable that can be.

Guild Mortgage Company

Fast facts:

- Value of retail loans issued in 2018: $15.7 billion -- fifth-biggest (Scotsman Guide)

- NMLS ID: 3274

- Better Business Bureau: A+ Accredited business

- J.D. Power score: 857

Founded in 1960, Guild is positively geriatric by the standards of our first two lenders. But it's barely a teen compared with most banks. It's not huge but has 250 branch and satellite offices in 27 states, though these are mostly concentrated in the west and south of the country. It's not currently licensed in New Jersey or New York.

That's a fairly small number of brick-and-mortar outlets for a landmass the size of the United States. So your ability to engage face-to-face will depend on where you live. If you prefer an online experience, it offers all the whizzy technology you'd expect

If you and your new home aren't mainstream enough for Quicken and Fairway, Guild might be more able to help. It's happy to work with the many of the state and local organizations that offer down payment assistance programs. And it's prepared to consider your "alternative" credit history, including rent payments.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Higher origination fees -- These could come in a little north of $1,400 -- more if you're atypical. It'll say precisely in your loan estimate but that's higher than many

- Mortgage rates that are competitive rather than industry-beating

- Terms of 15 years or 30 years

It also has its own helpful program for first-time buyers called "3-2-1 Home." If you get together a 3% down payment, it will give you a $2,000 Home Depot gift card plus a $1,500 grant toward your closing costs.

PrimeLending

Fast facts:

- Value of retail loans issued in 2018: $13.7 billion -- sixth-biggest (Scotsman Guide)

- NMLS ID: 13649

- Better Business Bureau: A+ Accredited business

- J.D. Power score: 850

PrimeLending was founded in 1986 and now has 2,800 employees and more than 300 office locations nationwide. Like others on this list, it provides some excellent technologies, backed up by helpful customer service through a range of channels.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Origination fees that may be a little higher than some. Check your loan estimate for details

- Mortgage rates that are competitive rather than industry-beating

- Terms of 15 years or 30 years

You may think it's less "in your face" than some of its competitors. But its success and customer satisfaction scores say it all.

Bank of America

Fast facts:

- Value of retail loans issued in 2018: Not in the Scotsman Guide, but CFPB says it originated 111,000 mortgages in 2017

- NMLS ID: 399802

- Better Business Bureau: A+ Accredited business

- J.D. Power score: 849

At last! A good old-fashioned bank that wasn't formed within living memory. In fact, Bank of America can trace its roots back 240 years. And it's not old-fashioned in its practices or technologies. Those are bang up to date, including its Digital Mortgage offering.

For those who value a face-to-face relationship with their mortgage bankers, Bank of America is a good bet. At the end of June 2018, it had 4,411 physical sites across America. So your chances of being within an easy drive of one are pretty good. Of course, there are inevitably cool spots where geographical coverage is poor.

The bank encourages borrowers to participate in homeownership- and down-payment-assistance programs. Talk to a loan officer if you need advice.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA (USDA loans unavailable)

- Your origination fees may be a little higher than some. But you may be eligible for a discount if you're a Preferred Rewards customer. Check your loan estimate for details

- Mortgage rates that are competitive rather than industry-beating

- Terms of 15 years, 20 years or 30 years

You may not find the largest variety of loans here. But this lender does offer excellent deals when it needs to beef up its pipeline, so it's worth a look.

loanDepot

Fast facts:

- Value of retail loans issued in 2018: $27.7 billion -- #1 biggest (Scotsman Guide)

- NMLS ID: 174457

- Better Business Bureau: A Accredited business

- J.D. Power score: 847

And we're back to the newcomers. In fact, loanDepot is the newest of the newcomers so far. It was founded in 2010. To have gone from zero to America's biggest mortgage lender in eight years redefines hitting the ground running. It now employs more than 6,400 people and has 150+ office locations. Those employees include 1,700 licensed loan officers so you've plenty of opportunities for human interaction.

As you'd expect, loanDepot has some of the most up-to-date technologies, allowing smooth online applications. Its smartloan™ option allows you to give the lender direct access in order to verify "your income, employment and assets -- making it the swiftest, safest and most secure data verification process you'll ever experience." Big Brother, or a smart way to avoid paperwork and speed up your application? You decide.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3.5% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA (USDA loans unavailable)

- Your origination fees may be higher than some. Check your loan estimate for details

- Mortgage rates that are competitive rather than industry-beating. The ones advertised on its site assume a lot about your credit and willingness to buy discount points

- Terms of 10 years, 15 years, 20 years or 30 years

You'll see below that loanDepot's fees can be higher than many of its competitors. But there may be some good news ahead. Its Lifetime Guarantee says, "After you refinance with us once, we'll waive the lender fees and reimburse appraisal fees on any future refinance with loanDepot."

Fifth Third Mortgage

Fast facts:

- Value of retail loans issued in 2018: Not in the Scotsman Guide, nor the CFPB's 2017 list of the top 25 lenders

- NMLS ID: 134100

- Better Business Bureau: as Fifth Third Bank A+ Accredited business

- J.D. Power score: 843

Fifth Third started out in 1858 as The Bank of the Ohio Valley. It now has 20,000+ employees and more than 1,200 banking outlets in 10 eastern states.

Judging from its website, it's more comfortable with telephone and in-person interactions than digital ones. When you want to get started, its website asks you a few basic questions and promises that someone will call you -- usually within 90 minutes during normal business hours.

It has a reasonably broad range of mortgages, including conventional, FHA, VA and a specialist one for physicians and dentists. It also offers construction, jumbo and community loans. However, its website wasn't sufficiently helpful for us to complete an "Expect" section. If you're interested, you'll have to ask a bank employee for more information.

CitiMortgage

Fast facts:

- Value of retail loans issued in 2018: Not in the Scotsman Guide, nor the CFPB's 2017 list of the top 25 lenders

- NMLS ID: 413108

- Better Business Bureau: F Not an accredited business

- J.D. Power score: 840

CitiMortgage may do well with J.D. Power, but it has a disastrous F-rating with the Better Business Bureau. The BBB alleges it fails to respond to some consumer complaints and doesn't resolve others. And it notes two government actions against the bank.

There are some other downsides. Citi's technology doesn't allow you to complete an online application. And it's shy about revealing its fees (including an application fee!) until some way into the process.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3.0% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Your origination fees are a secret, at least to start with. Check your loan estimate when it arrives

- Mortgage rates that are competitive rather than industry-beating

- Terms of 15 years or 30 years

Citibank satisfies most of its customers and it has a wide selection of mortgages. And existing Citi customers may be in line for lower interest rates or discounted closing costs.

Caliber Home Loans

Fast facts:

- Value of retail loans issued in 2018: $17.7 billion -- fourth biggest (Scotsman Guide)

- NMLS ID: 15622

- Better Business Bureau: A -- -Accredited business

- J.D. Power score: 836

Caliber has an impressive portfolio of mortgage options, including several intended for those who've had financial problems in the past. It's also willing to take alternative sources of information (such as rental payments) into account when deciding your creditworthiness.

Although its technology is reasonably impressive and includes a mobile app, it wants you to engage with one of its loan officers early in the process.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3.0% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA or USDA

- Your origination fees are a secret, at least to start with. Check your loan estimate when it arrives or ask your loan officer

- Mortgage rates that are undisclosed until you've applied

- Terms of 10 years to 30 years

Caliber doesn't advertise its rates or disclose its fees on its website. So that initial conversation with a loan officer needs to be intense.

PNC Mortgage

Fast facts:

- Value of retail loans issued in 2018: not on Scotsman Guide list. But the CFPB reckons it originated 58,000 mortgages in 2017

- NMLS ID: 446303

- Better Business Bureau: B -- Not an accredited business

- J.D. Power score: 835

PNC's history goes back 160 years. It has 2,320 branches and 53,000 employees across 40 states.

Although it's a very long way from one of those technology-led newcomers, PNC's no slouch when it comes to digital innovation. Its Home Insight Tracker can be especially useful, providing an overview of your application's progress that's updated almost in real time. And its website lets you get a preliminary pre-approval that directs you to loans for which you're qualified. Still, you can't complete the entire mortgage process online.

PNC has a decent selection of loans including VA and FHA ones, as well as conventional and jumbo.

Expect:

- To need a credit score of 620 or better

- A minimum down payment requirement of at least 3.0% of the purchase price, unless you're eligible for a zero-down-payment loan from the VA (USDA loans unavailable)

- Costs and fees typically "range from 3% - 5% of the loan amount," says the website. But it doesn't specify what that includes

- Mortgage rates advertised on the site appear competitive

- Terms of 10 years to 30 years

Everyone seems to want a credit score of 620 or better. What if yours is lower? Well, there are lenders out there that specialize in less creditworthy borrowers. But they tend not to be the sort that make top-10 lists.

How to evaluate lenders yourself

Now, it's time to teach you how to find your best lender without the list -- because with 17,500 plus lenders in the US, the odds are good that they very best lender for you is NOT on a national top ten list.

What are you looking for?

If your credit is perfect, you have at least 20% down and you're purchasing a single family primary residence, you can probably focus almost entirely on the rate. (But if you're trying to close quickly, service will also matter -- you don't want to fall out of contract and lose a house by using a slow lender.)

And if you're looking for a government-backed loan, trying to finance investment property or qualify for down payment assistance or a non-prime loan, you'll have to look a bit harder.

Once you've identified your issues (low credit score? USDA loan? self-employed?), you can start your search. Look online for lenders that drive in your lane. You might, for instance, search for "self-employed mortgage" if you're concerned about proving your income. Or "mortgage for low credit score" if that's your issue.

And don't forget local lenders. With those 17,500+ mortgage lenders out there, smaller ones stand little chance of making any top ten lists. But your local or regional bank -- or your credit union -- may be excellent. And many smaller regional lenders do pop up on sites like this one, ready to earn your business.

Get mortgage quotes

Contact a few lenders (at least four to ensure a competitive rate) and get mortgage quotes. Be prepared to provide an estimated credit score, down payment and desired purchase price to all contenders. And research each lender with the National Mortgage Licensing System (NMLS) consumer information page to get its licensing information.

You can also look for reviews on Yelp and other sites and check with the Better Business Bureau to make sure that the lender closes on time and provides a good experience.

If you want less legwork, try shopping online for mortgage quotes. Simply complete a form like the one on this site and let the lenders tell you what they can offer you. You'll be able to obtain several quotes in one shot.

Once you determine which are the most competitive, you can then review their ratings and licensing. You can also verify the license of the individual loan officer or broker who provides your quote.

Do you want to work with this person?

Understand that there are some factors common to good lenders, and some associated with bad lenders. When speaking to a loan professional, keep these things in mind and choose a representative who inspires your trust.

Good lenders:

- Return calls promptly

- Ask questions to understand your situation

- Make recommendations based on your profile

- Explain programs in plain language

- Are experienced enough to anticipate and avoid problems

- Respect your time

- Keep you informed

- Work in your comfort zone, contacting you when and how you prefer

Bad lenders:

- Go AWOL without explanation

- Make odd requests without explaining why

- Can't deliver bad news

- Brush off your concerns

- Don't understand the programs

- Gloss over disclosures

- Don't anticipate underwriting issues

- Don't respect your needs or time frame

It comes down to who you want on your team:

- The loan officer who gets you a complete list of required documents at the beginning? Or the one who calls you every day for some new thing?

- The one who can tell you that your income makes you eligible for a 97% first-time homebuyer program? Or the one who pushes everyone into more expensive FHA loans?

- The one who tells you upfront that a late auto payment might be a problem and helps you craft a letter of explanation before sending in your application? Or the one who is completely surprised when an underwriter suspends your file three days before closing?

There is a lot to be said for experience. Find out how long your lender has been in the business and what types of loans he or she specializes in doing.

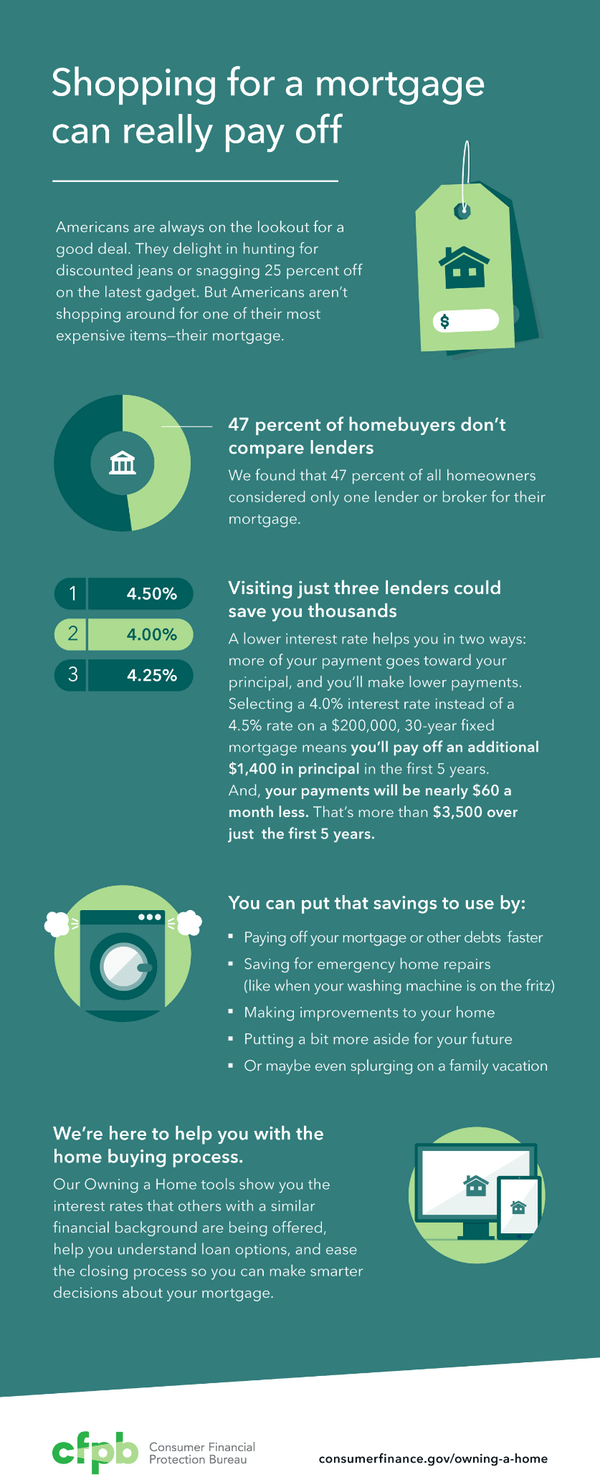

Why you need to compare multiple mortgage quotes

In August 2019, Fannie Mae surveyed consumers and found that one third of them still don't shop when they apply for a mortgage.

That can be an expensive mistake. With 30-year mortgage rates varying on average between .25% and .50% between lenders for the same loan on any given day, an inattentive borrower could pay thousands more over the life of a loan.

Here's how much more you'd pay on a $300,000 loan at 4.5% than you would at 4% over five, 15 and 30 years:

- Five years: $7,400

- 15 years: $20,879

- 30 years; $31,612

But savings over a number of years might not mean that much to you. But a study by researchers at Stanford University found that borrowers who obtained quotes from three or four mortgage lenders paid about $2,600 less in fees on a $200,000 mortgage than those who only got one or two quotes. Don't leave money on the table when you shop for a mortgage.

Related: How to Shop for a Mortgage

How to compare mortgage lenders' offers

When you get quotes from mortgage lenders, they should all come in the same format. These are called Loan Estimate (LE) forms and they make comparing offers much easier than it used to be. Unscrupulous companies can't so easily bury gotcha clauses in the fine print.

It's true that these are as described: estimates. But lenders have a duty to issue them in good faith. That means they can't just increase figures on a whim. There must be specific causes, which are spelled out in the law. And they must tell you as soon as they're aware of such issues.

Your loan estimate must include a whole lot of basic information:

- Loan amount

- Mortgage rate

- Monthly payment

- Monthly mortgage insurance (if any)

- Escrow (if any)

- Whether there's a prepayment penalty (if you want to refinance or otherwise pay down your loan early)

- Estimated property taxes and homeowners insurance

- Likely closing costs

- Estimated cash needed to close (closing costs plus down payment)

And that's just on the first of the three pages. Read the whole document carefully.

"In 5 years" is critical

But pay special attention to the first section on page 3: "Comparisons."

The "In 5 years" field will give you two figures. The first is a single figure that is how much you should have paid in total after five years, including payments for:

- Principal (the amount you originally borrowed)

- Interest

- Mortgage insurance (if any)

- All loan costs -- fees and charges, including closing costs

The second tells you by how much you should have reduced your principal (the sum you owe on your mortgage) after five years. Subtract the second "in 5 years" figure from the first to see how much your lender is taking in interest, insurance and fees.

These two figures are extraordinarily powerful when you compare mortgage lenders' offers. They lay bare the financial bones of each offer and let you make a meaningful comparison. If you expect to have your mortgage about five years, take the total costs and subtract your principal reduction. The cheaper loan has the lowest number.

The "no brainer" mortgage

It can be confusing looking at a fist full of mortgage quotes. For example, you might get these for a $300,000 mortgage:

- No points, no fees, 4.625% interest rate (cost: $0)

- No points, $1,500 in fees, 4.000% interest rate (cost: $1,500)

- 2 points, $3,000 in fees, 3.625% interest rate (cost: $9,000)

Which is the best deal? It depends on how long you plan to keep the property and how much you can afford to pay in upfront costs. You can look at the loan's APR, or annual percentage rate. But it only really applies if you keep the loan for its full term.

Why not take one variable out of the equation? For example, if you asked every lender to provide a quote with no points and no fees, you could just choose the one with the lowest rate. And be confident that you're getting the best deal.

Alternatively, you could choose a rate and ask each lender to disclose the costs to get that rate. Then, just choose the loan with the lowest costs.

The most important thing is that you do shop and compare before you borrow.