Here's your complete guide to how to buy a second home successfully. It covers:

Here's your complete guide to how to buy a second home successfully. It covers:

- The pros and cons of owning a vacation home

- How to choose a second home

- Whether you should buy with family and friends

- The benefits and drawbacks of renting out a vacation home

- How to pick the best mortgage for a second home

Recent ultra-low mortgage rates are bringing second homes within the grasp of many more Americans. And there may never have been a better time to buy yours.

See current mortgage rates for second homes

We're mostly talking about vacation homes

If you want to buy a second home, you might have many ideas in mind. We'll be covering these:

- A vacation home to which you hope to retire one day

- A place that's strictly for your family's weekend breaks and vacations, perhaps adding up to several months each year. You may or may not lend it occasionally to friends, colleagues and more distant relations when you won't be using it

- A house or condo that's mostly for your family's downtime but that you'll rent out for other people's vacations when you're not using it

- A vacation property that's purely an investment. You may use it yourself just occasionally, but its primary function is to generate revenue

If you plan to buy a second home as rental property, that's covered extensively in other articles on HSH.com. This is for those who buy a second home as a lifestyle enhancement.

Related: How to Become a Landlord

Is a second home right for you?

We've all done it. We've all been somewhere that's so stunningly beautiful or such fun that we've dreamed of owning a home there. Fewer of us are able or willing to take the next step by actually buying a place. Though low mortgage rates have opened up that option for many more Americans.

And those who do buy have different experiences. For some, the joy of owning a home somewhere special never fades. For others, reality intrudes. It's more costly than they thought. Or they get bored and tired of always taking vacations in the same spot. Or they realize they underestimated the logistical challenges of getting to and from their chosen location.

That's hardly surprising. We all have different wants, needs and priorities. Something that makes one person ineffably happy can make another miserable.

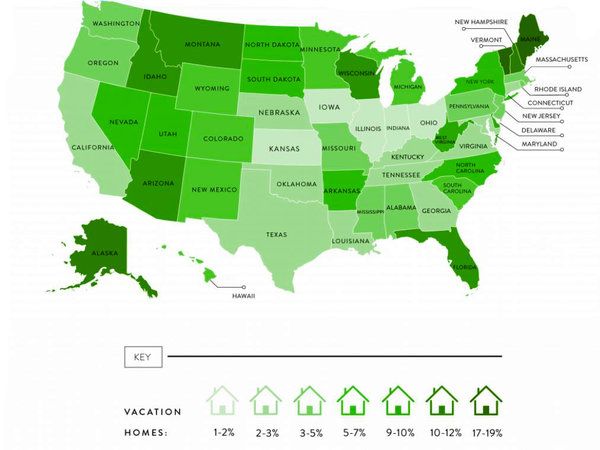

Where Are the Most Vacation Homes?

Vacation home pros and cons

Owning a second home has its advantages and drawbacks. Make sure vacation home ownership is right for you before you get caught up in the romance of your location and buy impulsively.

Pro: rising real estate prices

Let's start with a potential upside that's financial. Just as when you own any real estate, you stand to make money from your vacation home as property prices rise.

Indeed, you may make more with this investment. According to the National Association of Realtors® (NAR), "Between 2013 to 2018, the median sales price in vacation home counties increased at a slightly higher pace of 36% compared to the pace of increase of all existing and new homes sold, at 31%."

(Vacation Home Counties are counties in which "the vacant housing for seasonal, recreational, or occasional use made up 20% or more of the county's total housing stock.")

Con: the costs of vacation homeownership

You'll undoubtedly spend less on hotels or vacation rentals if you buy a second home. That's a genuine savings worth considering

However, don't think that owning a vacation home is cheap. The obvious cost is your monthly mortgage payment if you don't pay cash. But you'll also pay property taxes, homeowners insurance premiums (often more expensive for second homes), and repairs and maintenance. There may also be HOA dues.

The chances are good that you'd spend more out of pocket owning a second home than you would paying for nice vacations elsewhere every year. You wouldn't, however, get the benefits of rising home prices. Still, it's probably wise to see your ownership as a luxury purchase rather than an economy.

Pro: income potential

Many more second home buyers today plan to recoup as least some of their costs by renting out the home. The increasing popularity of platforms like Airbnb, Vbro and HomeAway certainly supports this. And a 2018 study by global real estate agency Savills revealed that "the number of buyers intending to use their property solely for their own use has fallen from more than 90% in 1971 to less than 40% today."

A second home can be a great source of income if you rent it out to vacationers. You may earn enough cover your homeownership expenses on that property. Or more.

How the math actually works out depends on many factors, including

- The size of your monthly mortgage payment

- Other expenses like utilities, maintenance and property management

- The desirability of the home's location

- The condition of the home and how well presented it is

- The costs involved in maintaining its rental appeal at an optimum level

Time was when the condition and presentation of a vacation rental property were less important than they are now. Owners could skimp without risking a steady stream of new renters. They just didn't get much repeat business.

But online technology's changed all that. From TripAdvisor to Airbnb, your customers can and will leave candid feedback that can make or break your business. So keeping your product in tiptop condition is now a necessity.

And that's not cheap, especially if you live far away and have to rely on local labor for cleaning between rentals and general maintenance. Alternatively, if you're able to do much or all of the work yourself, you must understand the burden you're taking on.

Pro: possible retirement haven

Some buy a second home and plan to eventually retire there. And why not? It makes perfect sense to live where you want once your job isn't a factor.

The danger is that a glorious summer haven may become a drab winter prison. And locals who were jolly and friendly during the high season, when they were busy making lots of money, may become bored and withdrawn when their bars, restaurants and shops are closed or empty.

But that's a plus for buying a second home for retirement now, a long time before you actually retire. You get plenty of chances to experience its surroundings year-round. Just don't pass up on that opportunity. You don't want to discover your mistake when you least want disruption.

Con: changing needs

Suppose you're 40 years old now and looking for the home to which you will retire. How will your vacation home and its surroundings be when you're 70? You don't know? That's the point.

Over decades, trendy resorts can go out of fashion. A new building or development might ruin your view. The local economy might tank. If you're buying in a condo, a development can slip from luxurious to shabby over that sort of period.

True, those are risks that may be small in your case. But they're ones you need to bear in mind.

Related: How to Refinance a Second Property

Tax planning

The tax treatment of your second home depends on whether the IRS considers the property a personal residence or a business.

- If you use your home for 14 days or fewer, or less than 10% of the days in which it's rented, it's a business

- If you use your home for more than 14 days, or more than 10% of the days in which it's rented, it's a personal residence

Whether it's a business or residence makes a big difference at tax time. If you rent it for more than 14 days, the income is taxable -- whether it's a residence or business.

If the home is a business, you get to deduct the mortgage interest, property taxes, repairs, maintenance, your costs to get there to work on the property, and depreciation for the home and furnishings. You can take losses or up to $25,000 against other income. "Paper" losses from depreciation can actually put money in your pocket at tax time.

But if the home is a personal residence, your deductions are limited. Yes, you still get mortgage interest and property taxes. But you can only deduct other costs on a pro-rated basis depending on the percentage of time the property is rented versus used personally.

If, for example, you spend 30 days at your vacation home and rent it for 30 days, you can deduct half of the maintenance and other costs. You don't get to deduct depreciation. And your other deductions (not mortgage interest or property taxes) can't exceed your rental income. You don't get to reduce your other income by taking a loss on your vacation rental.

Taxes are complicated, so don't just rely on this article. Read IRS Publication 527 and consider following up with a tax professional.

Related: FHA Second Home (Buy a "Kiddie Condo" for Your Child or Other Relative With 3.5% Down)

Other rental pitfalls

If you're planning to rent out your second home, make sure you're legally able to do so. There are two main barriers:

- Some local authorities have zoning laws that ban rentals, including short-term ones. Airbnb has been locked in legal battles over these for years

- Some homeowners associations (HOAs) and condos have rules against renting

It can be a serious mistake to assume nobody will notice or care if you have a succession of strangers moving into and out of your second home every week or two. Your neighbors expect to quietly enjoy the homes for which they paid. They will likely object if your money-making lowers their quality of life, causes security issues or reduces their property value.

So make your checks before you buy a second home for vacation rentals. Read your HOA's CC&Rs closely. And call your municipality to check on zoning.

How to choose your vacation home

If you're still reading, you've probably decided that a vacation home is for you. Now it's time to choose your property.

According to ipropertymanagement.com,

- 33% of vacation home buyers purchased in a resort area, 24% purchased in a rural area, and 18% in a small town

- Another 33% of vacation home buyers purchased in a beach area, 21% purchased on a lakefront, and 15% purchased in the country

- 34% of investors purchased in a suburb or subdivision, 24% in a small town, and 19% in an urban area or central city

Why not kick the tires before making a major purchase? Rent in the area you're considering. Try an extended rental or visit at different times to understand high, low and shoulder seasons. That will give you a feel for the local real estate market.

Check out online rental listings to see what kind of activity and income you can expect if you plan to rent out the place. Many landlords display online calendars showing what days their homes are rented. If you know how many days homes get rented and what the going rate is, you can make a more informed decision about investing in that area.

Of course, if you don't plan to rent it out to vacationers, your only target market is you. And only your tastes and needs count.

Related: How to Buy and Finance Investment Property

Where to buy a second home if you're rich

In 2019, the NAR published a report about the counties where vacation homes are most popular. Many are where you'd expect: in particularly beautiful places, often with the sea, lakes or mountains close at hand.

The nation's most expensive vacation homes were in Nantucket, Massachusetts, where you can expect to part with more than a cool million if you want an average sort of place. Other areas in the state, including Martha's Vineyard, were close behind in terms of cost.

And, of course, counties in other states were also highly desirable -- and came with chunky price tags. The NAR lists:

- Colorado -- The counties of Pitkin, Eagle, Summit and Grand, where the Rockies are a year-round attraction

- Florida -- Especially Monroe and Collier counties, for the Florida Keys and Naples

- California -- Mono, Alpine and Inyo counties, which are close to the Yosemite National Park and Lake Tahoe

- Arizona -- Coconino county includes part of the Grand Canyon

Don't expect to buy in these places unless you have a pile of cash or the sort of high income that should see you comfortably keep up mortgage payments.

Where to buy a second home if you're not rich

The NAR also lists plenty of places where vacation homes are more affordable. In the following counties, all of which have a high incidence of second homes, you may well find somewhere for under $100,000:

- Maine -- Aroostook, Piscataquis, Somerset, Franklin, Oxford, Washington and Waldo

- New York -- Chenango and Franklin

- Pennsylvania -- McKean, Venango, Clarion, Elk, Potter, Clearfield and Jefferson

- Missouri -- Miller

- Michigan -- Gogebic, Lake, Arenac, Iosco and Cheboygan

In their own ways, many of these places are as beautiful as the hugely expensive counties that the rich haunt. True, they're probably less exclusive and snobby. But those aren't characteristics that appeal to everyone.

Distance from your home

According to the NAR, the average distance between people's primary residences and their vacation properties is about 200 miles -- enough to make the trip by car. And that's important, because when vacation properties take longer than two hours to get to, they tend to get less use.

But there is an issue when you buy a second home nearby if you need a mortgage to complete your purchase. Many mortgage guidelines don't allow you to finance property as a second home if it's within 50 miles of your main home. You may have to get a mortgage for investment property, which is more expensive and as tougher underwriting guidelines.

Pros and cons of being far away

The main advantage of your second home being far from your first is obvious. The two places are likely to be completely different. If you live in Kansas or Nebraska, and you yearn for the ocean, you're not going to get a sea view anywhere nearby.

But the further you must travel, the higher your transportation costs will be. Getting there may not be half the fun, and spur-of-the-moment trips may not be possible. And if you rent it out, your profits may be eaten by property management costs.

Pros and cons of being close

If you live downtown in a sprawling, grimy city, a lakeside cabin 50 miles away could give you endless pleasure across decades of weekends and vacations. It's many urban dwellers' dream. Conversely, if your existence is relentlessly rural, you might enjoy a cozy condo in a nearby city. If you rent out your place, you may be able to handle the management duties yourself and keep more of what you earn.

But such contrasts over such short distances aren't common. And many people wouldn't see the point of vacationing so close to home: the same climate, the same environment, similar neighbors. Why not go somewhere exciting and different?

Related: Can You Buy Real Estate for Your IRA?

Cost cutting: buy a second home with family or friends

There are advantages in splitting the costs of vacation homeownership with others. Going halves with another buyer can remove a lot of financial pressure without sacrificing your vacation time.

But the quality of the experience really depends on the personalities involved. Property ownership is a massive commitment, and the wrong partner can turn paradise into hell.

Whatever the personality traits of those involved, it's a good idea for co-owners to sign an agreement that governs likely disputes. It's important for this to cover as many likely scenarios as possible. Here's a partial list of potential sticky situations:

- Two parties want to use the home during the same week

- A major repair becomes necessary but one party can't afford the cost

- One party needs to sell the home but the other doesn't want to

- One party (or their guests) causes damage to the home

- There is a question splitting rental income and expenses

- One family runs up huge utility bills while the other is frugal

Take time to try to anticipate as many possible squabbles as you can. If everyone signs the agreement, it will be hard for them to cry foul later on. And every purchase should also include plans for an exit.

Today's vacation home rental market

Savills published a report at the end of 2018, "Nine key trends in the second-home market." And the first point it made concerned the impact of the "digital revolution."

Online sites and apps make finding tenants easier

In some ways, this is helping owners of second homes immeasurably. You may think that websites such as Airbnb and TripAdvisor charge high commissions. But they're often much lower than their alternatives. And those who are used to doing things the old-fashioned way -- through brick-and-mortar agencies and ads in publications -- are often finding they're now making savings on finding short-term tenants while increasing their occupancy rates.

Online sites increase pressure and competition

But this technology is also bringing downsides. To start with, owners are becoming like Uber drivers in that their ability to make money is largely determined by online reviews. And that creates a huge pressure on those owners to deliver products (their second homes) and experiences that garner consistent 5-star reviews. Worse, doing so brings higher costs.

Savills also reckons new technology "has helped diversify and broaden the demand base beyond the traditional holiday rental market, providing more opportunity for owners to let on a full or part-time basis."

It's the part-timers who might bother you. Time was when the owner-occupied homes near your vacation place posed no threat. But now it's easy for those owners to rent out their homes whenever they're away -- creating real competition for your second home. And, as homeowners increasingly recognize the benefits to them, that competition is only likely to increase.

Vacation rental maintenance and repair from a distance

Keeping a second home up to the standards that will earn you 5-star reviews online is never easy. If you're trying to do so by remote control over a great distance, it can be a nightmare.

One solution is to retain a property manager or property management company. A good manager should regularly inspect the home and use her extensive network of contacts to source the local skilled and unskilled labor to keep it in tiptop condition. So you should never have to worry if the gutters have been cleared, the patio pressure washed or the HVAC serviced.

Property managers may also market the property and handle bookings, liaise with your tenants, troubleshoot issues and provide professional levels of satisfaction. But such a service doesn't come cheap and a property manager's likely to eat into your rental profits. Expect to pay 25% to 50% of your rental income for comprehensive management.

A more affordable alternative is to source your own local labor. You might need to hire conscientious and hardworking people to do the cleaning and yard maintenance on a permanent basis. One of them may take responsibility for liaising with renters, handing over keys, sorting out issues and dealing with routine and emergency maintenance.

If you choose to save money and do those yourself, you'll want a 24-hour plumber and electrician on speed dial. And expect to field calls at all hours. You'll also need a backup plan for when your people are sick or on their own vacations.

Perhaps the easiest solution is to buy in a condo. With those, you can expect the grounds and common areas in your building to be maintained for you. So you may need only a cleaner, though you'll want one who has enough initiative to spot and alert you to issues. Just make sure your condo's rules permit vacation rentals.

Related: Is Investing in Real Estate Worth It?

Financing when you buy a second home

While many purchase vacation property with cash, it's not uncommon to finance a vacation home.

Most second-home buyers who decide to borrow go down one of three routes:

- A cash-out refinance on your existing home -- That releases enough of your equity to buy the new place

- A home-equity loan or home equity line of credit (HELOC) -- again you're borrowing against your main residence but you're leaving your existing mortgage in place. You may decide to borrow only the down payment on your new place

- A whole new conventional mortgage, secured by the second home

Let's address the last in more detail.

Mortgage for a second home

Vacation home mortgage interest rates are just like primary residence rates. And underwriting guidelines are only a little stricter. Here are a few things to keep in mind when you apply for a vacation home mortgage:

- You won't be able to use a government-backed mortgage for your vacation home. Those only work for primary residences

- No FHA, VA or USDA financing means you'll need a higher down payment -- at least 10% for highly-qualified borrowers, and at least 20% for everyone else

- You can't use potential rental income a vacation property mortgage. If you need rental income to qualify, you have to apply for an investment property mortgage

If you have to finance your vacation home as an investment property, you'll face higher interest rates, bigger down payment requirements and stricter guidelines. But if the property generates enough income to cover the mortgage, you shouldn't have too much trouble getting a loan.

Actually, that difference is evolving. Fannie Mae has recently adjusted its rules for the Airbnb era, allowing some rental revenues to count toward your qualifying income for a vacation home mortgage -- but only for people refinancing primary residences. Not buying vacation homes.

Understand that not all mortgage lenders treat vacation home mortgages the same way. Or that pricing and guidelines are universal. You need to compare multiple quotes from competing lenders to secure the best terms and interest rates for which you qualify.

Compare second home mortgage offers now